EU must hurl solar funding at multiple headwinds to compete globally

Supply chain support promised by Europe must accelerate factory construction, lower operating risks and nurture new solar technologies that will come to rise in the coming years, industry experts said.

Related Articles

Europe is facing crucial funding decisions to create a solar supply chain that is competitive and sustainable.

European Union leaders have called for a rapid expansion of solar power and an acceleration in manufacturing capacity to reduce the region's reliance on imports from Asia.

China dominates global solar supply and U.S. factory construction is soaring on the back of the Biden administration's Inflation Reduction Act.

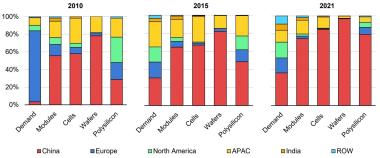

Solar manufacturing capacity by region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

EU leaders have pledged to match the support offered by the inflation act and agreed to temporary loosen state aid rules, allowing national governments to support new facilities.

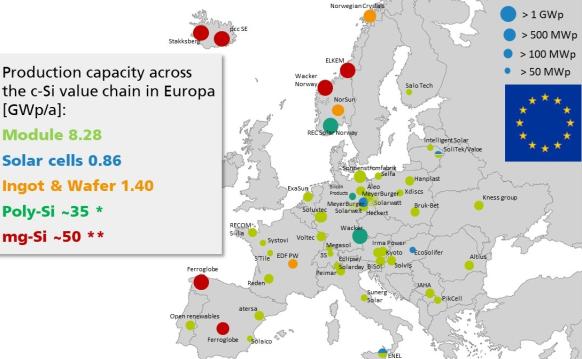

Alongside this, the European Commission has proposed a Net-Zero Industry Act which would set harmonised rules that support clean energy manufacturing and a target of 40% of renewable energy components from EU factories by 2030. The act targets 30 GW per year of production capacity along the full solar supply chain by 2025 but more direct support schemes are required to achieve this goal, industry officials say. Europe currently hosts 8 GW/year of module production but far less cell, ingot and wafer capacity.

EU authorities must implement further measures to improve financing and accelerate permitting of manufacturing facilities, a joint group of government and industry officials warned last month.

The act is currently "insufficient in delivering clear timelines and risk reduction," the European Technology and Innovation Platform for Photovoltaics (ETIP PV) said in a statement.

Europe should prioritise support for the key components of polysilicon, wafers and cells, as well as modules, as they are “potential enablers of the entire value chain,” Eliano Russo, Head of Enel's 3 GW cell and module factory under construction in Sicily, told Reuters Events. The cost of new manufacturing will vary widely between components, increasing the challenge of a fully domestic supply chain.

The emergence of new solar technologies and solar applications poses further questions on where funding should be directed.

Tandem cells and other new designs could enter mass production within a few years and deployment in agri-solar and solar on buildings is set to grow in the coming years.

Factory aid

European suppliers have called for government support as they cannot compete with the low costs of manufacturers in China and other Asian countries and the U.S. inflation act has given American suppliers an advantage.

Labour costs are far higher than in Asia, global inflation has raised prices and European firms have been hit hard by soaring energy prices following Russia's invasion of Ukraine and a switch away from fossil fuels.

EU solar manufacturing facilities

(Click image to enlarge)

Source: Fraunhofer ISE, June 2023

Industry group Solar Power Europe has called for a solar manufacturing fund or a dedicated EU equity instrument to cover both capital and operating costs.

In return for support, the private sector must accept a certain level of risk and lower operating margins, Gaetan Masson, managing director at the Becquerel Institute research group, said.

Europe's current module factories rely on "outdated equipment" and need to be upgraded to the latest technology, Jochen Rentsch, head of production technology, surfaces and interfaces at the Fraunhofer Institute for Solar Energy Systems (ISE), told Reuters Events.

Module manufacturing is a relatively inexpensive part of the value chain and U.S. suppliers were quick to announce new module factories following the inflation reduction act.

Upstream activities of cell, wafer and polysilicon production will be more challenging to build out, particularly due to a lack of current capacity.

Cell production requires more personnel and is more energy intensive per GW than module output, Peter Bachmann, Vice President Customer Solutions at module manufacturer Solarwatt, told Reuters Events. Under current conditions, the cost of cells in Europe would be three times higher than in China, he estimates.

Larger polysilicon factories will be needed to lower costs, Russo said.

Polysilicon factories require more than 300 million euros ($328.4 million) per GW of PV capacity, equivalent to integrated cell and module factories, and “the only way to decrease such costs is to leverage economies of scale," he said.

Emerging technologies

Europe has a strong history in solar research and development and more focused investments would allow suppliers to gain a foothold in emerging technologies.

The EU Horizon Europe R&D program offers support for demonstration and testing but there is a lack of funding available to scale up activities to commercial production.

The ETIP group also wants more investments in R&D as “other regions are now able to match or exceed the EU’s research and innovation capacity in many areas of the PV value chain.”

Europe has "world-class centres of excellence capable of structuring the research, innovation and anticipation activities," Roch Drozdowski-Strehl, Chief Executive Officer at Paris-based solar research group IPVF, told Reuters Events.

PERC monocrystalline silicon currently represents over 80% of global PV production capacity but new technologies are nearing commercial deployment and are set to make an impact in the second half of the decade.

TOPCon makes commonly used PERC cells more efficient by adding an ultra-thin oxide top layer while HJT combines crystalline silicon and amorphous thin silicon film in three layers. Tandem technology couples two different materials and often includes perovskite, a material with a crystal structure.

New technologies that offer a path for reduced material consumption and reduced production costs should be favoured, Masson said.

EU countries are increasingly supporting the deployment of solar farms on working farmland and building sufaces. For example, Germany's latest solar strategy allows large agri-solar development on set-aside land.

These emerging solar sectors require specialist equipment and some suppliers may benefit from focusing on these areas.

Europe in sync

Solar developers and suppliers are calling for a coordinated approach to support across the EU. Some are concerned a loosening of state aid rules will create a mismatch of funding as wealthier nations roll out bigger support plans.

EU import tariffs are also misaligned, as EU module imports from China can be duty free, while EU-based module manufacturers can pay 73% duties on Chinese PV glass, said Rentsch.

Enel proposes the creation of an EU-wide funding instrument and direct funding to sectors that enable the energy transition.

“State-aid and public subsidies can be part of the EU’s answer but “also have strong distortive effects on the single market," Russo said.

Solarwatt is prepared to invest substantially in Europe if there is a coordinated political approach, Bachmann said.

For a sustainable business case, companies need “a level playing field...fair competitive conditions,” he said.

EU members must "develop sovereignty on a European scale" and not be dependent on any one country, a spokesperson for developer Engie told Reuters Events.

Engie likes to work with suppliers over several projects in several countries and in return it expects them to be “robust, reliable and competitive,” the spokesperson said.

Reporting by Neil Ford

Editing by Robin Sayles