US solar dominates new build as developers widen search

Solar growth is spreading into new U.S. markets as developers tackle grid challenges and new demand pockets open up in central states.

Related Articles

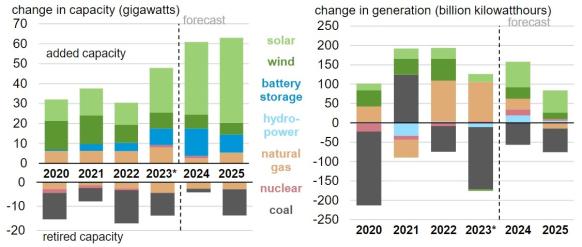

Solar installations will account for “almost all growth” in U.S. power generation in 2024-2025, increasing solar’s share of power production from 4% in 2023 to 5.6% this year and 7% in 2025, the U.S. Energy Information Administration (EIA) said last month.

Utility-scale solar installations are rising on the back of tax credits in the 2022 Inflation Reduction Act and growing demand for clean power. Supply chain disruptions and volatile costs dented installations in 2022 but these challenges have moderated, developers told Reuters Events.

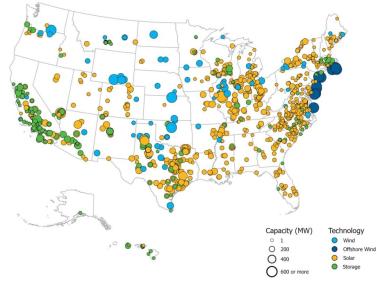

Clean power projects in development in Q3 2023

(Click image to enlarge)

Source: American Clean Power (ACP), November 2023.

Strong growth is expected in markets with mature regulated structures, state renewable targets and competitive solar and wind fundamentals, such as Texas' ERCOT, California's CAISO and the large eastern PJM network, Woody Rubin, Chief Development Officer at utility and operator AES, said.

New York's clean power targets and thermal retirements will also see a surge of projects looking to come online between 2026 and 2028, Rubin noted.

Grid connections are an increasing challenge, prompting some developers to shift into new regions.

Colorado, Texas and Florida all have strong growth potential, mainly due to an influx of data center customers, said Matt Futch, a managing director of resource planning and procurement at engineering-procurement-construction (EPC) group Black & Veatch.

“From the [construction] and developer side, we are seeing a high growth scenario from 2024 to 2028,” Futch said.

This will include “‘spikes’ in the system due to large ‘hyper scalers’ in specific regions where sufficient generation capacity, capital financing and immediate [power purchase agreements] are available,” he said.

Supply limits

Supply chain issues since the pandemic have eased but they continue to temper growth plans. Meanwhile, high interest rates are curbing wider economic activity.

Delivery schedules for major equipment are driving construction plans, whereas before 2020 suppliers matched delivery times with construction schedules, Rob Foree, a project manager at Black & Veatch told Reuters Events. Lead times for transformers and circuit breakers can be more than two years.

A shortage of EPC contractors is impacting projects in some high-growth regions and developers also continue to face long delays in grid connections. Dwindling grid capacity and slow approval processes are slowing clean power deployment across the U.S. and Europe, prompting CAISO and PJM to temporarily shelve new applications to tackle a backlog of projects.

Some power groups are seeking out sites in the Midwest and other central areas due to shrinking land and interconnection availability near large load pockets on the east and west coasts.

"We are seeing interconnection and site scarcity in both CAISO and PJM," Rubin said. "We are already seeing some customer migration to lower-cost markets that may still have interconnection constraints but to a lesser extent," he said.

Some planned projects may not be developed as “interconnection, generation and financing hurdles continue to stall projects despite a high degree of interest and demand for planning and developing these large-scale developments,” Futch warned.

Battery boomers

Rising solar capacity is hiking the demand for batteries as developers look to optimise the value of generation assets.

Tax credits in the inflation act are spurring developers to install bigger batteries, retrofit solar plants and build on disused coal plants.

U.S. utility-scale battery capacity will double this year to over 30 GW if projects are completed by their scheduled commercial operation dates, the U.S. Energy Information Administration (EIA) said last month.

Forecast US power installations

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

California and Texas are leading U.S. storage deployment as developers respond to rapid rises in solar and wind capacity and this will be repeated in other markets as they transition towards clean power.

Market regulation is needed to attract battery developers, typically through financial incentives and capacity mandates, Futch noted. California has mandated utilities to install energy storage while in Texas, rising power demand and surging solar capacity has improved the business case for storage and developers can benefit from faster grid connection and permitting than in many other markets.

Industry experts also predict battery growth in Arizona, Nevada and Colorado, where utilities are seeking to stabilise grid flows or shift the dispatch of power to when prices are higher.

The largest battery project currently in operation is Vistra’s 750 MW Moss Landing project in California and there are five projects of capacity between 443 MW and 621 MW planned for completion in California or Texas in 2024-2025, EIA data shows.

Technology boost

Incremental advances in solar technology are helping to optimise land use and drive down project costs, potentially opening up new markets for developers.

“The next phase of installations may need to be more considerate of project siting needs considering permits and proximity to the grid”, Michael Woodhouse, Research Analyst at NREL, told Reuters Events.

Growing module capacities are increasing revenue potential and the density and capacity retention of batteries is rising, developers said.

In another example, California-based developer Primergy is using TopCon, an ultra-thin oxide top layer for solar panels, to increase the efficiency of commonly used PERC cells.

Newer technologies are allowing developers to "build solar plants that require smaller footprints, reduce costs for customers and have less environmental impact overall," Ty Daul, CEO of Primergy, told Reuters Events.

Eyes West

Longer term, there is great potential for renewable energy development in the western U.S. as vertically-integrated utilities look to connect with real-time power markets in California and the Southwest Power Pool (SPP) network that runs from North Dakota down into Texas, Daul said.

The Western grid region outside California’s CAISO network saw the fastest growth in project applications in 2022 as CAISO and PJM tackled huge waiting queues.

Daul said at least 15 Western utilities had “already committed or expressed interest” in linking up networks with CAISO or SPP.

“We expect and hope to see operational markets by the end of this decade,” he said.

Reporting by Neil Ford

Editing by Robin Sayles