Solar, wind builders back EU contract reforms if steered by nations

EU market reforms will expand the pool of long-term energy buyers that provide revenue certainty to solar and wind operators but support mechanisms must be market-specific, developers said.

Related Articles

Changes to the EU electricity market design set out by the European Commission (EC) on March 14 will make it easier for businesses to sign long-term power purchase agreements (PPAs) while aiding developers with counterparty risk that can deter investors.

The reforms aim to encourage solar and wind growth while also protecting consumers from rocketing energy prices seen after Russia invaded Ukraine.

Under the proposals, all customers will have the right to request fixed-price long-term contracts and utilities and other suppliers will have to manage price risks and hedge part of their supply portfolio against potential wholesale price spikes. To aid suppliers, national governments will have to ensure they have access to market-based guarantees that address the credit risk of buyers.

Customers will not be obliged to sign fixed-term contracts and national governments will be permitted to temporarily fix energy bills if wholesale prices spike to extreme levels.

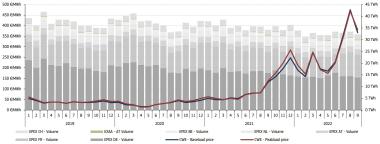

Day-ahead power prices in Central Western Europe

(Click image to enlarge)

Source: European Commission's quarterly electricity market report

Solar and wind operators broadly welcomed the measures but warned more detail is needed on the support mechanisms.

Member states should be left to decide the type of guarantees used to address credit risks as power generation mixes, renewable energy targets and industrial outlooks differ from country to country, a spokesperson for Swedish developer Vattenfall said.

Vattenfall operates 4.5 GW of renewable energy capacity in Europe and its projects include the 76 MW Tutzpatz solar farm in northern Germany on which construction will begin this summer.

Boost for developers

PPAs provide revenue certainty for developers, reducing project risks and investment costs. They also allow faster development of projects than regulated state-supported tenders in which the timing is decided by national governments.

PPAs “quickly mobilise private, corporate investments into renewable energy projects ," Naomi Chevillard, Head of Regulatory Affairs at industry group SolarPower Europe, said.

Estimates vary but around 60% of Europe's current solar and wind capacity may be based on state-backed contracts or long-term commercial PPAs, with around 40% based on short-term PPAs or a 'merchant' arrangement based on spot wholesale prices, according to indicative figures from research group Rystad Energy.

Spain currently has the most active PPA market due to strong market fundamentals and the ECs proposals could help other EU members catch up.

The EC’s reforms would expand the pool of potential customers for renewable energy projects, Christophe Desplats Redier, Regional Director Europe at French operator Neoen, told Reuters Events. Neoen has signed more than 2 GW of corporate renewable energy PPAs, of which 1 GW was signed within the last two years.

A growing number of companies are looking to sign renewable energy contracts to reduce their carbon footprint and to stabilise costs during times of volatility. The market-based credit guarantees will help developers group together smaller companies that typically have greater credit risk than larger corporates.

By strengthening the hedging requirements of suppliers, the EC’s reforms should also stimulate demand from utilities for renewable energy PPAs, Chevillard said.

For projects allocated contracts by EU member states, the reforms will require states to distribute any state support for renewable energy projects through Contracts for Difference (CFDs) that protect customers from price spikes.

CFDs provide developers with a secure form of long-term revenue but industry officials have warned other types of offtake structures, such as commercial PPAs and merchant projects will remain crucial for technology innovation and growth.

Limit on revenues

Renewable energy officials are less supportive of the EC’s proposal that it could extend an EU-wide revenue cap currently imposed on renewable energy operators until the end of June.

The price cap limits revenues from wind, solar and nuclear power generation to 180 euros/MWh and was imposed to reduce the impact of soaring wholesale prices on consumers following Russia's invasion of Ukraine.

While the price cap is far above the cost of new solar and wind generation, wholesale power prices can fall to below zero during times of oversupply and merchant projects have looked to top up revenues during price spikes.

More fundamentally, the repeated intervention in Europe's wholesale energy markets has dented investor confidence, industry officials say.

Some EU members have imposed lower national price caps and the EC’s market reforms would block countries from continuing these unilateral limits beyond June unless it declares an EU price crisis.

Reporting by Neil Ford

Editing by Robin Sayles