Texas power prices hit 30-month high; Italy solar installs hike 129% in H1

The solar news you need to know.

Related Articles

Texas power prices spike as temperatures soar

Texas day-ahead power prices hit a 30-month high on August 25 as high temperatures hiked power demand to record-breaking levels, Reuters reported.

Prices at the ERCOT North Hub, which includes Dallas, soared to $1,599/MWh for August 26, the highest since the 2021 February freeze knocked out power generation facilities and saw prices exceed $8,000/MWh.

Grid operator ERCOT urged consumers to conserve energy on consecutive days as sweltering temperatures above 100 degrees Fahrenheit drove up demand for air-conditioning units.

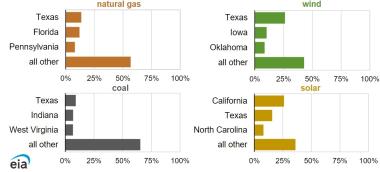

Texas is the fastest growing solar market in the U.S. and operates the largest wind power fleet, accounting for 26% of total U.S. wind generation last year. The Energy Information Administration (EIA) projects solar and wind capacity will double to over 100 GW by 2035 and battery storage is also on the rise, spurred by a growing need for dispatchable power and new tax credits in the 2022 Inflation Reduction Act.

Share of US power generation - top three states

(Click image to enlarge)

Texas solar developers are adding storage as inflation act tax benefits increase profit margins but a lack of transmission could delay projects and keep huge solar resources in the west beyond reach.

Most solar developers are expected to pair solar facilities with one to four-hour lithium-ion battery storage systems. This represents a dramatic change in just a couple of years.

At the start of 2022, only 27% of all solar projects in the Texas grid connection queue were coupled with storage and by the end of the year this had risen to 42%, according to preliminary data from Lawrence Berkeley National Laboratory (Berkeley Lab). In California, where solar penetration is higher, the figure was around 97%.

Rising US solar panel shipments signal installation push

U.S. solar panel shipments rose 10% in 2022 to hit a record high of 31.7 GW peak capacity, foreshadowing a sharp increase in installations expected this year.

Some 88% of shipments were imports, primarily from Asia, with the rest made up of exports and domestically supplied panels.

Last year, U.S. solar installations dipped as global inflation, logistics issues and new import rules drove up prices and delayed projects.

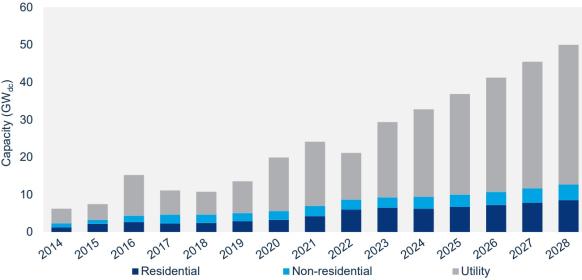

This year, installations are forecast to rebound and hit record levels as supply chain challenges ease and developers complete delayed projects. Developers brought online a record 6.1 GW of solar capacity in the first quarter of 2023, including 3.8 GW of utility-scale plants, the Solar Energy Industries Association (SEIA) and Wood Mackenzie said in a quarterly market report.

US solar installation forecast

(Click image to enlarge)

Source: Wood Mackenzie, June 2023

Solar power purchase agreement (PPA) prices in North America fell in the second quarter of this year, representing the first drop since early 2020, pricing platform LevelTen Energy said.

Average solar PPA prices in April-June softened by 1% quarter on quarter to $49.09/MWh in an indication that supply market conditions were "starting to stabilise," Gia Clark, senior director of strategic accounts at LevelTen, said. The price reflects the "market-averaged" price across the country.

Developers are also incorporating benefits from the 2022 Inflation Reduction Act into their projects, Clark said. The act provides tax credits for solar, wind, storage and clean technology manufacturing, softening the impact of rising component prices on power offtake deals.

Italy solar installs more than double as large arrays connected

Solar installations in Italy hiked by 129% in the first half of 2023 to 2.3 GW, putting the country on track for its highest annual installation rate since 2011, the latest data from renewable energy association Italia Solare shows.

Developers resumed the installation of solar arrays over 10 MW in the second quarter of this year following a stoppage since July 2022 and more capacity is expected to come online later this year. The largest plant brought online was a 36 MW array on the island of Sardinia.

To date, Italy has installed just 1.5 GW of large-scale solar capacity and 4.2 GW of solar facilities between 1 MW and 10 MW, compared with a total installed solar capacity of 27.4 GW.

Italy's government pledged to accelerate solar and wind installations in the wake of Russia's invasion of Ukraine and set a hugely ambitious goal of 65% of power from renewable energy sources by 2030.

Italy's installed power capacity in 2022 (GW)

(Click image to enlarge)

Source: National grid operator Terna

Slow permitting and grid approval processes are delaying utility-scale projects. Much of Italy benefits from strong solar resources and demand for projects has remained high despite bureaucratic permitting and long grid connection delays that add years to project timelines.

Italy is implementing European Union permitting reforms that could speed up projects but surging demand will pile further pressure on grid authorities already inundated with requests.

Italy must install a further 190 GW of renewable energy by 2035 to meet its targets, according to a recent report by climate change think-tank ECCO and consultancy firm Artelys.

Installation rates will need to "multiply by seven by 2030, and by more than eight by 2035," ECCO and Artelys said.

Reuters Events