US regulator urged to enforce grid build as Senators apply pressure

New Senate bills could help spur interregional grid expansions that are vital to wind and solar growth but industry groups say the energy regulator can act to mandate operators now.

Related Articles

Wind and solar deployment must accelerate to meet President Biden's target of a decarbonised power sector by 2035 but a lack of long-distance grid capacity is holding back growth.

To minimise the impact on consumers, low-cost renewable energy will need to be transferred from Central U.S. and other high resource areas to high demand centres around the country. Interregional transmission capacity must grow by two to three times the current capacity to decarbonise the power sector, requiring between 13,000 and 91,000 miles of new high-capacity lines, according to a study by the National Renewable Energy Laboratory (NREL) released in August 2022.

Wind and solar build is set to surge on the back of the Biden administration's Inflation Reduction Act but developers already face long grid connection queues and a lack of urgency on long-distance lines will create major bottlenecks. Interregional grid projects typically take over a decade to be completed as developers navigate a complex patchwork of state and federal approval processes and many have been derailed by local or state opposition.

To aid developers, U.S. lawmakers are seeking to pass a bill that sets a minimum requirement for grid capacity between regions within a set timeframe.

Dropped from the bipartisan debt deal in June, the Big Wires bill would require power networks to have interregional grid capacity equivalent to at least 30% of peak electricity demand, a threshold subject to data review.

The bill was introduced by Senator John Hickenlooper and Representative Scott Peter (Democrats) and the proponents plan to introduce it to Congress at the start of the next work period in early September, a spokesperson at the office of Senator Hickenlooper told Reuters Events.

The Senators’ teams are working with stakeholders and industry experts to ensure "the bill is on the right track," the spokesperson said.

FERC pressed

The final bipartisan debt deal included reforms to the National Energy Policy Act (NEPA) that limit the duration of environmental impact studies for new energy infrastructure but developers have called for deeper federal interventions in transmission planning, including the bulk planning of new lines from specially designated wind and solar zones.

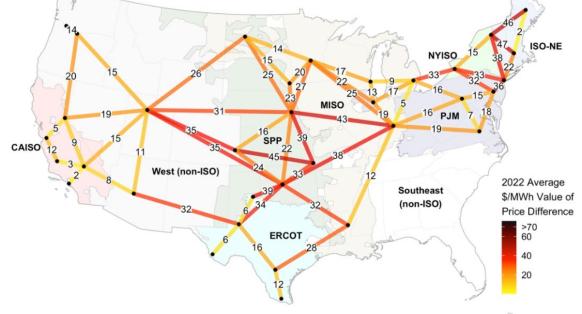

Average difference between zonal power prices in H1 2022

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory

Debt deal negotiators replaced the proposed Big Wires bill with an order for the North American Electric Reliability Corporation (NERC) to assess how much transfer capacity is needed between regions to strengthen grid reliability.

The report is set to be delivered to the Federal Energy Regulatory Commission (FERC) by December 2024 and renewable energy groups are pushing for the commission to act sooner.

FERC has the authority to establish a minimum transfer capacity between regions without congressional approval or a new study, according to Elise Caplan, Vice President of Regulatory Affairs at the American Council on Renewable Energy (ACORE).

FERC held a workshop on the matter in December 2022 and has received sufficient feedback to issue a proposed rule, Caplan told Reuters Events.

"FERC doesn't need to wait for that NERC study that was in the debt ceiling deal. We don't want that study to delay the process," she said.

A recent study by the U.S. Department of Energy (DOE) highlighted the need for more interregional transmission capacity. The study shows significant grid build is needed by 2030 in the Great Plains, Midwest, and Texas to support high clean energy goals.

"Large amounts of low-cost generation potential exist in the middle of the country and accessing this generation through increased transmission is cost-effective for neighboring regions," the study found.

"We think FERC has enough to act on without even needing legislation," Caplan said.

Further reforms

A permitting bill tabled by West Virginia Senator Joe Manchin could further aid the construction of interregional grids, Michael Skelly, CEO of Grid United, a group that promotes new interregional transmission, said.

Manchin's Building American Energy Security Act of 2023 proposes changes in the permitting process for fossil fuel and renewable energy projects, including setting maximum timelines for permitting reviews and empowering FERC to approve national interest transmission lines and ensure that project costs are allocated to the customers that benefit.

“The renewed emphasis of the [Biden] administration and others on expediting permitting should be helpful. There is awareness that this is a big issue which is step one in solving a problem,” Skelly said.

Federal authorities should require system operators to perform interregional grid planning and assess the wider benefits of new transmission, including savings from access to lower cost generation, reliability benefits and avoidance of power outages, Caplan said.

“Without a full analysis of the benefits, you have more difficulties allocating the cost for a whole wide region," she said.

Bureaus align

Two long-distance lines recently approved by federal authorities highlight the challenges faced by grid developers and indicate a federal initiative to accelerate coordination between agencies helped developers overcome delays.

In April, the Bureau of Land Management (BLM) approved the construction of the Wyoming-to-Nevada TransWest Express line after more than 15 years of development. The 3 GW line will deliver wind energy generated in southern Wyoming to consumers in Arizona, Nevada, and southern California.

Two-thirds of the TWE Project route is located on federal land and this typically means several review and approval steps by different federal agencies before full approval is given.

After 16 years in development, BLM approved Pattern Energy's Sunzia transmission project in New Mexico which will transmit over 3.5 GW of wind power across Western states.

Key changes to the project included a route change to allay concerns over proximity to the White Sands Missile Range.

A wind and solar developer, Pattern Energy acquired Sunzia last year and expects to start construction later this year and start transmitting power by the end of 2025.

Sunzia and TransWest were both granted FAST-41 status, a federal initiative launched in 2015 to streamline approvals of critical infrastructure.

"The Fast 41-team has been effective in overseeing the accountability of all federal agencies involved in the project to ensure major federal project development milestones were met," Pattern Energy CEO Hunter Armistead told Reuters Events in an email.

"The ability of the Fast-41 team to quickly and efficiently convene cooperating federal agencies to discuss and resolve specific permitting challenges throughout the NEPA process proved quite valuable to the successful completion of the SunZia permitting," Armistead said.

Reporting by Anna Flavia Rochas

Editing by Robin Sayles