US invests billions in grid expansions; European solar installs hike 30% on rooftop push

The solar news you need to know.

Related Articles

US government invests billions to de-risk grid construction

The Biden administration will invest $1.3 billion in three new power lines in the U.S. West and Northeast to support renewable energy and strengthen the resilience of the power networks, the Department of Energy (DOE) announced on October 30.

The proposed transmission projects are the 1.5 GW Cross-Tie line connecting Utah and Nevada, the 748 MW Southline transmission project in New Mexico and the 1.2 GW Twin States Clean Energy Link in New England. Construction is expected to start in 2025-2026.

The DOE will acquire up to 50% of the transmission line capacity for up to 40 years and sell this capacity to market participants, reducing the financial risk for the power line developers, it said. The department will use capacity contracts authorized by a $2.5 billion program in the 2021 Bipartisan Infrastructure Law.

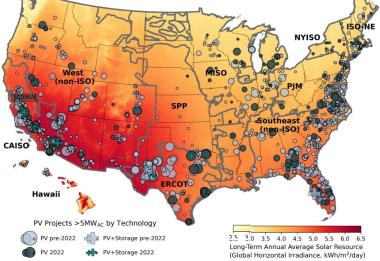

US utility-scale solar plants installed through 2022

(Click image to enlarge)

Source: Berkeley Lab's 'Utility-Scale Solar' report, October 2023.

A lack of grid capacity and slow approval processes are delaying solar and wind projects and hampering President Joe Biden's efforts to decarbonise the power sector by 2035.

On October 18, the Biden administration announced $3.5 billion of grid investments that will include five transmission projects across seven Midwest states under a new interregional planning process.

New power lines will be built in Iowa, Kansas, Nebraska, North Dakota, Minnesota, Missouri, and South Dakota to support renewable energy deployment, under a coordinated interregional assessment process that studies multiple projects at once, rather than in sequential timelines. This new process will result in "scalable transmission solutions, new renewable generation, lower energy costs, and enhanced community engagement and workforce development," the DOE said in a statement.

In total, the investment plan features 58 projects to strengthen the transmission grid in 44 states and make it more resilient to extreme weather events brought about by the climate crisis, the DOE said.

The plan will help bring more than 35 GW of solar and wind energy online, it said, and is the first round of selections under the $10.5 billion grid resilience and innovation partnerships (GRIP) program that is funded by the Bipartisan Infrastructure Law.

"The grid, as it currently sits, is not equipped to handle all the new demand ... we need it to be bigger, we need it to be stronger, we need it to be smarter, to bring all of these new projects online," Energy Secretary Jennifer Granholm told reporters.

Department of Energy sets out measures to reduce grid queues

The U.S. Department of Energy (DOE) has set out a range of measures to shorten grid connection queues for solar and wind projects in a draft transmission roadmap published on October 25.

A lack of grid capacity and slow approval processes are delaying solar and wind projects. Following consultation with industry and building on recent rule changes by the Federal Energy Regulatory Commission (FERC), the DOE proposes to enforce stricter financial commitments, withdrawal penalties and time limits for developers, and remove projects from the queue that are not ready to connect. The department also recommends deadlines and penalties for completing interconnection studies and, if required, one-off interventions for mitigating queue backlogs, such as the temporary fast tracking of projects and recruiting of staff.

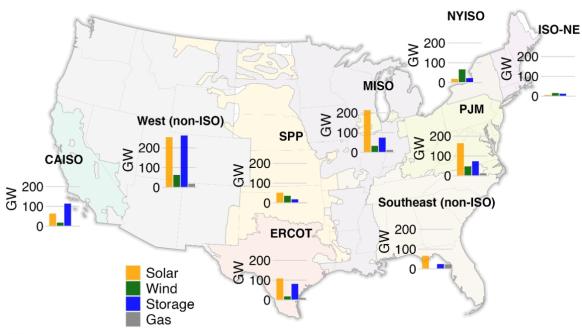

Capacity in US grid connection queues at end of 2022

(Click image to enlarge)

Source: Berkeley Lab, April 2023

Developers should gain access to higher quality and more standardised data on interconnection queues, including cost estimates, the DOE said.

Grid connection costs and project withdrawals are highest in congested grids such as the expansive PJM network, where costs for active projects in the queue have grown eightfold since 2019, the Lawrence Berkeley National Laboratory (Berkeley Lab) said in a separate study published in January. PJM paused new reviews until 2026 to tackle its huge backlog and many developers have pivoted to other markets.

Coordination between transmission system operators must be expanded to include joint system studies and new processes to build transmission lines between regions, the DOE said.

Long-distance power lines are needed to shift load from areas with high renewable energy sources to the largest cities. Senate bills have urged the FERC to enforce long-distance transmission build and industry groups say the energy regulator can act without a full rulemaking procedure.

Options for proactive transmission investments must be studied, the DOE said. In June, California pledged to spend $7.3 billion on 45 new power transmission projects by 2030 that will support the construction of 17 GW of solar capacity, 8 GW of wind and numerous battery storage projects.

More resources must be allocated to staff recruitment at grid and regulatory authorities to reduce queue times, the DOE said.

"Due to the increased number of interconnection applications, burnout issues have made it difficult to retain skilled staff," the department noted.

"Targeted efforts to increase training opportunities for and improve compensation of existing staff will improve workforce capabilities, increase retention, enhance diverse and equitable representation across the interconnection workforce, and, as a result, expand processing of interconnection applications," it said.

The DOE will review market responses to the draft roadmap this month before publishing a final plan.

European solar installations hike 30% as rooftop activity soars

Annual solar installations in Europe are set to rise 30% this year to 58 GW, dominated by rooftop projects, research group Rystad Energy said on October 26.

Rooftop projects will account for 70% of installations and much of the activity will be in Germany where annual solar installations will hike 85% to 13.5 GW, Rystad said. Rooftop solar faces less permitting and regulatory hurdles than utility-scale projects and Germany aims to install 215 GW of solar by 2030, compared with 63 GW in 2022, through a rapid buildout of rooftop solar as well as growth in utility-scale installations.

Spain will be the largest utility-scale solar market this year, installing around 5 GW of capacity, Rystad said.

"Rooftop solar is driving the transformation of Europe's renewable energy landscape, from a niche market to a powerful force in reshaping the continent's energy mix," the research group said.

Meanwhile, Rystad predicts onshore wind installations in Europe will fall 11% this year as permitting bottlenecks and rising supply chain costs stunt activity.

Reuters Events