US solar installation costs fell in 2022; White House awards billions to clean hydrogen hubs

The solar news you need to know.

Related Articles

US solar plant builders trimmed costs in peak inflation year

The average cost of installing U.S. utility-scale solar projects continued to fall in 2022 despite global inflation and supply chain challenges, Lawrence Berkeley National Laboratory (Berkeley Lab) said in its latest annual utility-scale solar report.

Median installed costs declined to $1.32/W based on a 4.6 GW (AC) sample of 59 plants and have fallen by 78% since 2010, Berkeley Lab said.

The levelised cost of utility-scale solar fell slightly to $39/MWh while the average price of power purchase agreements (PPAs), which factors in tax credits, firmed slightly to around $25/MWh based on a small sample of contracts, the study said.

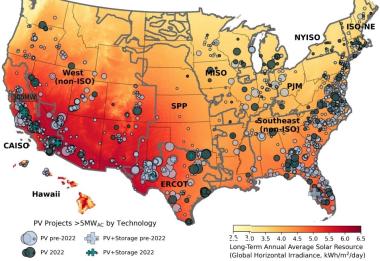

US utility-scale solar plants installed through 2022

(Click image to enlarge)

Source: Berkeley Lab's 'Utility-Scale Solar' report, October 2023.

Solar installations fell last year as developers faced rising costs and logistics issues following the coronavirus pandemic while also navigating U.S. import restrictions and tariff uncertainty.

This widened the range of costs for solar projects as smaller developers incorporated higher supply chain costs while larger developers minimised cost increases, investment bank Lazard said in a report published in April.

The levelised cost of utility-scale solar ranged from $24/MWh to $96/MWh on an unsubsidised basis, compared with a range of $30/MWh to $41/MWh for crystalline solar panels in the last report in 2021 and $28/MWh to $37/MWh for thin-film, Lazard said.

The Biden administration's Inflation Reduction Act has catalysed solar development since it was signed into law in August 2022. Industry experts predict rising deployment rates, tax credits and an eventual retreat in interest rates will put downward pressure on solar power prices in the coming years.

Installations bounced back this year to a record 6.1 GW in Q1 2023 as supply concerns eased and developers expect to install a record 32 GW this year, 53% higher than in 2022, the Solar Energy Industries Association (SEIA) and Wood Mackenzie said.

Texas, California win major federal clean hydrogen funding

Texas and California were among seven clean hydrogen hub projects awarded a total $7 billion of federal funding by the Biden administration on October 13.

The federal grants will go to hubs in the Gulf Coast (Texas), California, Middle Atlantic, Appalachian, Midwest, Minnesota and Plains states, and the Pacific Northwest, President Joe Biden said in a press conference in Pennsylvania, seen as a key election state next year.

"I'm here to announce one of the largest advanced manufacturing investments in the history of this nation," Biden said.

The hub initiatives involve a range of large energy companies and energy users and span 16 U.S. states in total. Administration officials expect the grants to leverage over $40 billion in private investment, generate tens of thousands of jobs and create a national hydrogen economy.

Clean hydrogen is produced by using clean electricity sources and the process of electrolysis. Texas is the fastest-growing U.S. solar market, hosts the largest wind feet and is seen as an early market for clean hydrogen due to significant hydrogen infrastructure on the Gulf Coast. California has the largest solar fleet as well as oil and gas infrastructure.

Supporters say clean hydrogen can help industries decarbonise and provide long duration energy storage (LDES) but costs are currently far higher than hydrogen produced by reforming natural gas.

Experts predict costs will fall due to economies of scale and technology learnings. The Biden administration aims to increase U.S. clean hydrogen output from almost zero currently to 10 million metric tons by 2030 and 50 million mt by 2050.

The proposed Texas hub is led by major industry players including Exxon, Chevron, Air Liquide, Mitsubishi Power Americas, Orsted, AES and Sempra Infrastructure. Amazon is among the hub's expected end users.

Biden's government has passed a slew of measures aimed at creating a low-emissions hydrogen economy, including the Infrastructure Investment and Jobs Act in 2021, which includes $8 billion for hydrogen projects, and the Inflation Reduction Act in 2022, which provides generous tax incentives. Industry players are awaiting guidance from the Treasury Department on how to access the inflation act subsidies.

Ireland fails to secure target volume in solar, wind auction

Ireland awarded just 500 MW of solar and 150 MW of onshore wind in its latest renewable energy auction, securing only 934 GWh of the 2,000 GWh-3,500 GWh of power generation it was seeking for 2026-2027.

The auction sought applications from mature projects with planning permissions and grid connection offers that would allow them to start delivering clean power by 2027 at the latest.

Around 3 GW of projects were eligible to compete but just under 1 GW applied, equating to 1,223 GWh of bids, the government said.

“The auction volumes underpin the need for a larger pipeline of onshore wind and solar projects coming through the grid connection and permitting processes,” it said, adding that a larger renewable energy auction will be held next year.

The government agreed to pay an average price of 100.47 euros per MWh ($73.7/MWh), compared with 97.87 euros/MWh in the previous auction.

Prices rose due to “inflationary pressures and interest rate rises,” the Minister for the Environment, Climate and Communications said.

The price increase was limited by the government's decision to partially index the costs to inflation and factor in curtailment in the conditions of the auction, industry group Wind Energy Ireland said in a statement.

Ireland plans to reach 8 GW of solar, 9 GW of onshore wind and 5 GW of offshore wind by 2030, allowing it to meet at least 80% of electricity demand from renewable energy sources.

Reuters Events