Rush for data centers creates US solar hotspots

Development is surging in areas with competitive land, grid connections and fibreoptics as data center operators chase clean power goals.

Related Articles

A growing thirst for data storage is driving up U.S. power demand and creating new opportunities for solar and wind developers.

Total demand from data centers will double to 35 GW by the end of the decade, property consultants Newmark said in a report last month.

Northern Virginia is the world’s biggest data center market, with more than 250 facilities owned by Amazon, Alphabet, Microsoft and others, creating a data centre "market" of 3.4 GW at the end of 2023, Newmark said. The next largest data center hubs are Dallas-Fort Worth, Phoenix, Chicago and Silicon Valley, each requiring between 350 MW and 1 GW depending on the methodology used by analysts.

The power demanded by data centers in Virginia is forecast to quadruple over the next 15 years, a spokesperson for regional utility Dominion Energy told Reuters Events.

Virginia's total power demand is forecast to rise 85% over that period and data centers and electrification will be the "two primary drivers," the spokesperson said.

The technology groups behind the growth in data centers are attracted to the clean power credentials of solar and wind. Low costs have made solar the primary choice for most U.S. power installations in the coming years and tech titans are continuing to sign large power deals that help finance new projects.

Indeed, Dominion plans to install 20 GW of solar in Virginia over the next 25 years, representing almost two thirds of new power generation, with the remainder mostly comprised of wind, battery storage and nuclear, according to the company’s latest Integrated Resource Plan (IRP).

Power needs

Data centers represented 2.5% of total U.S. power consumption in 2022 and this is set to triple to 7.5% by 2030, Boston Consulting Group said in September.

The facilities are either built and operated by companies, such as the “hyperscale” facilities built by large technology groups, or multi-tenant arrangements where a company leases servers to occupants.

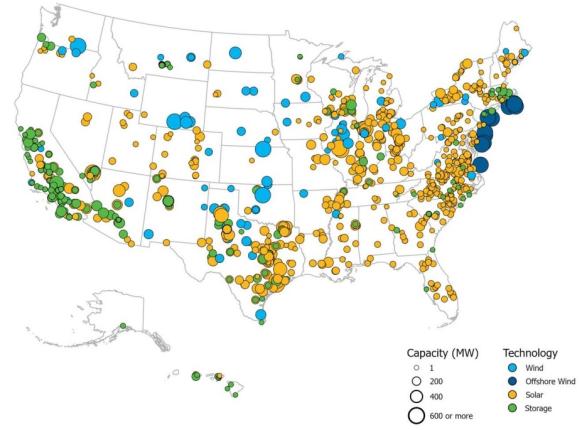

Clean power projects in development in Q3 2023

(Click image to enlarge)

Source: American Clean Power (ACP), November 2023.

Low vacancy rates underline the surging demand for data warehousing. Real estate analysts CBRE estimate a vacancy rate of 3.3% nationwide and just 0.94% in northern Virginia, compared with average office vacancy rates at over 18% in December.

Data centers are getting larger with facilities often requiring 50 to 100 MW of power capacity, compared with 30 MW just a few years ago, Dominion Energy said.

The buildings have higher heating and cooling requirements than other commercial buildings and power demand can rise by up to 5% in the afternoon and by up to 10% during summer months, Karla Moran, Manager of Economic Development at Arizona utility Salt River Project (SRP) said.

The day and night operations of data centers means they need a mix of power generation sources, including solar, battery storage, pumped hydro storage and natural gas, Moran noted.

SRP has decided to add some gas-fired capacity in the coming years "primarily to serve spiking energy demand during the hottest days of the year,” she said.

Location factors

Data center operators typically seek reliable, low carbon power supply at competitive costs and on sites with low land costs that can be developed rapidly. Other drivers of location include density of fibre networks, local and state climate and tax policies, workforce availability and natural disaster risks, Allison M. Gilmore, Vice President of the Data Center Coalition, told Reuters Events.

Phoenix has attracted data center interest from large tech groups such as Meta, Google and Digital Realty due to affordable land and energy prices, high-speed fibre optic networks and geologically stability, Moran said.

Power demanded by data centers in Phoenix is forecast to rise four-fold by 2030, adding 1 GW to the city's power requirements, according to SRP forecasts.

Demand for data centers is also growing in Texas – the fastest growing solar market -as well as Florida, Georgia and South Carolina, boosted by demand for AI and cryptocurrency applications, Matt Futch, a managing director at engineering group Black & Veatch told Reuters Events earlier this month.

Transmission investments will be needed to accommodate localised load growth from data centers, the North American Electric Reliability Corporation (NERC) warned in a forecast published in December.

Dwindling grid capacity and long approval processes are curbing U.S. solar and wind deployment and they are becoming an increasing factor when siting data centers.

"The majority of the data center clients we work with look for transmission availability as a reason for siting a new site," Moran said.

Hyperscaling

Data center operators tend to sign power purchase agreements (PPAs) of at least 15 years in length and technology groups have spearheaded corporate renewable energy contracts that are helping to boost solar and wind growth.

Depending on the size and power requirements, customers may sign multiple PPAs for a single data center.

Amazon signed supply agreements with more than 100 solar and wind projects globally in 2023 and aims to source all of its electricity from renewable energy by 2025.

Recent U.S. projects include Amazon Solar Farm Texas-Outpost, a 500 MW project in Webb County, Texas and its first brownfield project, the 170 MW Amazon Solar Farm Maryland-CPV Backbone, which will supply data centers.

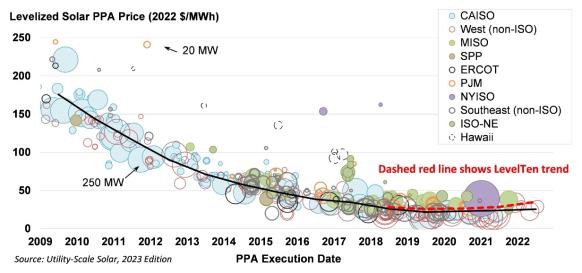

US solar power purchase agreement prices by market

(Click image to enlarge)

Source: Berkeley Lab, LevelTen Energy

In Arizona, Meta has signed PPAs with SRP to receive renewable energy credits (RECs) from the 100 MW West Line solar project owned by AES and Orsted's 300 MW solar/300 MW four hour battery storage Eleven Mile Solar Center. In December, Meta signed 330 MW of PPAs with Adapture Renewables for new projects in Illinois and Arkansas.

"Some of SRP’s largest technology customers, such as Meta and Intel, have chosen to offset the energy consumption of their industrial facilities with 100% renewables," Moran said.

These groups may opt to sign long-term power deals that support new solar, wind and storage projects or "receive renewable energy credits from newly developed renewable resources," she said.

Reporting by Neil Ford

Editing by Robin Sayles