U.S. prepared for more than a second wave of chemical investment–ACC

The U.S. is in place to be the most competitive global manufacturer of chemicals as a result of hydraulic fracturing and natural gas, and the wave of investments is far from over, the American Chemistry Council (ACC) told Petrochemical Update.

“I have heard people say that we should not be talking about a second wave of investment, because it is not just going to be a second wave. It is going to be a continuous flow of investment in chemical manufacturing in the U.S. for a significant period of time,” ACC President Cal Dooley said while speaking at Petrochemical Update’s Downstream Engineering, Construction and Maintenance Conference in New Orleans. “Rather it is second wave or third wave, the U.S. is well positioned.”

The Conference attracted more than 1,000 delegates over a three-day period.

Since 2010, $85 billion worth of petrochemical projects have been completed or started construction, according to the ACC.

U.S. competitive advantage

The first wave of investments in chemical manufacturing came because of the U.S. cost and margin advantage.

At least 85% of U.S. petrochemical production is natural gas or natural gas liquid (NGL) as feedstock, while 75% of the world uses oil and naphtha based production, Dooley said.

Product prices track crude oil, so a strong oil price is beneficial to U.S. producers making the same product using much cheaper NGLs as feedstock.

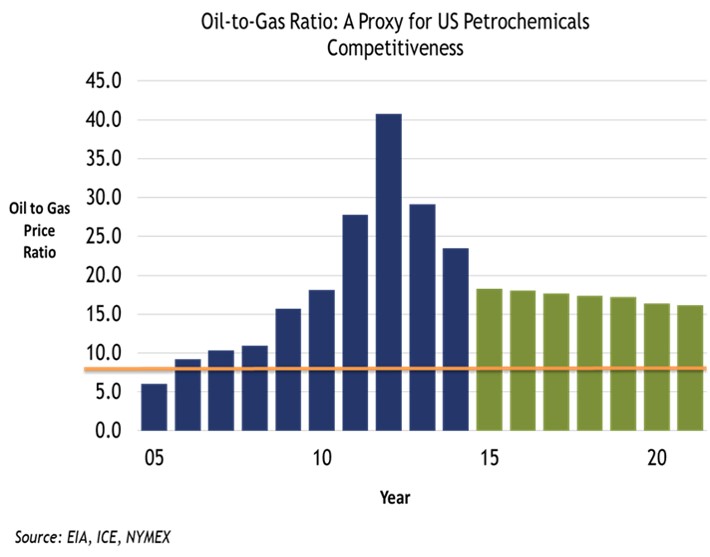

When the oil to gas ratio is above 7, U.S. competitiveness is enhanced, according to analysts. The current ratio remains very favorable for U.S. competitiveness, Dooley said.

"Growth is likely to slow, but be offset by the stimulative consumer effect," he added.

Image Source: ACC

There were significant investment announcements from 2010-2012 when oil spiked to more than $100/barrel.

Of those, four crackers totaling more than 5 million tonne/year of ethylene capacity are slated to start operations this year along the U.S. Gulf Coast. Five more are under construction and expected to begin operations before the end of 2019.

Some 10.3 million tonnes of ethylene capacity will enter the U.S. market before the end of 2019.

While oil prices declined, recent stability in oil prices and optimism for increased global demand is spurring another round of investments.

“We will continue to see competitive advantage because we have ability to access tremendous supplies of natural gas,” Dooley said. “The reserves seem to be growing each time we do an assessment.”

Dooley pointed to a study IHS did four years ago which predicted that the U.S. had a 30-year minimum natural gas supply for under $4/MMBtu, and said that price estimate has probably dropped because hydraulic fracturing has become even more efficient creating more supply.

Now 3oo+ projects

The ACC estimates there are 310 projects currently under construction or planned and $185 billion in potential capital investment as of June 2017, up from the 97 projects and $72 billion in Mach 2013.

Global investments are a big part of second wave investment. 62% of that investment is from firms based outside of the U.S.

“We have seen now because of our global competitive position, we are the most competitive platform to serve the growing demand for chemicals globally,” Dooley said.

Source: Petrochemical Update

Chemicals contribution to economy

The chemicals industry is contributing to the broader economy more so now than ever before.

In 2016, 48% of manufacturing construction spending in the U.S. was from the chemical industry, according to the U.S. Department of Commerce.

“When you look at the $185 billion in petrochemical spending, at a minimum, it will result in $90 billion in economic activity,” Dooley said. “That will result in 821,000 permanent new jobs by 2025.”

“When you look at a multiplier to the broader economy, that investment equals a $249 billion contribution to new U.S. economic output by 2025,” Dooley added.

Chemical Exports

U.S. exports are on the way to a major increase as a result of petrochemical investment.

In 2015, the chemical manufacturing sector had $184 billion in exports, accounting for 14% of all U.S. exports. According to the ACC, chemical industry exports are expected to increase an average of 7% through 2021.

Exports of chemicals linked to shale gas are projected to reach $123 billion by 2030, notes ACC, more than double the total in 2014. That will drive the trade surplus from these chemicals to increase from $19.5 billion to $48.3 billion by 2030.

“If you go back about 2012, we were exporting about 173 million in chemical products, we will see that increase in 2021 to about 245 million,” Dooley said.

Source: ACC

Appalachia Resources

When the industry thinks about how demand came, it thinks of the U.S. Gulf, but there is tremendous opportunity that has not been tapped, Dooley said.

“About 80% of the investment so far has been in the U.S. Gulf, but we have seen one investment by Shell in Pennsylvania. The Appalachian region could become a second center of U.S. petrochemical and resin manufacturing similar to the U.S. Gulf,” he added.

Lawmakers in the four-state area have told Congress that a storage hub is a crucial next step in transforming the Appalachian Basin and its natural gas assets into a petrochemical production center.

The Hub would handle some 100 million barrels of NGLs and liquid chemicals ethane, methane, ethylene, propylene and chlorine, and include about 3,000 miles of underground pipelines to move the chemicals to industries along a 454-mile corridor in the four states. The cost of the Hub would be around $10 billion according to TopLine Analytics.

The concept would be similar to the Mont Belvieu hub in Texas that supports the Gulf Coast chemical industry.

“If the hub is successful, the U.S. would have the potential to produce enough ethane to supply another six crackers, plus there would be additional ethane to ship to the U.S. Gulf region,” Dooley said.

Regulatory ups and downs

The U.S. is well placed for chemical investment from a regulatory standpoint.

“If you look at it from a chemical engineering perspective and look past some of the headlines, we have never had a political environment more sensitive and supportive of the regulatory policy needed to maximize the competitive advantage in the U.S.,” Dooley said.

The U.S. chemical industry has feedstock advantage, and regulations are being pushed to keep the US competitive in chemicals management, taxes and enegy and environment legislation, Dooley explained.

One issue has been troubling to the industry however.

“The one issue that has been somewhat troubling as we look at some of the early actions of the Trump administration and some of the early rhetoric we saw during the campaign is on trade,” Dooley said.

“When you have this glut of new investment coming into the U.S., it is not to serve primarily the domestic market, it is to serve the global marketplace.”

The U.S. petrochemical industry will benefit today and in the future from trade policies that make sure the U.S. has global access to the marketplace, Dooley said.

“We need to see efforts in congress and leadership to move forward advancing fair trade policy,” Dooley said.

By Heather Doyle