Europe's solar industry warns of bankruptcy risk; US solar installs set to hike 53% to 32 GW

The solar news you need to know.

Related Articles

European solar suppliers at risk after drop in import prices

A sharp fall in global solar prices has pushed more European solar manufacturers close to bankruptcy, requiring further support measures from European Union authorities, industry association SolarPower Europe said in a letter to the European Commission (EC) on September 11.

The price of imported solar modules has dropped by more than a quarter since the start of the year, leaving European manufacturers with excess supplies, SolarPower Europe said. Large investments and fierce competition among Chinese suppliers led to overcapacities in the market. EU imports of Chinese modules are forecast to reach 120 GW in 2023, compared with 60 GW of solar installations, the European Solar Manufacturing Council said.

"This is creating concrete risks for [EU] companies to go into insolvency as their significant stock will need to be devalued," SolarPower Europe said.

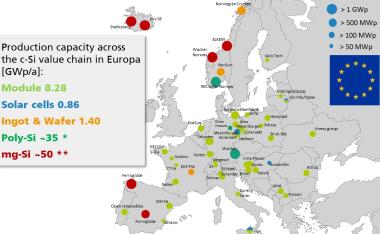

EU solar manufacturing facilities

(Click image to enlarge)

Source: Fraunhofer ISE, June 2023

EU authorities have already pledged support for solar factory expansions but the price slump necessitates further action, the industry group said.

The EC should buy the module inventories of at-risk suppliers, create a Solar Manufacturing Bank to fund factory expansions, enforce non-price criteria in solar power auctions and increase the demand for solar in the EU through rooftop solar mandates and other initiatives, it said.

US solar installations bounce back to record levels

The U.S. solar industry expects to install a record 32 GW of capacity this year, 53% higher than in 2022, the Solar Energy Industries Association (SEIA) and Wood Mackenzie said in their latest quarterly market report.

Last year, U.S. utility-scale solar installations fell by 23% as customs delays, tariff uncertainty and soaring global demand hiked solar costs and delayed projects.

Developers then installed a record 6.1 GW of solar capacity in the first quarter of this year, including 3.8 GW of utility-scale plants, as supply chain challenges eased and developers completed delayed projects, SEIA and Wood Mackenzie said in June.

U.S. developers plan to install 19.3 GW of utility-scale solar capacity in the second half of this year, taking total utility-scale installations for this year to 25.2 GW, the U.S. Energy Information Administration (EIA) said last month.

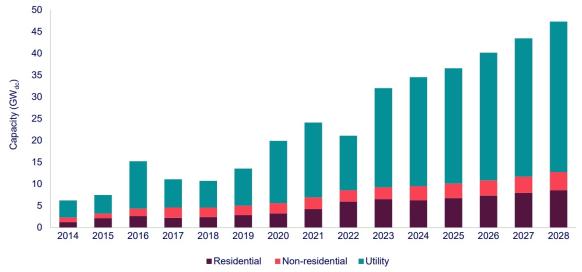

Forecast U.S. solar installations

(Click image to enlarge)

Source: Wood Mackenzie, September 2023

Solar power purchase agreement (PPA) prices in North America fell in the second quarter of this year, representing the first drop since early 2020, pricing platform LevelTen Energy said in July.

Average solar PPA prices in April-June softened by 1% quarter on quarter to $49.09/MWh in an indication that supply market conditions are "starting to stabilise," Gia Clark, senior director of strategic accounts at LevelTen, said.

Developers are also incorporating benefits from the 2022 Inflation Reduction Act into their projects, Clark said. The act provides tax credits for solar, wind, storage and clean technology manufacturing, softening the impact of price swings on power offtake deals.

China predicted to install 1,000 GW of solar by 2026

China is on track to double its solar capacity to 1,000 GW by the end of 2026 as it ramps up investments in renewable energy, analysts at Rystad Energy said in a research note.

China's solar capacity is expected to hit 500 GW by the end of this year, up from 392 GW at the end of 2022.

The government has set a target of 1,200 GW of solar and wind capacity by 2030. Demand for solar components will also surge in the U.S. and Europe during this period as governments chase ambitious climate targets.

"China's national program to build out solar capacity, launched in June 2021, has led to a significant boost in large-scale projects," said Yicong Zhu, senior renewables and power analyst at Rystad.

Utility-scale solar deployment has been concentrated in less populated north-western regions. In other regions, limited land availability has led to more investment in rooftop solar, Rystad said.

Reuters Events