US solar developer M&A set to bolster installation rates

Growing cost advantages and federal incentives will spur more developers to seek scale and could help protect projects from future supply chain risks, industry experts said.

Related Articles

U.S. solar mergers and acquisitions (M&A) are picking up as the cost advantages of larger companies combine with wider growth in renewable energy deployment.

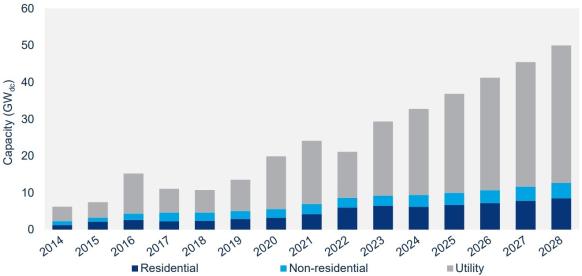

Solar installations are set to surge as developers capitalise on tax credits in the Biden administration's Inflation Reduction Act and post-pandemic supply challenges ease. President Biden aims to decarbonise the power sector by 2035 and the inflation act could hike annual utility-scale solar installations to 49 GW by 2025, five times higher than in 2020, and increase thereafter, Princeton University said in a report.

"We are seeing an increasing interest in horizontal and vertical integration, an increasing trend relative to 18 to 24 months ago," Sam Scroggins, a director in Lazard's Global Power, Energy & Infrastructure Group, told Reuters Events.

Transactions since late 2022 include the acquisition of Con Edison's Clean Energy Businesses by German energy group RWE for $6.8 billion and the sale of Duke Energy's Commercial Renewables business platform to investment group Brookfield Renewable for $2.8 billion, announced in June.

Solar M&A activity has been robust at the project, portfolio and developer level, according to Carter Atlamazoglou, managing director in FTI Consulting's Power, Renewables and Energy Transition practice. This is set to continue, impacting solar companies and costs.

"We continue to see substantial solar sector M&A in 2023 and expect this to be the case through year-end as investors look to take advantage of the unprecedented opportunities provided by the [inflation reduction act] and participate in the energy transition," Atlamazoglou said.

Cost advantage

Larger companies have been able to achieve lower solar costs amid disrupted supply chains and global inflation.

Component costs have risen on the back of rising materials costs, logistics issues and U.S. import tariff policies while rising interest rates have pushed up the cost of capital. Utility-scale solar installations fell by 23% last year as some developers delayed projects until 2023.

US solar installation forecast

(Click image to enlarge)

Source: Wood Mackenzie, June 2023

Companies with large portfolios can achieve more favorable financing terms, greater purchasing power, and broader supply networks than smaller firms.

The difference in solar costs between larger and smaller developers has widened massively since 2021 as smaller companies have incorporated higher supply chain costs while larger developers have used economies of scale to minimise cost increases.

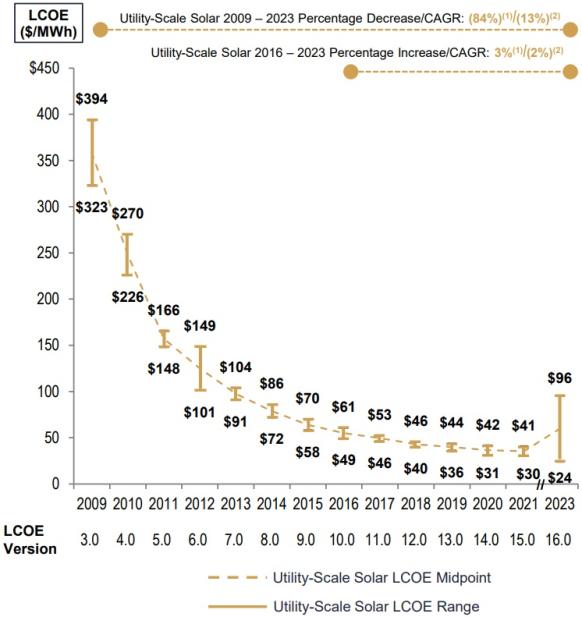

As a result, the levelized cost of the "best in class" utility-scale solar projects has declined 20% since 2021, reaching parity with wind for the first time, at $24 per megawatt-hour (MWh), Lazard said in its latest Levelized Cost of Energy (LCOE) report published in April.

Meanwhile, higher costs for smaller companies means the average cost of solar has risen by 69%.

The levelised cost of utility-scale solar ranges from $24/MWh to $96/MWh on an unsubsidised basis, compared with a range of $30/MWh to $41/MWh for crystalline solar panels in the last report in 2021 and $28/MWh to $37/MWh for thin-film, Lazard said.

Levelised cost of US solar - unsubsidised

(Click image to enlarge)

Source: Lazard's 2023 Levelized Cost Of Energy report, June 2023.

Most new solar projects are being coupled with battery storage, the bank noted, and costs range between $46/MWh and $102/MWh.

The widening cost gap suggests larger companies will continue to lead the buildout of renewable energy projects, adding further consolidation pressure, Lazard said.

Factory builders

A more consolidated market with larger and fewer companies will be better prepared to mitigate further supply chain challenges and macroeconomic impacts going forward, Scroggins said. This should help to limit the impact on solar costs.

In a new trend, larger developers are starting to invest in U.S. manufacturing to secure domestic supply and take advantage of additional tax credits in the inflation act.

In a prime example, renewable energy developer Invenergy is building the U.S.' largest solar panel factory in Ohio with Chinese partner Longi. The 5 GW/year Illuminate USA facility will supply monofacial and bifacial solar panels to the utility-scale and rooftop solar markets and Invenergy will purchase 40% of all output, an Invenergy spokesperson told Reuters Events in April.

Solar companies have announced plans for 47 GW of new U.S. module manufacturing capacity on the back of the inflation act and other government policies, the Solar Energy Industry Association (SEIA) said in a statement in March.

While many firms will seek scale, smaller regional developers with local expertise will continue to play a role, Scroggins noted.

"There is a need for development companies that are nimble and intimately connected with local communities, where development really matters," he said.

"We are seeing developers sell projects early in the development life cycle, which allows larger owners and operators to extract incremental value from the supply chain, offtake negotiations and financing."

Deals ahead

Large energy companies will continue to acquire solar and storage projects to expand low carbon portfolios while financial institutions will continue to invest in portfolios and companies, Atlamazoglou said.

The incentives in the inflation act will spur further vertical integration as companies expand their reach along the value chain and new entrants seek to establish a U.S. footprint, he said.

New M&A opportunities will arise as financial players exit their investments in the future.

"There will likely be more listings of solar developers [and independent power producers] as the financial players that have invested in platforms over recent years seek to exit and monetize their investments over the medium term," Atlamazoglou said.

"This will also lead to further consolidation as they sell down their positions as an alternative path to monetization."

Reporting by Anna Flavia Rochas

Editing by Robin Sayles