US solar wafer factory scrapped; Europe agrees to favor local components

The solar news you need to know.

Related Articles

CubicPV scraps plan to build US wafer factory

Solar manufacturer CubicPV has ditched its plan to build a 10 GW silicon wafer factory, blaming a collapse in global product prices and rising construction costs.

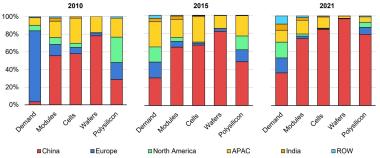

China dominates global solar manufacturing and the U.S. must rapidly expand wafer manufacturing to establish a fully domestic supply chain. The process involves slicing silicon into wafers that are used to build cells, which are then assembled into modules.

Global solar manufacturing capacity by region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

Tax credits in the Biden administration's Inflation Reduction Act have led to a surge in new module and cell factories but wafer production is lagging far behind. Rules that allow developers to claim bonus tax credits without sourcing U.S. wafers have dented the business proposition for new facilities.

CubicPV will restructure and focus on developing advanced solar modules, the company said in a statement.

EU agrees rules to boost clean energy manufacturing

EU policymakers have provisionally agreed new rules to promote local production of clean technology equipment, including solar panels and wind turbines.

The EU is heavily dependent on Chinese manufacturers and European suppliers are concerned that tax credits in the U.S. Inflation Reduction Act will also damage their competitiveness and lure investors away from Europe.

More recently, Europe's solar industry has called for additional support for manufacturers following a surplus of Chinese imports that have crushed prices. The industry has warned policymakers not to impose tariffs on imports, fearing disruption would delay solar power deployment.

Under the Net-Zero Industry Act (NZIA) approved on February 6, at least 30% of the volume of renewable energy auctioned every year must include pre-qualification and non-price award criteria to encourage developers to source materials from EU suppliers. These criteria will include environmental sustainability, contribution to innovation and integration of energy systems, EU policymakers said.

"This is a positive, measured, approach, which will help EU solar manufacturers finance project pipelines, knowing that there is reliable demand for their product," industry group SolarPower Europe said in a statement.

"This also means the rest of the auction market should remain unaffected, maintaining the necessary pace of solar deployment," it said.

The NZIA aims to ensure that at least 40% of all clean energy technology is manufactured in the EU by 2030, including solar panels, wind turbines, and batteries. Under the proposed legislation, EU members must issue construction permits for large clean energy manufacturing facilities (of more than 1 GW) within 18 months, while smaller projects must be approved within 12 months.

The NZIA has been provisionally approved by the European Council and the European Parliament, but still needs to be formally endorsed and adopted by both institutions.

Grid tech could unlock 6.6 GW of projects in largest US network

Grid enhancing technologies could unlock 6.6 GW of transmission capacity in the large U.S. PJM network far faster than an expansion of grid capacity, non-profit group Rocky Mountain Institute (RMI) said in a report published on February 15.

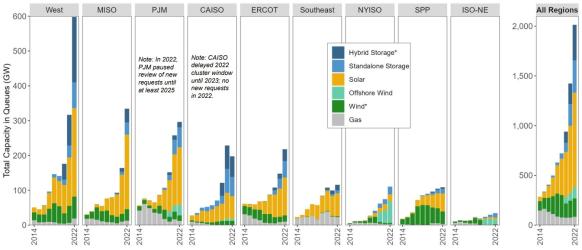

The PJM network spans 13 states in central and eastern regions and solar and wind developers face some of the longest queues for grid connections. In 2022, PJM paused new reviews until 2026 to tackle its huge backlog and some developers have pivoted to other markets.

Power capacity in US grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

Hardware and software solutions that re-route power and provide real-time data could be deployed "in a matter of months, and offer a multi-faceted solution – they unlock greater efficiency on the grid, keep electricity rates down, and enhance reliability throughout the energy transition,” RMI said in its report, funded by Amazon.

The technologies are currently in use in pilot programs and could be rolled out commercially to provide savings of nearly $1 billion by 2027 compared with physical expansions, it said.

U.S. network operators are streamlining grid approvals to tackle a flood of renewable energy applications and advanced data technology is set to slice approval times in the coming years, industry experts said.

New rules from the U.S. Federal Energy Regulatory Commission (FERC) require grid operators to prioritise projects that have secured permits and imposes penalties for transmission operators that miss deadlines. Grid operators will be able to assess multiple projects in clusters to make best use of their resources and will be subject to a daily penalty for overdue approvals.

US bill could more than double interregional transmission

New legislation being considered by U.S. lawmakers could increase national interregional transmission capacity from 84.4 GW to 191 GW within 10 years, a study shows.

More interregional transmission will accelerate clean energy deployment, lower prices for consumers, and increase grid reliability, the analysis by the Center on Global Energy Policy at Columbia University (CGEP) said, citing data from the U.S. Department of Energy.

However, grid operators have barely built any interregional transmission over the past 10 years.

To ensure that renewable energy can be transported to urban and industrial centers, the U.S. Congress is considering several pieces of legislation, including the Big Wires Act, which would require grid operators to have interregional grid capacity equivalent to at least 30% of peak electricity demand.

Under the proposed legislation, the Federal Energy Regulatory Commission (FERC) must set these minimum transfer requirements within 18 months of the bill’s passage, and regions will have two years to outline what kind of infrastructure needs to be built to meet those targets.

“More critically, these joint filings would have to incorporate a deadline for the construction of new transmission lines by the end of 2035, including which entity or entities would build the facilities and how costs would be allocated on an interregional basis,” CGEP said in its analysis.

The bill was introduced in September by Senator John Hickenlooper and Representative Scott Peters. The Democratic legislators last summer said they are working with stakeholders and industry experts to ensure "the bill is on the right track." However, it is unclear if the bill will be approved before November's presidential and congressional elections.

“If passed, the Big Wires Act could set in motion an expansion in transmission capability unprecedented in speed and scope, a crucial factor for a more integrated, cleaner, and cost-effective national grid,” CGEP said.

Reuters Events