US expands federal solar build zone; Solar installs jump; Battery build soars

The solar news you need to know.

Related Articles

US expands federal solar build area to 22 million acres

The U.S. federal government has expanded its Western Solar Plan for priority development on public lands to include Idaho, Montana, Oregon, Washington and Wyoming.

The Western Solar Plan offers a combined environmental impact statement to developers in areas with high solar potential and minimal conflict with other uses and was last updated in 2012 to cover areas in California, Nevada, Utah, Colorado, Arizona and New Mexico.

The new plan proposed by the Interior Department identifies 22 million acres for priority solar access across the 11 states and reflects rising demand for clean energy capacity and advances in solar technology. The areas lie within 10 miles of existing or planned transmission lines to minimise costs and reduce the risk of delays during development.

The plan forms part of the Biden administration's efforts to decarbonise the power sector by 2035 which require a massive expansion of solar and wind capacity.

The 245 million acres of U.S. public land managed by the BLM represent around 10% of the country's entire land area but host just 6% of national installed solar capacity and 1% of wind, according to data in 2022. Much of the land lies in 12 western states and the Rockies.

The Interior Department's plan is open for public comment until April 18 and a final plan is expected to be published by the end of the year.

Solar to spearhead US power installations

U.S. solar power installations will far exceed other generation types in 2024 and 2025, hiking the share of generation capacity represented by solar from 4% to 7%, the U.S. Energy Information Administration (EIA) said in its latest short-term energy outlook (STEO).

Solar installations are on the rise, propelled by tax credits in the 2022 Inflation Reduction Act and growing demand for clean energy sources.

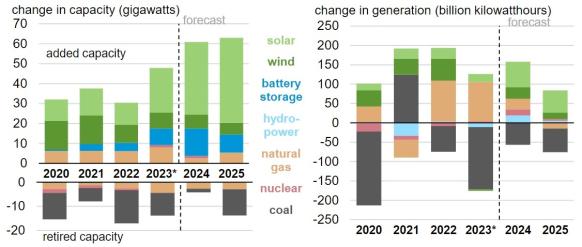

Forecast US power installations

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

"As a result of new solar projects coming on line this year, we forecast that U.S. solar power generation will grow 75% from 163 billion kilowatthours (kWh) in 2023 to 286 billion kWh in 2025," EIA said. "We expect that wind power generation will grow 11% from 430 billion kWh in 2023 to 476 billion kWh in 2025."

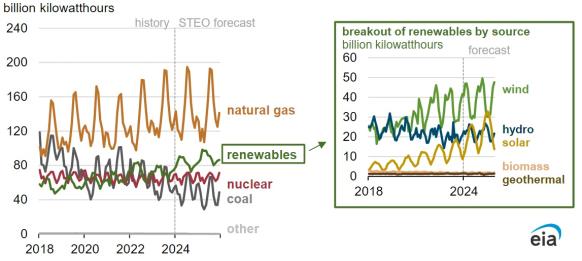

Forecast monthly US power generation by source

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

US battery capacity set to double this year

U.S. utility-scale battery capacity will double this year to over 30 GW if projects are completed by their scheduled commercial operation dates, the U.S. Energy Information Administration (EIA) said in a research note.

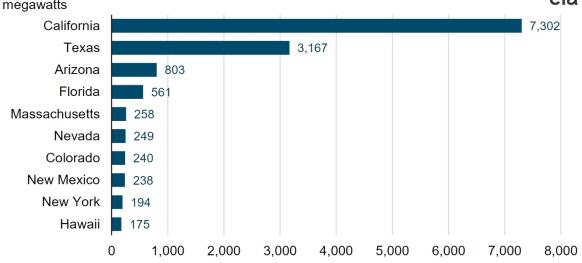

California and Texas are leading U.S. storage deployment as developers respond to rapid rises in solar and wind capacity and this will be repeated in other markets as they shift away from fossil fuels.

California has mandated utilities to install energy storage while in Texas, surging solar capacity has improved the business case for storage and developers benefit from faster grid connection and permitting than in many other markets.

US states with largest battery capacity at end of 2023

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

Tax credits in the 2022 Inflation Reduction Act are spurring developers to install bigger batteries, retrofit solar plants and build on disused coal plants.

Around two-thirds of U.S. storage installations by 2025 will be in California's CAISO and Texas' ERCOT networks while Nevada will also become a key storage market in the coming years, according to S&P Global.

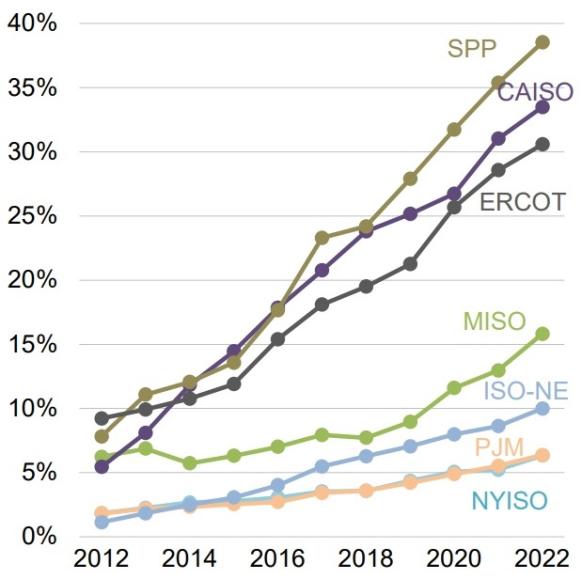

Market share of solar + wind, by US market

Source: U.S. Department of Energy's Land-Based Wind Report, September 2023.

Global solar corporate funding hiked 42% in 2023

Global corporate funding in the solar sector hiked by 42% in 2023 to $34.3 billion as the U.S. Inflation Reduction Act, favourable global policies and increased focus on energy security led investors towards the solar sector, Mercom Capital said in its latest annual solar funding report.

There were 160 solar corporate funding deals in 2023, including venture capital, public market and debt financing, compared with 175 in 2022, Mercom said.

"Despite high-interest rates and challenging market conditions, corporate funding in the sector was the highest in a decade," Mercom CEO Raj Prabhu said.

"Debt financing also hit a decade high, and venture capital investments and public market financing recorded the second-highest amounts since 2010," Prabhu said.

Debt financing climbed by 67% last year to $20 billion and the securitisation of assets was a key contributor, Mercom said.

Meanwhile, global solar mergers and acquisitions (M&A) activity fell by 25% to 96 transactions, due to a range of factors including global market uncertainties, elevated interest rates, resource shortages and unpredictable project timelines, it said.

The largest transaction was Brookfield Renewable's acquisition of Duke Energy’s unregulated U.S. utility-scale renewable energy business for approximately $2.8 billion.

Reuters Events