US battery bonanza in solar states signals major role for storage

Tax credits and soaring demand in California and Texas are spurring developers to install bigger batteries, retrofit solar plants and build on disused coal plants.

Related Articles

The Biden administration's Inflation Reduction Act has catalysed energy storage development across the United States.

Rising solar and wind capacity is increasing the need for battery storage and the inflation act includes investment tax credits (ITCs) for stand-alone storage facilities for the first time.

Energy storage allows solar developers to capitalise on evening peak power prices or provide ancillary grid services and most new utility-scale solar projects include batteries.

Utility-scale battery capacity was around 9 GW at the end of 2022, around half of which was solar plus storage. S&P Global Commodity Insights predicts 40 GW of storage capacity will be installed by the end of 2025.

California and Texas are spearheading storage deployment as developers respond to rapid rises in solar and wind capacity and this will be repeated in other markets as they shift away from fossil fuels.

California has mandated utilities to install energy storage while in Texas, surging solar capacity has improved the business case for storage and developers benefit from faster grid connection and permitting than in many other markets.

Around two-thirds of U.S. storage installations by 2025 will be in California's CAISO and Texas' ERCOT networks while Nevada will also become a key storage market in the coming years, according to S&P Global.

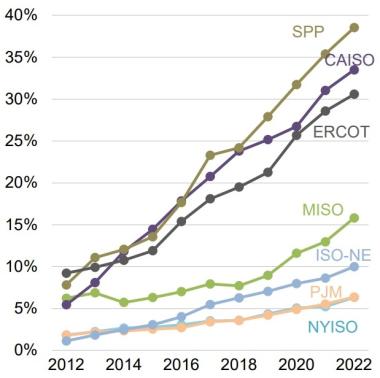

Market share of solar + wind, by US market

(Click image to enlarge)

Source: U.S. Department of Energy's Land-Based Wind Report, September 2023.

Developers are installing larger batteries as solar capacity grows. Planned battery storage projects average about 100 MW, compared with 40 MW for installed projects, analysis by S&P Global shows.

“Depending on how much storage gets deployed independently of solar, batteries that are directly located at solar projects will likely become bigger relative to the solar capacity and have a longer duration over the next few years," Joachim Seel, Policy Researcher at Lawrence Berkeley National Laboratory told Reuters Events.

Wider incentives in the inflation act have also stimulated demand for retrofitting batteries at existing solar sites and installing solar and storage in former coal communities, industry experts said.

Bigger batteries

Developers often start with smaller battery capacity in emerging storage markets and then build larger units as they gain market learnings and economies of scale, Vanessa Witte, Senior Analyst, North America Storage at analysts Wood Mackenzie, told Reuters Events.

This was the case in Texas and New York, where some of the most active developers started with batteries around 10 to 20 MW and then moved up in size to 50 MW and over 100 MW, Witte said. New York provides production payments to storage facilities and aims to install 6 GW by 2030.

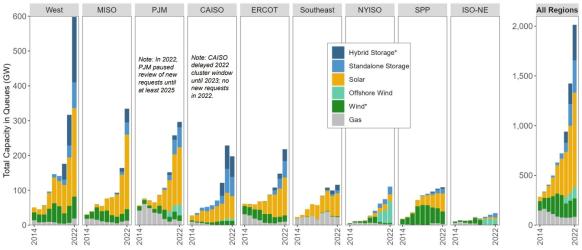

Power capacity in US grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

Market regulation is a key driver of storage durations. In many markets, four-hour storage durations have allowed operators to provide capacity during peak summer demand and many market regulators have encouraged this through regulation. Resource adequacy rules in California's CAISO market incentivise four-hour batteries, for example. In Texas, the U.S.' largest wind power market and the fastest growing solar market, ancillary services regulation incentivises two-hour storage.

"ERCOT doesn’t currently have the price support for developers to build the more costly four-hour batteries," Xiaoyu Gu, managing director of investment group AB CarVal, said. "Two-hours are the norm there, up from one-hour a few years ago."

Regulatory changes are likely to spur growth later this decade in the Southwest Power Pool (SPP) and the MISO markets in Central U.S., as well as the PJM network in the east, Xiaoyu said.

Some states such as New York, Massachusetts and Connecticut provide incentives for smaller retail or commercial battery systems to encourage wider adoption across the grid, he noted.

As renewable energy penetration grows, the demand for long duration energy storage (LDES) will rise. A range of different technologies are being developed to provide storage for several hours or longer, or store power between seasons. The California Public Utilities Commission (CPUC) has already called for 1 GW of new LDES capacity by 2026 as the state pursues ambitious decarbonisation goals.

Storage scramble

New tax credits in the inflation act have led to a surge in stand-alone energy storage projects that can be placed closer to demand centres, as well as projects that take advantage of shared grid connections.

A number of solar developers are using the credits to retrofit storage to existing solar facilities or add them to projects under development, avoiding the need for a separate grid connection point that can take years to be approved.

Utility Alliant Energy has secured approval to add nearly 75 MW storage to its existing 150 MW Wood County solar project in Wisconsin. Alliant will also install a 100 MW battery at its 200 MW Grant County solar project due online in 2024.

The inflation act also offers bonus tax credits for clean technology projects in energy communities hit hard by the energy transition. Solar and storage is often a good fit for land areas at closed coal plant sites and areas with less space can favour stand-alone storage facilities.

In one example, Alliant plans to install 99 MW of storage capacity at its Edgewater coal-fired power plant that is due to close in 2025. The group will also acquire the 200 MW solar/75 MW storage Duane Arnold project being developed by NextEra at its shuttered nuclear power plant in Iowa.

Alliant is taking advantage of the energy community credits and the existing grid infrastructure at the sites, Ben Lipari, AVP Development & Customer Solutions at Alliant, told Reuters Events.

Alliant clearly sees value in building energy storage now. The utility has announced plans to develop over 1,000 MWh of energy storage since the inflation act was enacted.

Reporting by Neil Ford

Editing by Robin Sayles