US solar power prices fall for first time in three years; EU lawmakers ditch revenue cap

The solar news you need to know.

Related Articles

US solar power prices fall for first time since Q1 2020

Solar power purchase agreement (PPA) prices in North America fell in the second quarter of this year, representing the first drop since early 2020, pricing platform LevelTen Energy said in a statement.

Average solar PPA prices in April-June softened by 1% quarter on quarter to $49.09/MWh in an indication that supply market conditions are "starting to stabilise," Gia Clark, senior director of strategic accounts at LevelTen, said. The price reflects the "market-averaged" price across the country.

Solar developers have faced price volatility due to global inflation, rising interest rates, logistics issues and regulatory uncertainty that has impacted imports of solar components. Many developers delayed projects in 2021-2022 but activity has picked up and a record 6.1 GW of solar capacity was installed in the first quarter of this year, including 3.8 GW of utility-scale plants, as supply chain challenges eased and developers completed delayed projects.

Developers are also incorporating benefits from the 2022 Inflation Reduction Act into their projects, Clark said. The act provides tax credits for solar, wind, storage and clean technology manufacturing, softening the impact of rising component prices on power offtake deals.

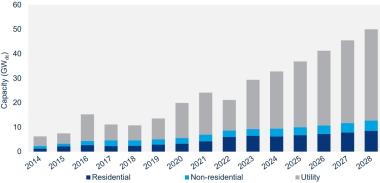

Forecasts U.S. solar installations

(Click image to enlarge)

Source: Wood Mackenzie, May 2023

In contrast, wind PPA prices rose last quarter as permitting and grid connection challenges reduced the number of projects coming to market while demand from consumers held firm.

Average wind PPA prices rose by 13% compared with the first quarter, to $58.00/MWh, LevelTen said.

“Wind projects typically have higher capacities and are less flexible in siting conditions than solar projects, making it more challenging to secure land control," Clark said.

"Permits tend to take longer due to a more complex environmental review process. Additionally, we’re hearing from developers that [grid] interconnection studies are taking longer than ever, and when they do come back, interconnection costs are far higher than historical norms,” she said.

Texas curtailment outlook highlights need for grid upgrades

Solar power curtailments in Texas are forecast to hike to 19% of total available generation by 2035, up from 9% in 2022, if there are no upgrades to the Texas power grid, the U.S. Energy Information Administration (EIA) said in a research note.

Wind curtailments are forecast to rise from 5% to 13% under the same grid scenario, EIA said.

Texas is the fastest growing solar market in the U.S. and operates the largest wind power fleet, accounting for 26% of total U.S. wind generation last year. EIA projects solar and wind capacity will double to over 100 GW by 2035 and battery storage is also on the rise, spurred by a growing need for dispatchable power and new tax credits in the 2022 Inflation Reduction Act.

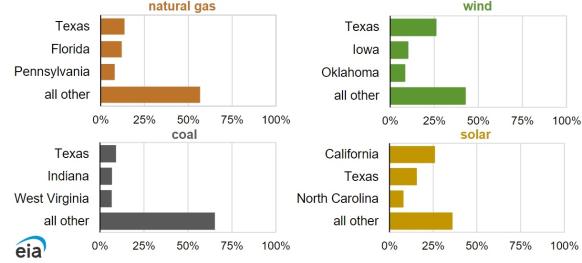

Share of US power generation - top three states

(Click image to enlarge)

Some 64% of the curtailments in 2035 would occur during times of high solar and wind resources and low electricity demand, while 36% would be due to limited transmission capacity during periods of high solar and wind and high power demand, EIA said in its forecast.

Texas has hit record high power demand five times already this summer as hot temperatures drive up demand for air-conditioning. Last summer, Texas broke power demand records 11 times.

Greater power demand from battery charging could potentially reduce curtailments during lower demand periods, EIA noted.

EU lawmakers drop revenue cap in power market reforms

The European Parliament's energy committee has agreed to drop a proposal to limit power generation revenues if Europe faces another energy price crisis.

In a move welcomed by Europe's solar industry, the committee agreed a position on reforms of the electricity market on June 19 which did not include the revenue cap.

The EU is negotiating reforms that will encourage solar and wind growth and protect consumers from future price spikes.

Last month, the European Commission (EC) ended emergency limits on power generation revenues that were implemented after Russia's invasion of Ukraine sent wholesale prices soaring.

The unprecedented measures, agreed by EU members in September, limited revenues from solar, wind and nuclear power generation to 180 euros/MWh ($199.7/MWh) from December 2022 until the end of June 2023.

The intervention capped revenues at less than half the market prices at the time, but far above the costs of most solar and wind assets. In August, the benchmark German annual power contract had soared to over 1,000 euros/MWh as gas prices rocketed.

Germany and several other EU member states imposed lower power revenue limits than the EU measures and some renewable energy developers feared ongoing market intervention and individual measures by national governments would deter investors going forward.

’‘Today we breathe a sigh of relief," Naomi Chevillard, Head of Regulatory Affairs at industry group SolarPower Europe said in a statement on July 19.

"[The Members of the European Parliament] have recognised the hugely negative impact of the caps on renewable energy growth – resulting in a contraction of the Power Purchase Agreement (PPA) market by 21% in 2022 due to regulatory uncertainty," Chevillard said.

The electricity market reforms will make it easier for businesses to sign long-term PPAs while aiding developers with counterparty risk that can deter investors.

Under the proposals, all customers will have the right to request fixed-price long-term contracts and utilities and other suppliers will have to manage price risks and hedge part of their supply portfolio against potential wholesale price spikes. To aid suppliers, national governments will have to ensure they have access to market-based guarantees that address the credit risk of buyers.

Reuters Events