Europe forecast to double solar capacity by 2030; US cuts federal land costs

The solar news you need to know.

Related Articles

Europe set to install 475 GW solar capacity by 2030

Europe is forecast to double solar power capacity to 475 GW by 2030 with investments of more than 145 billion euros ($158.2 billion), Aurora Energy Research said in a new report.

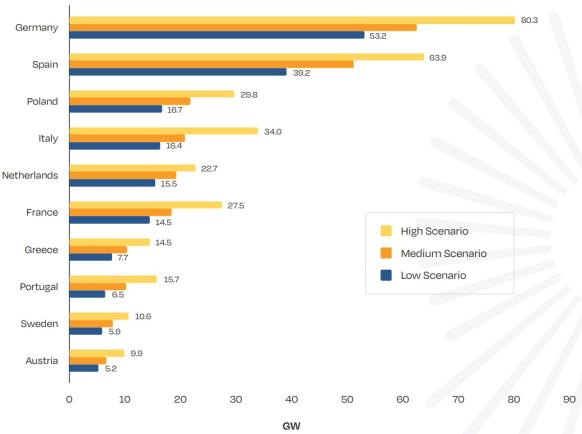

Germany, Spain and Italy are Europe's most attractive solar markets and will account for 83% of new investments between 2023 and 2030 and 58% of total installed capacity in Europe, Aurora said. These countries have set out ambitious deployment plans and extensive policy support that enables favourable returns, the research group said.

Germany is Europe's largest solar market and aims to install 215 GW by 2030, compared with 63 GW in 2022, through a rapid buildout of rooftop solar and growth in utility-scale installations.

By 2030, the German government aims to generate 80% of power from renewable energy, double the level seen in 2022, slicing carbon emissions and ending the country's reliance on Russian fuel supplies.

Spain has the highest solar yields in Europe, good land availability and is Europe's most attractive market for corporate renewable energy power purchase agreements (PPAs).

The Spanish government aims to double the share of renewable energy to 74% of power generation by 2030.

Italy also boasts strong solar resources but has less ambitious procurement targets than in Germany and Spain, Aurora noted.

Poland, Netherlands and France could match or surpass installations in Italy in the next few years, depending on national policies and other market drivers, industry group SolarPower Europe said in its latest annual report in December.

Forecast largest solar markets in the EU in 2023-2026

(Click image to enlarge)

Source: SolarPower Europe, December 2022

US federal bureau lowers land costs for solar, wind

The U.S. Bureau of Land Management (BLM) plans to further reduce the fees for solar and wind on federal land and streamline permitting processes in priority areas under new proposed rules announced by the Interior Department on June 15.

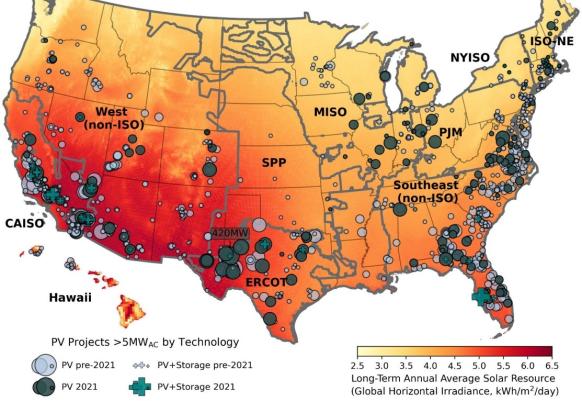

The Biden administration aims to permit 25 GW of renewable energy on federal lands by 2025 and by March 2023 it had approved 8.2 GW of projects, mostly solar, data from the BLM shows.

In 2022, the BLM reduced acreage rents by 50% through guidance and the proposed rule will codify a reduction of 80%. The previous payment terms had deterred many developers as they led to higher project costs than on farmland and other locations. Federal land sites are also often less flat and wilder, increasing project costs.

The bureau will also start to accept non-competitive solar and wind leasing applications in priority areas when they are “in the public interest” and will continue to hold auctions “where appropriate and consistent with past practice,” it said.

The 245 million acres of U.S. public land managed by the BLM represent around 10% of the country's entire land area but host just 1% of national installed wind capacity and 6% of solar, according to data in 2022. Much of the land lies in 12 western states and the Rockies.

U.S. utility-scale solar installed by end of 2021

(Click image to enlarge)

Source: Berkeley Lab, September 2022

The BLM is currently processing 74 utility-scale onshore clean energy projects for public lands in western U.S., including solar, wind and geothermal projects, for a total capacity of 37 GW, the Interior Department said.

The bureau is reviewing a further 150 applications for solar and wind development, as well as 51 applications for solar and wind testing.

US Treasury clarifies key inflation act provisions

The U.S. Treasury Department and the Internal Revenue Service have issued new guidance on direct pay and transferability provisions for the clean energy tax credits allocated through the Inflation Reduction Act.

The inflation act offers a 30% investment tax credit (ITC) or a production tax credit of $27.5/MWh if labour conditions are met, plus an additional bonus of 10% if the project meets domestic content thresholds. The incentives aim to accelerate renewable energy deployment and expand domestic manufacturing capacity.

The latest clarifications, issued on June 14, set out conditions for elective pay and transferability, two provisions that allow local and state governments, as well as some for-profit entities, to benefit from the tax credits.

Treasury clarified that tax-exempt organizations “can receive elective payments for 12 clean energy tax credits, including the major investment and production tax credits.” This tool effectively allows public utilities to receive tax credits from the inflation act if they choose to develop their own renewable energy projects. In addition, private investors can claim elective pay for three of those credits: the credits for advanced manufacturing, carbon sequestration, and clean hydrogen.

Under the transferability provision, renewable energy developers can transfer all or part of their tax incentives to another party in exchange for cash. This allows developers with a small tax burden to monetize tax credits and access a wider pool of investment options.

“Making renewable tax credits broadly transferable helps address current constraints in the nation’s tax equity market, while the new direct pay regime makes it easier for tribes, state and local governments, co-ops and other nonprofit entities to participate in the clean energy transition,” the American Council on Renewable Energy (ACORE) said in a statement.

UK opposition Labour Party pledges to triple solar capacity

Britain's main opposition Labour Party would triple solar power to 50 GW by 2030 through an acceleration of rooftop solar and co-ownership of utility-scale facilities if it wins a general election expected next year, the party said on June 19.

Opinion polls suggest Labour is on course to win the next election and the party has set a hugely ambitious target to decarbonise the entire power sector by 2030, five years earlier than the ruling Conservative party.

Labour plans to stop allocating new North Sea oil and gas licences following the election and offer incentives to renewable energy that match the Biden administration's U.S. Inflation Reduction Act and similar pledges by the European Union.

The current UK government is yet to commit to equivalent plans, despite calls from industry.

Labour would create a state-owned renewable energy company called Great British Energy (GB Energy), based in Scotland, which would invest in projects alongside private investors, party leader Kier Starmer said in a speech on June 19.

GB Energy would primarily invest in cutting-edge technologies to reduce investor risk but would also be able to invest in more established technologies if it boosts private sector activity. The UK is leading Europe in offshore wind deployment and has built up significant supply networks in Scotland and in eastern and northern England.

The Labour Party would reform planning rules that have held back solar and onshore wind development, it said.

Labour would look to reduce onshore planning approval timelines from years to months, through tough new targets for consenting decisions, and require local authorities to proactively identify areas suitable for solar and wind development, it said.

The party would also promote community solar and wind projects where local citizens can benefit from hosting clean energy infrastructure.

Reuters Events