US solar experts predict further drop in offtake prices

Rising solar deployment rates, tax credits and an eventual retreat in interest rates will put downward pressure on solar power prices in the coming years, industry experts said.

Related Articles

In the second quarter of 2023, the price of solar power purchase agreements (PPAs) in North America fell for the first time in three years as constraints on project development eased.

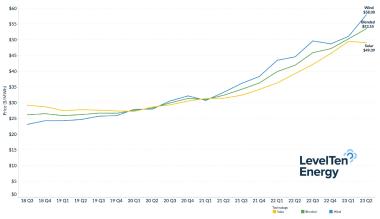

Market-averaged solar PPA prices in Q2 fell by 1% quarter on quarter to $49.09/MWh, according to figures from pricing platform LevelTen Energy. In contrast, wind PPA prices rose by 13% to $58.00/MWh as additional permitting and grid connection challenges reduced the number of projects coming on stream.

The drop in solar prices suggests that supply market conditions are “starting to stabilise”, Gia Clark, Senior Director of Strategic Accounts at LevelTen, said in a statement.

US solar, wind PPA prices (market-averaged)

(Click image to enlarge)

Source: LevelTen Energy's 'Q2 2023 PPA Price Index North America' report.

Last year, solar installations fell as developers faced rising costs and logistics issues following the coronavirus pandemic while also navigating U.S. import restrictions and tariff uncertainty.

Installations then bounced back to a record 6.1 GW in Q1 2023 as supply concerns eased and developers expect to install a record 32 GW this year, 53% higher than in 2022, the Solar Energy Industries Association (SEIA) and Wood Mackenzie said last month.

Developers are becoming more confident about obtaining equipment, "though at a higher price than they’re accustomed to historically," Joey Lange, Managing Director, Energy Supply Advisory, at consultancy Edison Energy, told Reuters Events.

Tax credits in the 2022 Inflation Reduction Act are providing market certainty and reducing delivery risks for future projects by offering bonuses for American-made parts or projects in coal communities.

While high interest rates remain a challenge for developers, industry experts predict a further softening of solar PPA prices going forward as market disruptions ease and tax incentives spur project development.

Cleaner companies

Demand for renewable energy contracts remained strong in 2022, putting upward pressure on prices, as many companies chased clean energy sources for the first time, Greg Simmons Director for Energy, Sustainability, and Infrastructure Consulting at consultants Guidehouse, told Reuters Events.

Companies signed a record 14 GW of solar PPAs with developers in 2022, up from 10 GW in 2021, according to industry group American Clean Power (ACP). Corporate wind PPA deals climbed from 3 GW to 4 GW.

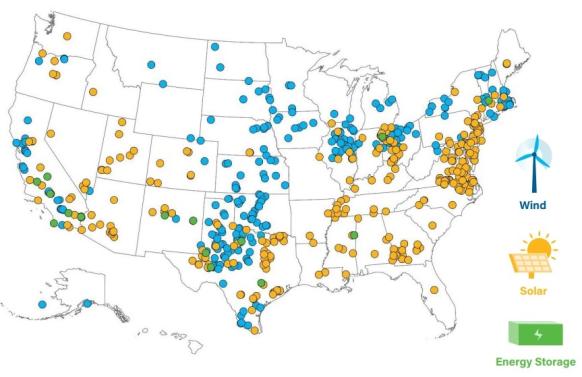

US renewable energy projects with a corporate buyer (end 2022)

(Click image to enlarge)

Source: American Clean Power (ACP)

Developer RWE is continuing to see high demand for PPAs as companies and utilities look to "avoid long-term commodity price risk and yield savings, while reducing their carbon footprint," Mark Noyes, CEO of RWE Clean Energy, told Reuters Events.

In July, RWE announced eight long-term PPAs with utility Dominion Energy Virginia for seven solar projects totalling more than 300 MW. Two of the projects are operating, four are under development and the biggest project, the 75 MW Wythe County Solar array, is due online in 2024.

Elsewhere, Virginia-based developer Greenvolt Power Actualize concluded three PPAs with Dominion Energy for projects totalling 76 MW while Clenera announced a PPA with Arizona Public Service for 258 MW of solar and 824 MWh of battery storage at the CO Bar Solar complex near Flagstaff, Arizona. CO Bar Solar will eventually comprise 1.2 GW solar and 824 MWh battery storage, making it one of the largest U.S. renewable energy facilities.

Both the supply and demand for renewable energy PPAs should continue to grow, driven by the inflation act and federal and state energy policies, Noyes said.

Many corporations have favoured the lower prices and daytime load profiles offered by solar power but as more solar and battery capacity comes online, some clients are turning to wind PPAs to supply off-peak hours, Simmons said.

“A notable shift is occurring as more clients begin to seek solutions that provide not just intermittent energy, but continuous 24/7 carbon-free electricity”, favouring wind with its capacity to offer off-peak production, he said.

RWE is seeing increased demand for co-location of battery storage with solar and wind farms, Noyes noted.

RWE's facilities co-located with battery capacity include the Texas Waves wind farms and the Fifth Standard Solar Array under development in California.

Project push

Noyes predicts the availability of projects "ready for PPAs" will grow in the coming years as supply chain constraints ease and builders expand development pipelines in response to new tax incentives.

This will put "downward pressure on prices well into the future," he said.

Strong growth outlooks have led to a rise in solar mergers and acquisitions (M&As) as developers seek economies of scale that provide cost advantages and greater protection against supply chain risks. Transactions since late 2022 include RWE's acquisition of Con Edison's Clean Energy Businesses for $6.8 billion and the sale of Duke Energy's Commercial Renewables business platform to investment group Brookfield Renewable for $2.8 billion.

The supply of projects will grow as governments, financial institutions and utilities invest heavily in clean energy infrastructure but demand for renewable electricity will remain robust so it is difficult to predict the direction of prices, Simmons noted. The federal government has pledged to source 100% of its electricity from zero carbon sources by 2030, on the way to President Joe Biden's target of a zero-carbon electricity sector by 2035.

Another key factor will be interest rates that have increased capital costs and continue to apply upward pressure on PPA prices, he said.

Edison Energy expects both supply and demand for PPAs to remain stable through 2024 and downward pressure on prices as the inflation act filters through to deals.

“While moderate price decreases may be seen as developers get more comfortable with managing the tax benefits in the [inflation act], large reductions are not expected," said Lange.

In the medium to long term, the impact of the inflation act on prices is likely to be limited as multiple cost factors are in play, Lange noted.

“Much of the savings from the domestic content adder in the IRA will be eroded by the higher costs for the U.S.-made equipment," he said.

A retreat in interest rates would have a more significant effect on prices, Lange said.

“Interest rates are driving up the cost of debt and of capital. In the medium term, interest rate reductions will likely have the biggest impact on PPA prices”, he said.

Reporting by Neil Ford

Editing by Robin Sayles