Grid delays threaten Italy's solar, wind goals

Italy must follow permitting reforms with faster grid connections to achieve installation rates that meet its climate targets, industry experts said.

Related Articles

Italy's pledge to accelerate solar and wind capacity in the wake of Russia's invasion of Ukraine will severely test power authorities across the country.

Italy generates over 50% of its power from fossil fuel power plants, mainly gas-fired, and has committed to end gas imports from Russia by 2025. The government has pledged to supply 65% of the country's power from renewable energy sources by 2030 and, under an agreement with the G7 group of industrialised nations, decarbonise its entire power sector by 2035.

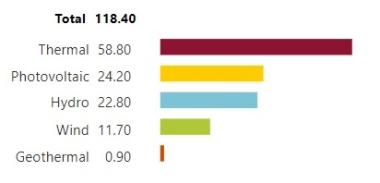

Italy's installed power capacity in 2022 (GW)

(Click image to enlarge)

Source: National grid operator Terna

Italy must install a further 190 GW of renewable energy by 2035 to meet its targets, according to a recent report by climate change think-tank ECCO and consultancy firm Artelys. The country installed only 2.5 GW of solar and minimal wind in 2022, bringing solar capacity to 25 GW and wind capacity to 12 GW.

Installation rates will need to "multiply by seven by 2030, and by more than eight by 2035," ECCO and Artelys said.

Much of Italy benefits from strong solar resources and demand for projects has remained high despite bureaucratic permitting processes and long grid connection delays that add years to project timelines.

Italy is implementing European Union permitting reforms that could speed up projects but surging demand will pile further pressure on grid authorities already inundated with requests.

Solar and wind installations hiked 120% in the first half of 2023 to 2.5 GW, data from national grid operator Terna showed.

There is currently over 130 GW of solar projects under development, Matteo Coriglioni, Market Lead, Italy at Aurora Research, told Reuters Events.

“Compared to the last decade of anaemic growth in deployment, we should expect a decisive acceleration in the coming years," he said.

Permit progress

Italy’s solar development to date has been concentrated on the islands of Sicily and Sardinia and in the southern regions of Puglia and Lazio, mainly due to strong solar resources and land availability. Higher power prices in Sicily have boosted the business case there.

Recent investments include Capital Dynamics' acquisition of three projects totalling 323 MW in March 2023 that will be completed by late 2024, following previous project acquisitions in Sicily. Last October, Octopus Energy Generation created a joint venture with Milanese developer Nexta to develop 1.1 GW of solar, onshore wind and energy storage in southern Italy by 2025.

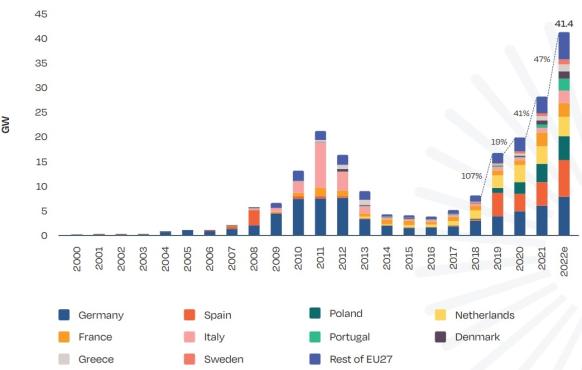

Annual solar installations by EU country

(Click image to enlarge)

Source: SolarPower Europe

Projects are often delayed during permitting in Italy due to bureaucracy and disagreements between central and regional governments. To accelerate deployment, the central government has passed a range of measures over the last 18 months that have simplified permitting and set stricter timelines for environmental assessments, in line with pending EU reforms.

EU officials have provisionally agreed to reform permitting procedures in a revised renewable energy directive that targets 42.5% of gross energy from renewable sources by 2030. The reforms, yet to gain full legislative approval, require all permitting procedures for new projects to be completed within two years and requires states to set aside accelerated development areas by 2025 in which permitting must be completed within one year.

Italy recently mandated its regional authorities to define the accelerated development regions within 180 days. Developers could still face pushback by any regional governments that oppose the measures, Michele Governatori, ECCO Power & Gas Programme Lead, told Reuters Events.

“Regions are not constitutionally obliged to support the central government’s energy strategy,” he said.

In general, Italy's permitting actions should help with environmental and construction permits, Zoisa North-Bond, CEO of Octopus Energy, said.

However, like in many parts of Europe, "the time it takes to connect projects to the grid remains a hurdle everywhere," she said.

Grid delays

Grid operator Terna is being presented with an "enormous" number of connection requests and often issues expected connection dates "years into the future," Coriglioni said.

Terna is "overloaded," says Alessandro Savini, Senior Executive Consultant at energy technology firm Trailstone, "resulting in delays in the approval process.”

One driver is the low cost of applying which increases the volume of applications. In the U.S., some grid operators inundated with requests have introduced a filtering process to reduce the number of less developed projects clogging up the connection queue. Others are using forward bulk transmission planning, assessing projects in clusters or using data automation to streamline processes.

Grid operators are also expanding permitting teams to manage a growing volumes of renewable energy applications. Terna aims to increase its total workforce by around 20% to 5,900, the grid operator said in a multi-year investment plan in 2021.

Rising demand in Italy is also making it difficult to procure experienced engineering procurement construction (EPC) companies as the industry tools up after years of low activity, Savini said.

Wider growth

As more renewable energy is brought online, regional grid constraints will become a key driver of deployment strategies.

Italy's power market is split into seven regional market zones and grid restraints could see prices diverge. Limitations in South to North capacity will curb growth in some southerly areas and incentivise more development nearer the large consumption centres in the north.

To reduce bottlenecks, Terna plans to double interconnection capacity between the seven markets by 2030 under its Hypergrid package of grid upgrades. This includes the installation of a new 1 GW subsea Tyrrhenian Link by 2028 that will run from Sardinia to Sicily to the mainland region of Campania.

Italy must also adapt its market regulations to improve the business case for renewable energy and incentivise the development of energy storage, Governatori said.

The government must end schemes that require fossil plants to run and allow renewable energy to participate in ancillary services markets that help to balance the grid, he said.

According to Governatori, Italy should also launch auctions for new energy storage capacity so that output from new solar installations can be optimised.

A lack of storage increases the risk of price erosion during high solar periods, which could undermine investments, he said.

"This is why we think central procurement of storage is a good idea.”

Reporting by Neil Ford

Editing by Robin Sayles