Europe accelerates power exports from fast-growing solar, wind markets

Measures to fast-track transmission corridors will help Spain and other EU countries meet ambitious solar and wind targets but vast investments are needed in distribution grids as developers go local.

Related Articles

The European Union has set out 68 onshore grid projects that will gain priority access to permits and be eligible for funding from the EU’s Connecting Europe Facility in a bid to accelerate the deployment of renewable energy capacity.

Across Europe and the United States, dwindling grid capacity and slow approval of new connections are increasing project costs and slowing the growth of solar and wind.

The priority grid projects, identified by the European Commission in November, address the "most pressing bottlenecks" in the EU transmission networks and around half are scheduled to be commissioned in 2027-2030.

The EU aims to install 1,000 GW of solar and wind capacity by 2030, compared with 400 GW in 2022, requiring 584 billion euros ($637 billion) of investments in the power grid, the European Commission (EC) said. Solar capacity must triple to 750 GW, it said.

The grid projects include north-south transmission lines in Western Europe, such as between Beariz in north-west Spain and Fonte Fria in northern Portugal, links across the Pyrenees mountain range between France and Spain and several lines in Germany. Elsewhere, planned Sicily-Tunisia and Greece-Israel projects could allow solar power produced outside Europe to be imported.

EU cross-border transmission capacity will increase by 23 GW by 2025, up from a current level of 93 GW, with another 64 GW required by 2030, the EC said.

Cross-border projects could reduce EU generation costs by 9 billion euros a year and the EC will also work to improve long-term grid planning and access to finance, it said.

The new transmission lines will help balance power flows between high solar and wind regions and the high demand centres of Europe, Sylvain Cognet-Dauphin, Executive Director, Climate and Sustainability at S&P Global Commodity Insights, told Reuters Events.

Transmission upgrades in Spain and Portugal could have the largest impact in the short term due to high solar growth in these regions, Cognet-Dauphin said. Spain's grid connection pipeline is bulging with solar projects and last year Spain's government lifted its 2030 solar target from 39 GW to 76 GW.

Links with France and Portugal “will help evacuate surplus solar or wind power in general, and ensure that curtailment within Spain remains minimal,” Cognet-Dauphin said.

New power lines planned for emerging solar markets such as Poland could encourage faster development, Cognet-Dauphin added.

Solar provided 10% of Poland's power in 2022, up from just 1% three years previously, and industry group SolarPower Europe predicts Poland will be the EU's fourth largest solar market in 2024-2027.

Connection delays

Currently, grid approvals for new solar and wind can take several years, depending on permitting requirements, the level of congestion and the resources available to power authorities.

Last year, the European Union agreed new faster permitting laws that require governments to set aside land for faster solar and wind permitting and designate renewable energy as projects of overriding public interest. Germany is fast tracking the new rules into its national laws in order to accelerate renewable energy build but other EU countries have been much slower to implement the rules.

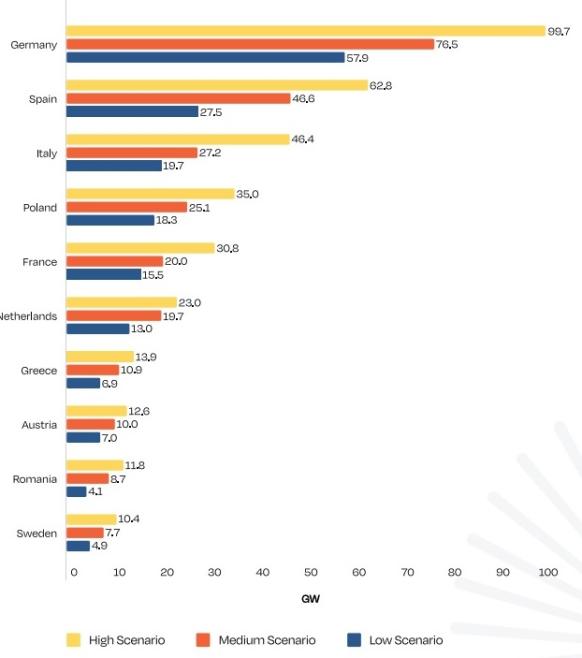

Forecast largest EU solar markets in 2024-2027

(Click image to enlarge)

Source: SolarPower Europe's annual EU Market Outlook, December 2023

The funding of new grid infrastructure will become an increasing challenge as the growing role of solar and wind requires a wider and more interconnected power network.

Alongside its priority projects, the EC will work with investors to identify “tailored financing models and strengthen dialogue to address obstacles to private financing” for new grid infrastructure and will assess bank lending, debt and equity market instruments, debt guarantees and blended finance. The U.S. federal government recently committed to invest in new power lines in order to de-risk construction costs.

Grid upgrades are typically planned based on individual project applications and more forward planning of bulk grid upgrades could significantly accelerate solar and wind deployment. Last year, California pledged to spend $7.3 billion on 45 new power transmission projects by 2030 that will support the construction of 17 GW of solar capacity, 8 GW of wind and numerous battery storage projects.

The EC said it will “propose guiding principles identifying conditions under which anticipatory investments in grid projects should be granted."

Local networks

Industry participants welcome the support for transmission corridors but warn a vast amount of investment in local distribution grids will be required.

Rising solar and wind is putting increasing pressure on distribution grid operators to expand and upgrade their networks. Larger utility-scale solar and wind plants typically connect to the high-voltage transmission grid, while smaller farms and residential and commercial projects tend to connect to the low-voltage distribution networks that run between the transmission network and end users.

Italian-owned utility Enel plans to invest 18.6 billion euros in distribution grids in 2024-2026, equivalent to 53% of total investment, as these are “the primary and most effective lever to enable the energy transition," a company spokesperson said.

Distribution level connection requests increased by an average of 19% across EU markets in 2021, the EC said, and this is set to dramatically increase in the coming years. Sector association Eurelectric forecasts that 70% of total new renewable energy capacity will be connected to distribution rather than transmission grids by 2030.

The majority of new solar power capacity will be connected to the distribution grid and more planning of these networks is required, Jose Andres Visquert, Head of Grid EMEA at developer BayWa r.e., told Reuters Events.

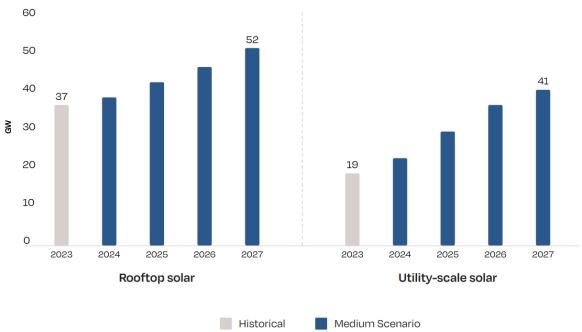

Forecast annual EU solar installations by segment

(Click image to enlarge)

Source: SolarPower Europe's annual EU Market Outlook, December 2023

In some markets, high costs and connection challenges at transmission grid level are fuelling more requests for low-voltage connections.

Italian grid operator Terna introduced measures in 2022 that encourage solar farms to connect to the distribution grid.

The new rules mean developers of projects up to 100 MW are able to connect to the grid at a voltage of 36 kV, decreasing connection costs and thereby the cost of energy in comparison with high voltage solutions, the Enel spokesperson said.

Distribution grids must also be modernised to be able to adapt to solar and wind fluctuations. This would reduce the need for long transmission lines.

Distribution grids must be "ready to manage a much more complex scenario," the Enel spokesperson said.

Reporting by Neil Ford

Editing by Robin Sayles