US set to restore tariffs on bifacial solar panels; US grid connection queues surge 27%

The solar news you need to know.

Related Articles

US plans to restore import tariffs on bifacial solar - Reuters

The Biden administration is expected to reverse a two-year exemption on import tariffs for bifacial solar panels, most of which are supplied by Chinese manufacturers, Reuters reported on April 17.

The U.S. government is set to grant a request by South Korean manufacturer Hanwha Qcells to reverse the exemption, filed in a letter to the U.S. Trade Representative on February 23, Reuters reported, citing two sources familiar with White House plans.

No decision has been made on the timeline of the expected reversal, the sources said.

Hanwha Qcells is seeking to protect a $2.5 billion commitment to expand its U.S. solar manufacturing base and the petition included letters of support from seven other companies that have together invested billions of dollars in U.S. solar factories.

Most solar modules imported into the U.S. are made by Chinese companies operating in Cambodia, Malaysia, Thailand and Vietnam. A separate two-year waiver on import tariffs for companies operating in the four Southeast Asia countries is set to come to an end in June. Most U.S. utility-scale solar developers opt for bifacial panels so the removal of the exemption on bifacial technology would effectively impose tariffs on the bulk of U.S. solar panel imports.

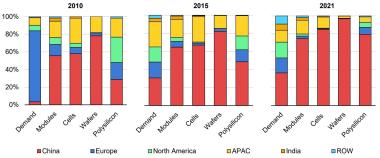

Solar manufacturing capacity by country, region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

U.S. solar installations are on the rise on the back of tax credits in the 2022 Inflation Reduction Act and growing demand for clean power.

Heavily dependent on solar panel imports, the U.S. has had to tread a difficult path between supporting solar power deployment and bolstering its U.S. manufacturing base.

Solar panel imports soared by 82% in 2023 to 54 GW, highlighting the growing thirst for products.

Tax credits in the inflation act led to announcements of 85 GW of planned new U.S. module manufacturing capacity within one year, compared with just 8 GW of manufacturing capacity in 2022, but not all this new capacity is likely to be built.

There is "growing evidence that negative market conditions caused by surging imports of bifacial modules are causing several companies to rethink their plans to invest in the U.S.," the petition from Hanwha Qcells said.

US grid connection queues surge 27% in 2023

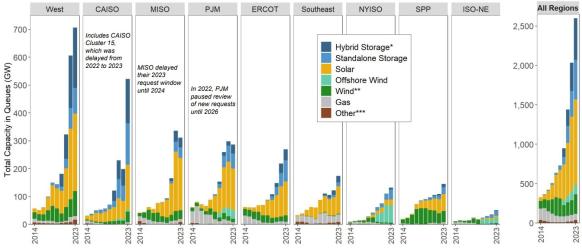

Power capacity in U.S. grid connection queues rose by 27% in 2023 to 2,600 GW, the Lawrence Berkeley National Laboratory (Berkeley Lab) said in its annual “Queued Up” report.

Solar (1,086 GW) and energy storage (1,028 GW) represent 81% of grid connection applications, followed by wind, which accounts for 14% (366 GW), a third of which is offshore. Natural gas projects represent the remaining 3% (79 GW). Only a fraction of the projects that apply for grid connections are eventually completed, the report notes.

For exclusive solar insights, sign up to our newsletter.

Dwindling grid capacity and long approval times for new connections are delaying solar and wind projects and pushing up costs. The typical timeframe from connection request to commercial operation hit five years in 2023, up from four years for the 2018-2023 period and two years for projects built in 2000-2007, the report said, based on data from the country’s seven ISOs/RTOs alongside 44 non-ISO utilities.

Capacity joining the interconnection queues is growing rapidly. Last year, projects totaling 908 GW joined the queues, up from 759 GW in 2022 and 561 GW in 2021.

The biggest queues are in the West (706 GW), followed by California’s CAISO (523 GW), MISO (311 GW), PJM (287 GW) and ERCOT (269 GW).

US power capacity in grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2024

There are currently 571 GW of solar hybrids and 48 GW of wind hybrids in grid connection queues. Hybrid projects are typically coupled with a battery and are seeing particularly strong growth in CAISO and the non-ISO West.

US lowers fees, accelerates permits on public lands

The U.S. Interior Department has issued a final rule on new regulations that will reduce costs and streamline permitting for solar and wind projects on federal land.

The 245 million acres of U.S. public land managed by the Bureau of Land Management (BLM) represent around 10% of the country's entire land area but host just 6% of national installed solar capacity and 1% of wind, according to data in 2022. Much of the land lies in 12 western states and the Rockies.

The new rules set out by the BLM will reduce capacity fees (royalty payments) for solar and wind projects by 80% compared with 2020 levels, a larger reduction than the interim guidance issued by the bureau in 2022, the Interior Department said.

The final rule also streamlines the review of applications in priority solar and wind areas and allows the BLM to accept leasing applications in priority areas without first going through a full competitive auction, if appropriate.

The final rule follows a period of public consultation from a wide range of stakeholders.

The U.S. has now permitted nearly 29 GW of clean energy on public lands, surpassing the Biden administration's goal of 25 GW by 2025, the Interior Department said.

Since 2021, the BLM has permitted more than 7 GW of projects and is currently processing permits for an additional 32 GW.

The bureau is also planning to expand its Western Solar Plan for priority development on public lands to include Idaho, Montana, Oregon, Washington and Wyoming.

The Western Solar Plan offers a combined environmental impact statement to developers in areas with high solar potential and minimal conflict with other uses and was last updated in 2012 to cover areas in California, Nevada, Utah, Colorado, Arizona and New Mexico.

The new plan proposed by the BLM identifies 22 million acres for priority solar access across the 11 states and reflects rising demand for clean energy capacity and advances in solar technology. The areas lie within 10 miles of existing or planned transmission lines to minimise costs and reduce the risk of delays during development.

A public consultation on the expanded plan ended on April 18 and a final decision is expected this year.

EU countries pledge more support for solar manufacturing

Energy ministers from 23 European Union countries and around 100 industry representatives signed a new EU Solar Charter to support regional solar manufacturing.

Europe faces the widespread closure of solar factories within months without emergency support measures from EU authorities, the European Solar Manufacturing Council (ESMC) warned in a letter to the European Commission (EC) in January. Surging exports from China have driven down solar panel prices and led to a glut of Chinese products in Europe.

The signatories of the Solar Charter committed to support measures such as "early" implementation of new rules that favour the procurement of local content - set out under the EU's provisionally-approved Net Zero Industry Act - and the use of non-price criteria in renewable energy auctions.

The European Commission (EC) committed to provide access to EU funding for solar PV manufacturing projects under the Recovery and Resilience Facility, structural funds, the Innovation Fund, the Modernisation Fund, and Horizon Europe, it said.

The EC will also work with the European Investment Bank (EIB) to "reinforce its support to investments in the solar manufacturing value chain, including through InvestEU," it said.

The signatories also committed to using "all available EU funding opportunities as well as flexibilities under the State aid Temporary Crisis and Transition Framework (TCTF) to provide support for new investments in the solar energy supply chain," the EC said.

The Net Zero Industry Act will require at least 40% of all solar components to be manufactured in the EU by 2030 but it could take years for some member states to implement the rules at a national level.

Some 3.5 GW per year of EU module capacity is at risk of closure – around half of operational EU capacity, ESMC said in January. EU module production capacity was around 8 GW in 2023 and the EC should ensure production of at least 5 GW/year until 2026, it said.

EU module prices plummeted from 30 cents/Watt to around 10 cents/Watt during 2023 and this is “below the manufacturing cost even for the largest Chinese module producers,” ESMC said.

The manufacturing group called on the EU to help buy up excess inventories of European solar modules, change state aid rules to let national governments provide direct support for manufacturers, and insert supportive mechanisms in solar auctions.

The ESMC suggested trade defence measures as a last resort but in March EU energy policy chief Kadri Simson ruled out cutting off solar imports to ensure developers have sufficient supplies.

Earlier this month, the EU launched investigations into two solar project bids featuring Chinese components to determine whether foreign subsidies gave them an unfair advantage.

The probe will focus on two consortiums bidding for the development of a 455 MW solar park in Romania, part financed by EU funds. The first consortium is composed of Romania's ENEVO Group and a subsidiary of LONGi Green Energy Technology Co and the second involves subsidiaries of Chinese state-owned Shanghai Electric Group.

Reuters Events