US solar wafer build stutters as Chinese surplus bites

A select group of suppliers are building American solar wafer factories but Chinese imports are set to dominate unless the U.S. takes action to narrow the competitive gap.

Related Articles

Earlier this month, solar manufacturer CubicPV ditched its plan to build a 10 GW U.S. silicon wafer factory, blaming a collapse in global product prices and rising construction costs.

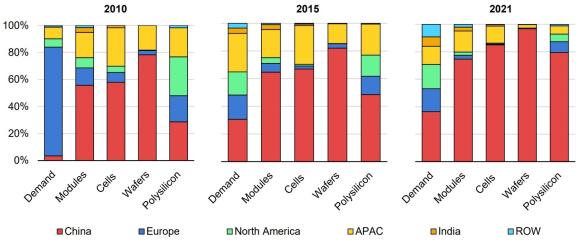

China produces around 98% of the world's solar wafers and a ramp up of Chinese solar manufacturing has lowered global prices. Meanwhile, U.S. construction prices have surged since the Covid pandemic due to rising material and labor costs.

U.S. plans for new wafer production were already lagging far behind module and cell manufacturing. Tax credits in the Biden administration's 2022 Inflation Reduction Act led to announcements of 85 GW of planned new module manufacturing capacity and 43 GW of cell production within one year, compared with just 20 GW of new wafer and ingot (polysilicon melting) capacity. U.S. module production capacity was a mere 8 GW in 2022 and there was zero wafer capacity. U.S. solar panel imports soared by 82% in 2023 to 54 GW, highlighting the growing thirst for products.

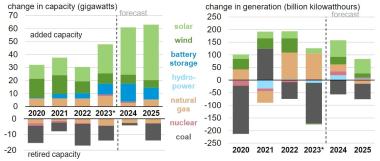

Forecast US power installations

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

U.S. solar installations must triple to over 60 GW/year to hit President Biden’s climate goals and the inflation act aims to bolster energy security and create jobs.

The act offers developers a 10% tax credit for using U.S.-made content, on top of a 30% baseline tax credit. However, developers do not need to source U.S. wafers to meet domestic content thresholds and suppliers in China and Southeast Asia benefit from far lower capital costs.

A small group of suppliers including Qcells, First Solar and NexWafe, are moving ahead with U.S. wafer factory plans, either using integrated full supply chain facilities or innovative wafer production methods to drive down costs. However, unless more support arrives, the U.S. will be importing mostly Chinese wafers for some time to come.

In one example, Chinese supplier Trina Solar is building a 5 GW solar module factory in Wilmer, Texas but “at this time, wafers are not in our near-term U.S. manufacturing plans,” Steven Zhu, president of Trina Solar US, told Reuters Events.

Wafers from Southeast Asia have "huge cost advantages,” Zhu said.

Wafer builders

Suppliers bucking the trend and investing in U.S. wafer supply include Qcells, a unit of South Korea’s Hanwha Group, which is building 3.3 GW of new silicon wafer production capacity in a new full vertically-integrated solar supply facility in Cartersville, Georgia.

The fully automated factory will use polysilicon refined in Washington state to manufacture ingots, wafers, cells and modules by the end of this year. The facility comes alongside a 2 GW expansion of Qcells' module factory in Dalton, Georgia to 5.1 GW, bringing Qcells' total U.S. module output to 8.4 GW.

In January, Qcells signed an agreement with U.S. tech giant Microsoft to supply 12 GW of American made solar panels through 2032, locking in a major customer to back up its factory investments.

"Our expanded agreement with Qcells is designed to drive large-scale domestic production of solar modules essential to advancing a resilient U.S. supply chain and clean energy economy," Bobby Hollis, Vice President of Energy at Microsoft, said in a statement.

Solar manufacturing capacity by country, region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

Meanwhile, U.S. company First Solar is adding production capacity through its integrated full chain manufacturing process.

First Solar's manufacturing line integrates wafer and cell production and uses cadmium rather than silicon. The company is expanding its facilities to increase full chain U.S. production capacity to 14 GW by 2026.

Qcells and First Solar will both benefit from full chain integrated facilities, helping to minimise costs. Vertically integrated factories can reduce transport risks and costs but the overall benefits depend on component sourcing, regional costs and the business model of the facility.

In a different approach, German group NexWafe plans to build a 6 GW U.S. wafer factory that will use a "gas to wafer" approach instead of using conventional silicon methods. Wafers are produced from chlorosilanes instead of polysilicon and the process can offer lower costs than conventional silicon-based methods, the company says.

NexWafe is currently building its first commercial factory in Germany of capacity 250 MW and the larger U.S. factory could come online by the end of 2027, Davor Sutija, CEO of NexWafe, told Reuters Events.

Inflation act tax credits alongside support from the Department of Energy’s Loan Program Office "provide a favorable environment for investment," Sutija said.

Trade tariffs

Many policymakers in U.S. and Europe are concerned about China's dominance of solar components.

The U.S. imposes tariffs on products from China but some companies have invested in wafer plants in nearby countries such as Malaysia and Vietnam, which has allowed them to continue shipping at lower prices. U.S. trade officials have widened tariffs to include some companies importing from these countries but the Biden administration has waived these until mid-2024 to support U.S. solar development while domestic manufacturing is ramped up.

Europe's solar industry has warned that some local manufacturers are close to bankruptcy due to a glut of lower cost Chinese products but the European Union has avoided imposing tariffs on imports.

In January, U.S. Senators Jon Ossoff (D-GA), Sherrod Brown (D-OH), Marco Rubio (R-FL), and Reverend Raphael Warnock (D-GA) sent a letter urging President Biden to increase tariffs on Chinese-made solar module, cell, and wafer imports under Section 301 of the Trade Act of 1974.

Meanwhile, supplier group Solar Energy Manufacturing for America wants stricter domestic content rules to promote a full U.S. supply chain.

Wafer and cell technology is key to high performance solar panels, "so if China dominates that they can dominate not only the present but also the future of the photovoltaic industry," Sutija warns.

This would mean that in the solar arena, "in five-to-10 years from my perspective they will be more powerful than OPEC,” he said.

Reporting by Mark Shenk

Editing by Robin Sayles