US tax bonus spurs solar projects on coal sites

Bonus tax credits are boosting the economics of solar and battery storage on former coal plant sites and nearby land but developers must forecast local unemployment to limit risks.

Related Articles

Two bonus credit schemes in the Biden Administration’s Inflation Reduction Act are set to redistribute renewable energy deployment towards energy communities impacted by the closure of coal mines or coal-fired plants, or in low-income areas.

Over 90% of renewable energy investors and developers are “to some extent” prioritising projects in these areas, according to a recent survey by non-profit group the American Council on Renewable Energy (ACORE).

The Energy Community Tax Credit Bonus program provides 10% extra tax credits to solar and storage projects, on top of the 30% investment tax credits (ITCs) or $26/MWh production tax credits (PTCs) available to all renewable energy projects through the inflation act. A separate Low-Income Communities Bonus Credit Program offers a range of credits to eligible areas.

To qualify, energy community projects must be located in areas with high fossil fuel-related employment and where the unemployment rate is higher than the national average, or in coal communities disproportionately affected by closures, including but not solely in terms of employment.

Areas containing retired coal-fired power plants offer the most opportunity for utility-scale solar development under the scheme as they offer ready-made grid connections nearby, Alyssa Edwards, Senior Vice President Government Relations and Environmental Affairs at developer Lightsource bp, told Reuters Events. Dwindling U.S. grid capacity means developers of greenfield projects must typically apply for new grid connections in a process which takes several years.

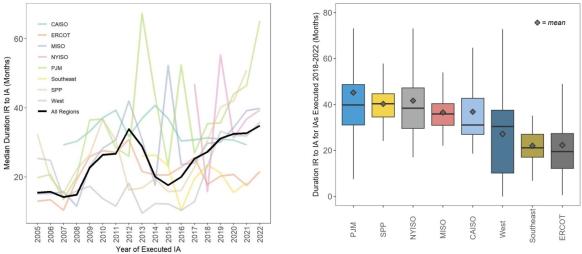

U.S. grid connection approval times, by market

(Click image to enlarge)

IR = Interconnection Request

IA = Interconnection Approval

Source: Berkeley Lab, April 2023

Lightsource bp is already using the energy community support scheme for part of its 246 MW Cottontail solar project located adjacent to a retired coal-fired plant in Northumberland County, Pennsylvania.

Coal plant closures have accelerated, offering significant opportunity for developers. Around 12 GW of coal plant capacity was retired in 2022 and a further 40 GW of closures are expected by 2029, according to EIA data.

Developers applying to the scheme must factor in the risk of fluctuating unemployment rates in the local area, since criteria is based on unemployment levels at certain project milestones.

Meanwhile, applications for the low-income bonus credit are scheduled to open in the coming months and some of the permitting requirements could present a challenge for financing small projects.

Coal connections

The slow approval of new grid connections has increased the risk and cost of renewable energy projects and made closing coal plant sites attractive to developers hungry for growth.

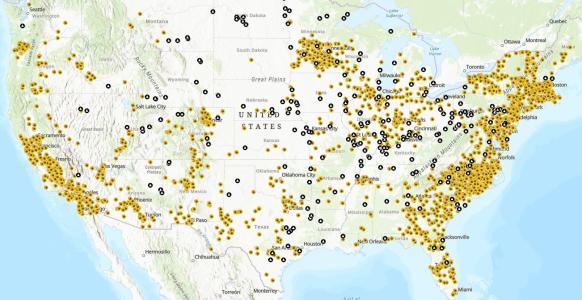

U.S. coal, solar power plants

(Click image to enlarge)

Coal-fired plants are indicated in black. Solar plants in yellow.

Source: U.S. Energy Information Administration (EIA), 2022

Coal plant sites can offer solar developers a large land area to maximise economies of scale, as well as transport and utility infrastructure. Development on closed coal mining sites is also gaining momentum. These sites offer plenty of opportunities but developers face additional challenges due to complex topography and land ownership.

Utility Xcel Energy will gain the bonus credits for 10 MW of battery capacity attached to the 710 MW Sherco solar project in Minnesota that will replace 2.2 GW of coal-fired capacity.

The bonus credit program will make “the location of these projects more price-competitive and more likely to be constructed,” an Xcel Energy spokesperson told Reuters Events.

Outside of coal facilities, many of the areas that qualify as energy communities have land constraints that are best suited to solar and battery deployment, rather than wind farms, the spokesperson said. These will likely be more densely-developed urban or industrial areas with limited land and also limited wind resources.

To gain the bonus credit, developers must ensure construction times align with eligibility criteria.

Projects must be in areas where unemployment rates are higher than the national average in either the year prior to the start of construction or the year prior to completing the project, or in areas disproportionately affected by the closure of coal mines or coal-fired plants.

Some areas will see higher fluctuations in unemployment rates, raising questions over the availability of tax credits when a project starts construction or is placed into service, said Edwards. Developers could develop a project in an area with higher-than-average unemployment but the rate could fall below that line by the time they are ready to start construction.

Wider benefits

Last month, the Internal Revenue Service (IRS) released guidance on the Low-Income Communities Bonus Credit Program. This program aims to increase adoption of renewable energy in low-income areas, encourage new participants and provide social and economic benefits to communities hit by environmental trends.

The bonus is only available to smaller projects of capacity less than 5 MW, which have historically been difficult to finance under existing schemes, Jessica Millett, Partner at law firm Hogan Lovells, told Reuters Events.

Tax equity structures can be "complex and can have high transaction costs. So it may not be worth it for a tax equity investor to fund a smaller project which will result in less tax benefits," she said.

This size of project typically favours solar or battery storage and the level of bonus depends on the type of area. While projects in low income or American Indian communities are eligible for a 10% credit bonus, community benefit projects and projects in areas with low-income affordable housing schemes are eligible for 20%.

Affordable housing projects are "often located in dense urban areas where solar is going to be the only option,” Millett noted. Many of these projects may be rooftop arrays.

Allocation priority will be based on ownership or geographic criteria, such as areas designated as disadvantaged in a climate and economic justice screening tool.

One challenge will be lining up the financing to meet the criteria of the tax rules, Millett said.

Applicants must obtain a number of permits to construct a facility before they submit to the scheme as the IRS wants to ensure the project will be developed within four years, Millett said.

This could create a "chicken and egg problem in terms of getting project funding lined up and getting a project permitted,” she said. Funding would be impacted by tax credit eligibility but a developer may need to buy or lease a property to gain a permit, for example.

The Solar Energy Industries Association (SEIA) welcomed the fast implementation of the tax credit rule and said it would take clean energy to communities that need it most.

“It’s also worth noting that this is the first rule to make it across the finish line under the [inflation act]," Ben Norris, senior director of regulatory affairs at the SEIA told Reuters Events.

"This is a monumental task for any federal agency to produce a final rule in less than a year and we appreciate that the [Biden] administration is continuing to make [inflation act] implementation a top priority."

Reporting by Neil Ford

Editing by Robin Sayles