Solar suppliers call for EU aid as imports crush margins

Europe's solar industry wants emergency aid to help sell local modules combined with long-term support for factory expansions to reduce the region's dependence on China.

Related Articles

The European Union is set to require solar developers to source components from local suppliers under a new Net Zero Industry Act (NZIA) but for many manufacturers there are more pressing concerns.

Europe faces the widespread closure of solar factories within months without emergency support measures from EU authorities, the European Solar Manufacturing Council (ESMC) warned in a letter to the European Commission (EC) in January.

Some 3.5 GW per year of module capacity could be shut – around half of operational EU capacity, ESMC said. EU module production capacity was around 8 GW in 2023 and the EC should ensure production of at least 5 GW/year until 2026, it said.

A total of 180 MW PV module manufacturing capacity has already closed in recent months with the bankruptcies of Exasun in the Netherlands and Energetic Industries in Austria. Meyer Burger, Heckert Solar and Solarwatt are also considering closing capacity.

Surging exports from China have driven solar prices far below the cost of manufacturing in Europe. EU module prices plummeted from 30 cents/Watt to around 10 cents/Watt during 2023 and this is “below the manufacturing cost even for the largest Chinese module producers,” ESMC noted.

Years of investment in factories has seen China dominate the global supply market. EU suppliers produced just 2 GW of modules last year while EU stockpiles of Chinese solar modules have surged to between 70 and 85 GW, ESMC said. The EU installed a record 56 GW of solar power capacity last year as member states ramp up renewable energy goals.

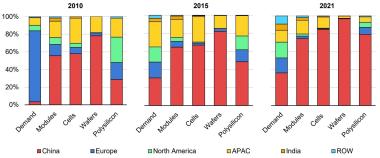

Solar manufacturing capacity by region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

In its letter, ESMC called on the EU to help buy up excess inventories of European solar modules, change state aid rules to let national governments provide direct support for manufacturers, and insert supportive mechanisms in solar auctions.

EU authorities are yet to respond with measures. The ESMC suggested trade defence measures as a last resort but in March EU energy policy chief Kadri Simson ruled out cutting off solar imports to ensure developers have sufficient supplies.

More long term in scope, the NZIA will require at least 40% of all solar components to be manufactured in the EU by 2030. The act has been provisionally approved by EU officials and Germany’s parliament are already debating implementing the measures but it could take years for many member states to follow suit, threatening the future of European solar supply.

Long implementation times would allow China and the U.S. to “extend their competitive advantage," a spokesperson for the German Solar Association (BSW), told Reuters Events.

Saving factories

To prevent factory closures, state support will be required and this requires political consensus, warned Andreas Bett, Director of the Fraunhofer Institute of Solar Energy Systems.

Some factories may need to be temporarily halted and workers transferred to other positions where possible, he said, warning some permanent closures are inevitable.

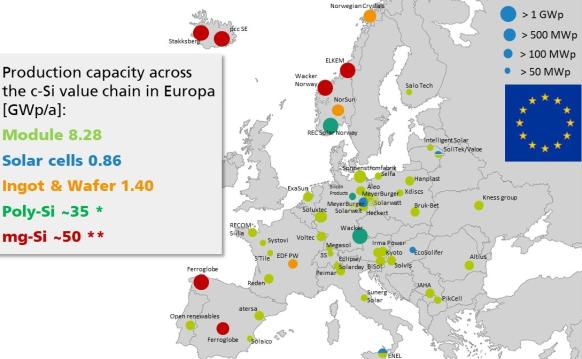

EU solar manufacturing facilities

(Click image to enlarge)

Source: Fraunhofer ISE, June 2023

One emergency measure proposed by the industry is to buy up the inventories of ailing suppliers to boost their balance sheets, potentially through the European Investment Bank (EIB) or another intermediary.

This would be a "one-time emergency measure to support EU manufacturers hit by the sudden price erosion," Jochen Hauff, Director of Corporate Strategy, Energy Policy & Sustainability at developer BayWa r.e, told Reuters Events.

BayWa r.e. supports a mix of short and medium term measures combined with the long-term support offered by the NZIA. As a developer, BayWa r.e. needs diverse supply chains to avoid overdependence on certain companies or regions, Hauff noted.

Intermediate solutions include a “resilience bonus” which would add a bonus to feed-in tariffs or bidding criteria based on the proportion of European content.

By approving the NZIA, EU officials have recognised that dependence on imports from Asia also poses data security risks, which poses additional risks to "secure energy supply," said Eric Quiring, Head of Public Affairs at manufacturer SMA, Europe’s largest inverter supplier.

Scale needed

The long-term goal for the EU must be three to five “solar Airbuses” that create ecosystems along the value chain, rather than 20 small and medium-sized cell and module only factories, Hauff said.

The value chain must span "from R&D and materials to high efficiency cells and modules for smart applications," he said.

EU states should support the construction of large factories to narrow the competitive gap with Asia, the BSW spokesperson said.

China operates far larger factories that benefited from state funds as well as lower costs. The U.S. is also building large-scale factories backed by long-term tax credits in the Biden administration's 2022 Inflation Reduction Act.

Without support for new large factories in the EU, the prospect of competing internationally is “virtually non-existent," the BSW spokesperson said.

European polysilicon suppliers are also hampered by higher electricity input prices than in China and the U.S. due to the energy intensive processes involved, Tobias Brandis, President of the Polysilicon Division at solar cell manufacturer Wacker, told Reuters Events.

“Regions with low energy costs like China or the U.S. have a clear advantage," Brandis said.

If lawmakers can provide predictable long-term support for operational and capital expenditure, alongside measures that secure offtake, "the investment risk in Europe could be mitigated,” he said.

Reporting by Neil Ford

Editing by Robin Sayles