Europe's solar industry warns against import tariffs; EU solar jobs set to hike 24% this year

The solar news you need to know.

Related Articles

EU solar industry warns tariffs would slow deployment

Industry group SolarPower Europe has warned policymakers not to impose tariffs on imports, fearing a disruption of imports from Chinese companies would delay solar power deployment.

The statement from SolarPower Europe comes after Reuters reported Germany was mulling options to protect domestic solar manufacturers.

A sharp fall in global solar prices and an oversupply of supplies from Chinese companies has pushed more European solar manufacturers close to bankruptcy, requiring further support measures from European Union authorities, industry association SolarPower Europe said in an earlier letter to the European Commission (EC) on September 11.

The price of imported solar modules has dropped by more than a quarter since the start of the year, leaving European manufacturers with excess supplies, SolarPower Europe said.

However, the industry group said trade barriers on solar would be a "lose-lose strategy" and instead called on EU authorities to adapt regulation that temporary loosens state aid rules so that it allows countries to support the running costs of existing factories. Alongside this, the EU should introduce support mechanisms in its planned Net-Zero Industry Act and create an EU financing instrument for domestic solar manufacturers, it said.

Last month, SolarPower Europe called on the EC to buy the module inventories of at-risk suppliers.

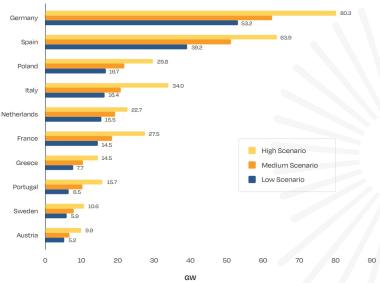

Forecast largest solar markets in the EU in 2023-26

(Click image to enlarge)

Source: SolarPower Europe, December 2022

"We urge EU leaders to deliver and implement an industrial strategy for solar, as clear, and ambitious as the U.S. [Inflation Reduction Act]," Aristotelis Chantavas, President of SolarPower Europe, said in a statement. The inflation act provides tax credits to U.S. renewable energy manufacturers alongside credits for renewable energy developers.

"There are balanced, effective measures ready to go,” Chantavas said.

EU solar employment forecast to rise 24% this year

Solar employment in the European Union is forecast to rise by 24% this year to 804,702 jobs as rising deployment rates continue to create installation jobs, industry association SolarPower Europe said in its latest annual jobs report.

EU solar jobs hiked 39% in 2022 to 648,000 full-time equivalent positions (FTEs) as companies installed a record 40.2 GW of solar capacity, SolarPower Europe said. The forecast for next year is based on 53.8 GW of solar installations and the industry group predicts much higher employment in the coming years than in its 2022 jobs report.

"Based on our Medium Scenario, this trajectory of growth leads to 1 million jobs already by 2025 – an impressive 56% surge compared to 2022 levels," the industry group said.

Increased support by European policymakers could see jobs reach 1.3 million by 2025, it said.

Industry officials fear skills shortages could hold back growth and want EU authorities to do more to help train staff.

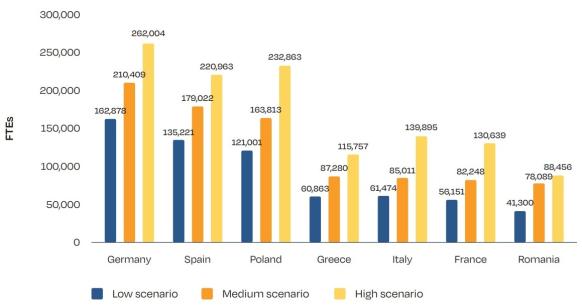

Germany is set to remain the largest market for solar employment in the coming years, followed by Spain and Poland, where there will be a significant number of rooftop solar jobs.

Forecast top EU solar employment countries in 2027

(Click image to enlarge)

Source: SolarPower Europe's 'EU Solar Jobs Report 2023' (October 2023)

Of the 648,000 EU jobs in 2022, around 281,000 were direct employment opportunities and the remaining 367,000 were indirect jobs. Some 84% of roles were related to solar deployment, compared with 8% in operations and maintenance (O&M) and 7% in manufacturing. SolarPower Europe expects these shares to remain largely stable over the next five years.

EU countries slow to enact faster permitting laws

Few EU countries have implemented laws to accelerate permitting of solar and wind farms, some nine months after the rules were agreed by EU leaders, industry group SolarPower Europe said in a report.

The permitting of solar and wind projects currently takes several years due to complex administrative processes and a lack of resources at approval authorities. New rules provisionally approved by EU officials earlier this year set a two-year maximum for permitting of solar and wind farms and require member states to create accelerated deployment areas and define solar and wind as projects of overriding public interest.

Only Germany, Spain, Portugal and Belgium have mostly implemented, or plan to implement, the new permitting deadlines in national laws, SolarPower Europe said. Even when fully implemented in national laws, the rules could take time to impact projects on the ground, the industry group warned.

Germany is the only country to have implemented the overriding public interest rule in national law while several other countries are at various stages of implementing it.

In addition, developers still lack clarity on the land areas that EU countries will designate for the accelerated permitting of renewable energy projects when the latest EU Renewable Energy Directive (RED) is fully approved by member states, SolarPower Europe said.

Reuters Events