Europe's solar industry warns of imminent closures; China's output rockets

The solar news you need to know.

Related Articles

EU facing swathe of solar factory closures within weeks

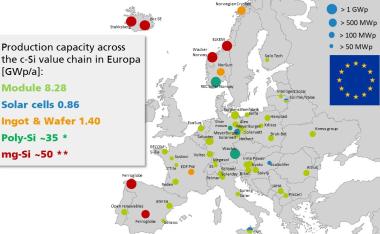

Europe faces the widespread closure of solar manufacturing facilities within two months without support measures from European Union authorities, the European Solar Manufacturing Council (ESMC) said in a letter to the European Commission (EC) on January 30.

The solar industry has been calling for support measures for European manufacturers following a surplus of Chinese imports that have crushed prices.

Without rapid action, Europe risks losing 3.5 GW of module production capacity within weeks, ESMC said in its letter. Some 180 MW of capacity has already been shuttered in recent months, it said.

EU solar manufacturing facilities

(Click image to enlarge)

Source: Fraunhofer ISE, June 2023

The ESMC is calling for the EU to buy up excess inventories of European solar modules, change state aid rules to allow national governments to provide support for manufacturers and insert supportive mechanisms in solar auctions.

If these measures cannot be enacted within two months, the EC must activate trade defence measures against imports as a last resort, the manufacturing council said.

On February 6, EU policymakers provisionally agreed a new Net Zero Industry Act (NZIA) which promotes local production of clean tech equipment.

The act aims to produce 40% of clean technology deployed in Europe in the region's factories and requires EU members to provide faster permits to projects that boost clean technology capacity. It also allows countries to incentivise the use of domestic content in power auctions and procurement processes.

Chinese components play a critical role in the global solar supply chain and Europe's wider solar industry has warned policymakers not to impose tariffs on imports, fearing disruption would delay solar power deployment.

Last year, EU leaders agreed a new higher target of 42.5% of gross energy consumption from renewable energy by 2030 as countries ramp up efforts to end their reliance on Russian oil and gas.

The EU sourced 22% of energy from renewable energy in 2020 and the previous target for 2030 was 32%.

European solar offtake prices drop 3% in Q4

The average price of solar power purchase agreements (PPAs) in Europe fell by 3% in the fourth quarter of 2023, reversing gains seen in the previous quarter as pandemic-led supply disruptions eased and a surplus of panels weighed on prices, pricing platform LevelTen Energy said.

Prices in Spain, Europe's most active PPA market, fell by 7% last quarter while prices in Germany fell by 5%, LevelTen data showed. Prices in Italy rose by 6%, supported by the setting of prices at national levels rather than based on local markets, it said.

The expected retreat of high interest rates is set to put downward prices on PPA prices in the coming years, but demand for renewable energy will remain high, supporting prices, LevelTen said.

Solar offtake prices hike in California, fall in Texas

The average price of solar power purchase agreements (PPAs) in California's CAISO market rose by 15% in the fourth quarter of 2023 while prices dropped by 3% in Texas ERCOT and by 2% in the Southwest Power Pool (SPP) in Central U.S., pricing platform LevelTen Energy said.

Increases in PPA prices were likely driven by regional regulatory adjustments, prevailing market conditions and increasing buyer demand, said Sam Mumford, Analyst, Energy Modeling at LevelTen Energy.

The large increase in California was likely due to some developers raising prices to account for "expectations around cost of capital or future [Renewable EnergyCredit] value,” he said.

Meanwhile, prices faced downward pressure in Q4 as supply chain constraints eased and companies factored in expectations of lower interest rates going forward.

"The push-pull dynamics of solar PPA prices persist,” Mumford said.

“We’re seeing improvement in the challenges of a few years ago like the solar supply chain and PV module prices. However, the impact of high interest rates is now impacting project returns, offsetting the impact of those improvements and making it challenging for developers to reduce solar PPA prices,” he said.

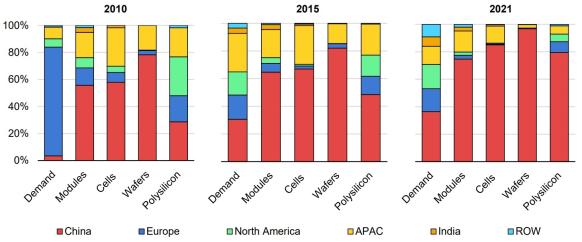

China installed 216 GW of solar in 2023

China installed 216 GW of solar power last year, hiking installed capacity by 55.2% in a single year, according to data from the National Energy Agency on January 26.

Total power generation grew by 13.9% to 2,919 GW and wind capacity jumped by 20.7%, agency data showed.

Beijing has set a target of 1,200 GW of renewable energy capacity by 2030 and is currently on track to meet that goal five years early.

Global solar manufacturing capacity by region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

China's clean energy sector accounted for the largest share of the country's economic growth in 2023, largely driven by growth in solar, energy storage and electric vehicles, according to an analysis published by the Finland-registered Centre for Research on Energy and Clean Air (CREA).

Clean energy sectors, including renewable energy, nuclear power, grids, storage, electric vehicles and railways, accounted for 9.0% of China's GDP in 2023, up from 7.2% the previous year, CREA said.

Meanwhile, the slowdown in China's property sector continued.

Capital was reallocated from real estate to high-end manufacturing, representing a "major pivot" in the country's macroeconomic strategy, CREA said.

China risks overcapacity of clean technology if the growth rate outstrips the needs of its economy. A surplus of solar panels and electric vehicles has already raised concerns in Europe as EU officials consider measures to protect domestic industries.

Reuters Events