US implements faster grid connection rules; EU set to install 900 GW of solar by 2030

The solar news you need to know.

Related Articles

US energy regulator streamlines grid connections

The U.S. Federal Energy Regulatory Commission (FERC) has agreed to streamline grid connection processes for solar and wind farms under new rules that prioritise projects that have secured permits and imposes penalties for transmission operators that miss deadlines.

The final ruling aims to reduce delays in grid connections that are stunting renewable energy growth. Developers currently take several years to secure grid connections as transmission operators work through a backlog of projects.

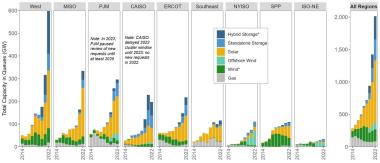

Capacity in US grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

The FERC's reforms mean developers will be required to meet financial requirements to enter the grid connection queue and projects that have gained land rights and permits would be assessed before less advanced projects.

Grid operators will be able to assess multiple projects in clusters to make best use of their resources and will be subject to a daily penalty for overdue approvals.

Some grid operators have already imposed similar measures following a surge in solar and wind applications.

Eastern network operator PJM has paused new reviews and introduced a first-ready, first-served cluster study process to reduce the number of speculative projects that are delaying approvals. New requests submitted since October 2021 will be reviewed under the new rules from 2026. During a transition phase, PJM will expedite approval of projects that require network upgrades costing up to $5 million, according to FERC approval documents.

The Southwest Power Pool (SPP) also assesses projects in clusters. SPP typically conducts studies for groups of 30 to 50 projects, sometimes as many as 200, as this approach is "much more efficient," SPP’s vice president of engineering David Kelley told Reuters Events in April.

SPP provides preliminary cost data within 60 days of a request and a final in-depth cost analysis within around a year, Kelley said. The whole study process takes between 12 and 18 months, compared with over three years in most other regions.

FERC is also studying reforms to speed up the deployment of long-distance transmission lines that are crucial to solar and wind growth. Developers have called for deeper federal interventions in transmission planning, including the bulk planning of new lines from specially designated solar and wind zones. Power will need to be transmitted from Central US and other high resource areas to major demand centres around the country. California recently agreed to develop upfront bulk transmission to speed up solar, wind and storage projects.

New Senate bills could help spur interregional grid expansions but industry groups are calling for FERC to act sooner on the issue.

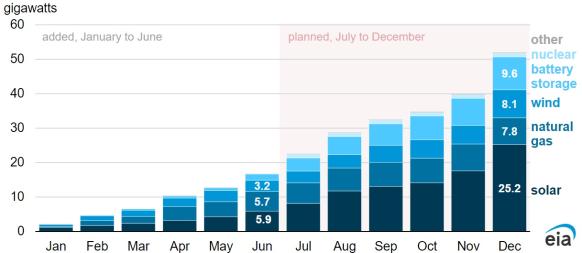

US solar developers plan to install 19.3 GW in July-December

U.S. developers plan to install 19.3 GW of utility-scale solar capacity in the second half of this year, taking the total for this year to 25.2 GW, the U.S. Energy Information Administration (EIA) said in a research note.

The annual total will be double the previous record of 13.4 GW set in 2021 but is lower than the 29.1 GW predicted by developers in February.

Forecast U.S. power installations in 2023

(Click image to enlarge)

Last year, solar installations fell by 23% and were far lower than forecast by the EIA due to a combination of volatile prices and supply disruptions following the coronavirus pandemic and uncertainty over U.S. import tariffs.

In addition, a ban on solar imports from China's Xinjiang region under the Uyghur Forced Labor Prevention Act (UFLPA) blocked inflows at U.S. ports.

Solar projects are set to represent 55% of all new capacity added to the grid in the second half of this year and 4.6 GW was originally scheduled for the first half of the year, EIA said.

New tax incentives in President Biden's Inflation Reduction Act are set to stimulate renewable energy investment in the coming years but the U.S. lies far behind Biden's goal of a decarbonised power sector by 2035.

Solar installations must hit 60 GW/year by the middle of the decade and 70 GW/year in 2031-2035 to meet the President's goals, the Department of Energy (DOE) said in a report in 2021.

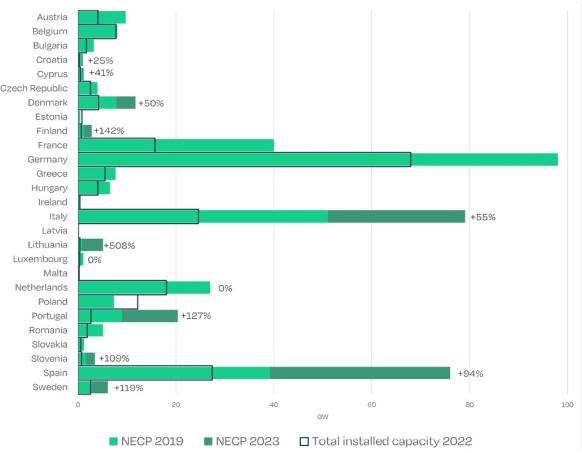

EU solar industry forecasts 900 GW by 2030

The European Union is set to install 900 GW of solar capacity by 2030, exceeding the European Commission's target of 750 GW, based on higher targets set out in National Energy and Climate Plans (NECPs) and analysis by industry group SolarPower Europe.

By early August, 12 out of 27 EU member states had submitted revised NECPs and these raised the EU solar target by 90 GW to 425 GW, double current installed capacity, SolarPower Europe said in an interim statement.

Four EU countries have already surpassed their solar target for 2030, a further 19 countries will likely hit their target within the next five years, and the remaining four countries will reach their goals between 2027 and 2030, the industry group noted.

EU solar capacity vs updated targets

(Click image to enlarge)

Source: SolarPower Europe, August 2023.

After modelling current installation trends, SolarPower Europe predicts a "most-likely scenario where over 900 GW of solar capacity will be installed in the EU by 2030," it said.

Reuters Events