Texas kicks on with solar, storage as developers eye profits

Texas solar and battery deployment is soaring on rising power demand and federal tax incentives, increasing the need for major grid investments.

Related Articles

Solar and energy storage is thriving in Texas as developers look to capitalise on growing power demand, driven by a rising population, economic growth and summer heat waves that hike air-conditioning use.

Texas is set to install 12.7 GW of utility-scale solar power in 2024, 35% of total U.S. solar additions, the Energy Information Administration (EIA) said last month, based on developer projections.

Texas operated 23 GW of solar power at the end of 2023 and is forecast to install a further 100 GW over the next 10 years, "outpacing the next closest state by a two-to-one margin," Solar Energy Industries Association (SEIA) and WoodMac said in a recent report.

Summer heatwaves in Texas have prompted price spikes during peak demand periods, offering high revenues for batteries when solar power wanes.

An increasing number of developers are coupling solar with battery storage to maximise revenues and new tax credits in the 2022 Inflation Reduction Act have spurred a surge in stand-alone battery storage projects.

“We have built many batteries with our solar plants, probably 50% of our projects nationally and in Texas," Scott Canada, executive vice president of McCarthy Building Companies’ Renewable Energy division, told Reuters Events.

U.S. installed battery capacity is set to double this year to 30 GW with Texas and California installing the majority of projects, EIA said in January.

"Developers expect to bring more than 300 utility-scale battery storage projects on line in the United States by 2025, and around 50% of the planned capacity installations will be in Texas," EIA said.

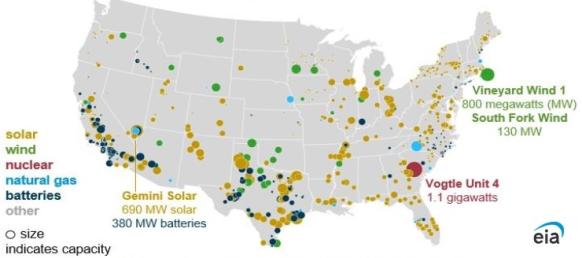

Planned US utility-scale generator installations in 2024

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), February 2024

Surging solar and storage installations, combined with rising wind power capacity, have put pressure on Texas grid operator ERCOT to plan ahead and expand transmission capacity to send power from high development areas to the larger load centres.

“With how fast Texas is needing more energy, we’ve got to speed up getting more solar, wind, and battery storage online,” Sabah Bayatli, President, OCI Solar Power, said.

South Korean-owned OCI has developed and sold around 1 GW of solar and storage projects in Texas with buyers including major Japanese group Mitsui.

Separate storage

"One of the best things to happen for the energy sector recently is the decoupling of solar and battery storage,” Canada said.

Solar developers must find sites with sufficient land, solar resources and nearby grid capacity while separate utility-scale batteries can be placed nearer load centres.

Following new tax credits for standalone storage, Texas is taking "a leadership role in figuring out batteries and locating them exactly where the power is needed as opposed to where the production is,” Canada said.

Fossil fuel units become the marginal supplier during high demand periods, driving up prices and expanding revenue opportunities for solar and storage operators.

"When the price jumped to $5,000/MWh many times last summer, the solar guys charged that price too,” Ed Hirs, an Energy Fellow at the University of Houston, told Reuters Events.

Owners of battery assets can take advantage of spiking energy prices late in the day.

A battery owner can buy power at a low price and sell it at a much higher level a few hours later, Hirs notes.

Even on a low demand day such as April 2, when prices stood near zero for much of the day, prices surged to $80/MWh a few times in the early evening before returning to nearly zero, data from ERCOT shows.

The grid operator also pays battery owners for Regulation Up and Regulation Down services that help to stabilise grid frequency. Owners can also make money from being available to inject power into the grid if another generator trips offline unexpectedly.

“You can make a boatload of money with a two-hour battery in Texas,” Dennis Wamsted, an energy analyst at the Institute for Energy Economics and Financial Analysis, said.

Renewables impact

Rising deployment of solar, wind and battery storage is reducing the need for fossil fuel plants during peak demand periods and could reduce the chance of electricity outages that occurred during Winter Storm Uri in February 2021.

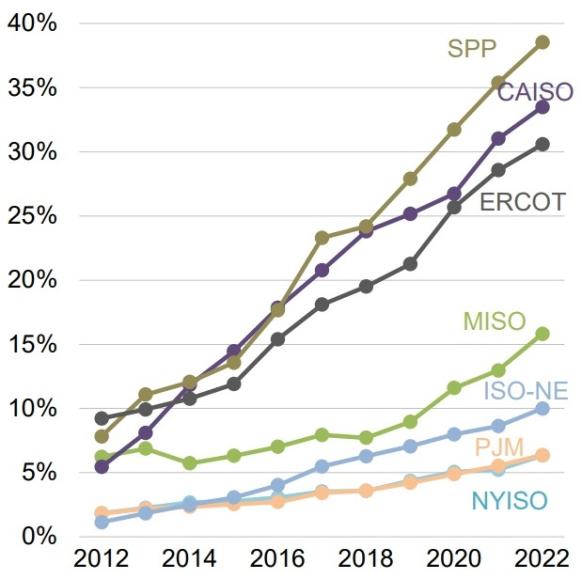

“Fossil fuel, which was responsible for 80.5% of generation 10 years ago has fallen to 61%, though overall demand in the state has grown,” Wamsted told Reuters Events.

Market share of solar + wind, by US market

Source: U.S. Department of Energy's Land-Based Wind Report, September 2023.

Solar and wind developers in Texas benefit from faster grid connections than in many other U.S. markets, but transmission expansions will be needed to send power from high growth areas to load centres.

Solar farms in West Texas have bumped up against saturation, as indicated by the congestion charges that hit parts of ERCOT, Hirs said.

Rising solar and storage capacity is also likely to soften wholesale price swings going forward, reducing the revenue potential for operators.

Another potential risk is a future drop in battery prices as electric vehicles and battery storage is deployed globally, making existing storage assets less competitive, Hirs said.

For now, the outlook is bullish in Texas and companies are expanding offices and building new facilities to capitalise on the surge of activity.

“We continue to hire and grow our Texas offices,” Canada said.

Module supplier Trina solar and solar tracker group Nextracker are among a number of suppliers that have expanded operations in Texas.

“We see many suppliers build additional facilities in the state," Canada added.

Reporting by Mark Shenk

Editing by Robin Sayles