California set for solar, storage surge in zonal grid plan

California identifies key development zones in its latest grid plan that will intensify competition and help whittle out speculative projects, market experts said.

Related Articles

California is pushing ahead with its energy transition objectives in its latest annual transmission plan, published this month.

State grid operator CAISO proposes to invest $6.1 billion in 26 grid improvements to connect new renewable energy projects by 2035, it said.

The draft plan will support 38 GW of new solar capacity, in areas such as the Westlands area in the Central Valley and areas in the south near the city of Tehachapi, Kramer in San Bernardino County and Riverside County, as well as in southern Nevada and western Arizona. Most of these grid projects involve upgrading existing grid infrastructure, such as installing transformers or stringing new conductors to existing towers.

The grid plan represents a second instalment of forward bulk transmission planning, instigated last year to provide greater clarity to developers and reduce future connection delays. The grid projects would be completed over the next 8 to 10 years at a predicted lifetime cost of 0.5 cents/kWh. The majority of the grid investments would be used to facilitate 4.7 GW of new floating wind projects, CAISO noted.

Almost all new solar projects in California include battery storage and the latest plan would improve access for battery projects co-located with solar or wind, as well as stand-alone batteries close to major load centers in the LA Basin, Greater Bay Area and San Diego, CAISO said. U.S. installed battery capacity will double this year to 30 GW on the back of investment in California and Texas, the Energy Information Administration (EIA) said in January.

CAISO has provided more detailed zonal information in its latest plan, allowing developers to focus more on specific regions.

There will be “a significant increase” in interest in these zones and this could impact land costs and competition for development resources, a spokesperson for consultancy GridSME told Reuters Events.

There was over 100 GW of solar capacity in the CAISO grid connection queue at the end of 2023, according to Berkeley Lab's latest national grid queue report. While not all of this will be completed, connection approval times have been increasing in the CAISO region, Berkeley Lab said.

Expected solar, battery storage additions in CAISO grid plan

Source: Reuters Events, using data from CAISO’s 2023-24 Transmission Plan (April 2024)

The more detailed zonal information provided in the plan should help to reduce the number of speculative solar and wind projects submitted to the grid authorities, resulting in fewer projects that are more likely to be completed, Vivian Yang, Western States Energy Analyst at the Union of Concerned Scientists, said.

Until now, some developers have been submitting a number of projects to “hedge against uncertainty of grid cost upgrades in the interconnection process,” Yang said.

Green state

California aims to supply 100% of its power from zero carbon sources by 2045, compared with around 60% in 2021. The California Public Utility Commission (CPUC) estimates 85 GW of additional capacity will be required in the CAISO gid by 2035, beyond existing resources and those under development. The new capacity will be needed to support growing electrification in transport and construction as well as the switch to low carbon generation.

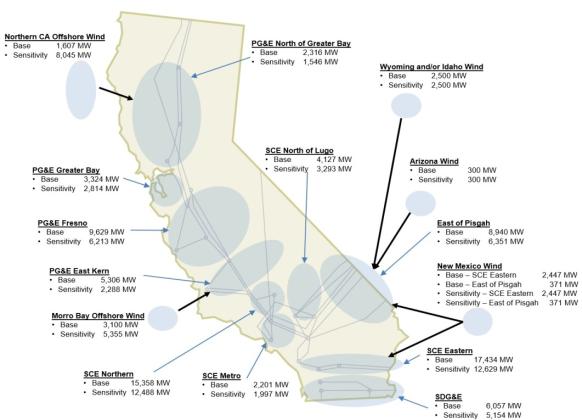

Alongside solar and storage growth, the draft grid plan will connect 3 GW of in-state wind generation in existing development regions including Tehachapi and strengthen south-eastern borders to import over 5.6 GW of out-of-state wind generation from Idaho, Wyoming and New Mexico.

Capacity in California enabled by CAISO grid plan

(Click image to enlarge)

Source: CAISO's 2023-2024 transmission plan, April 2024

Some $4.6 billion of the proposed $6.1 billion investment will be used to build three major transmission lines that will deliver power from the first wave of floating wind turbines off the northern coast of Humboldt County. In total, the grid plan will connect 4.7 GW of offshore wind, including 1.6 GW in Humboldt County and 3.1 GW in Morro Bay in central California.

Storage surge

U.S. deployment of standalone storage has soared on the back of new tax credits in the 2022 Inflation Reduction Act.

There is currently 6 GW of standalone battery capacity with interconnection agreements in California and 21 GW at earlier stages of development in metro areas, Morris Greenberg, senior manager, North American power analytics, S&P Global Commodity Insights, told Reuters Events.

For instance, NextEra Energy Resources is developing the 300 MW 4-hour Corby standalone battery storage project in Solano County, which is due to come on stream in 2025. Some of the power will be supplied to a San Francisco Public Utilities Commission (SFPUC) community choice energy program under a 15 year contract signed in August 2023.

For exclusive solar insights, sign up to our newsletter.

Much of the planned storage capacity could take advantage of existing grid capacity made available by the potential closure of gas-fired power stations going forward, Greenberg said.

Several storage projects have already been installed on retired gas plant sites, including Vistra group's giant 750 MW Moss Landing battery facility in Monterey County.

Some gas plants on the Southern California coast have been slated for retirement for several years "but remain online due to reliability concerns," Greenberg noted. Lifespan of the gas plants will depend on grid needs and whether running costs surpass revenues.

"Some of this capacity could be replaced by storage depending on local opposition and redevelopment plans. There are about 3.6 GW of capacity in this category," he said.

Many standalone battery projects may be located close to main load centres, but this may still require the proposed grid upgrades in order to supply power to the facilities from distant renewable energy generation sites, the GridSME spokesperson noted.

Build risks

The development timelines set out in the draft plan could be complicated by delays in permitting and building the proposed transmission lines, the GridSME spokesperson said.

Transmission build takes longer as development areas spread further from load centres and the number of grid projects to be designed and constructed "could be a major strain on utility resources,” the spokesperson said.

Developers must work with local communities early in the process to avoid permitting "setbacks," Yang said.

In some areas like the Central Valley, there is "scepticism" about new large scale clean energy infrastructure in rural areas that will supply power to the large urban centres of California, she said.

Community benefit agreements “can go a long way to help transmission and solar development move more smoothly," Yang noted.

Going forward, a greater emphasis on offshore wind transmission could impact the demand for solar and storage, Carrie Bentley, CEO of Gridwell Consulting, told Reuters Events.

If the CPUC were to shift to an "offshore wind future" with 13 GW of offshore wind, this would decrease the amount of solar and storage needed by about 15%, Bentley said.

Reporting by Neil Ford

Editing by Robin Sayles