More than half of companies find cross-border e-commerce challenging

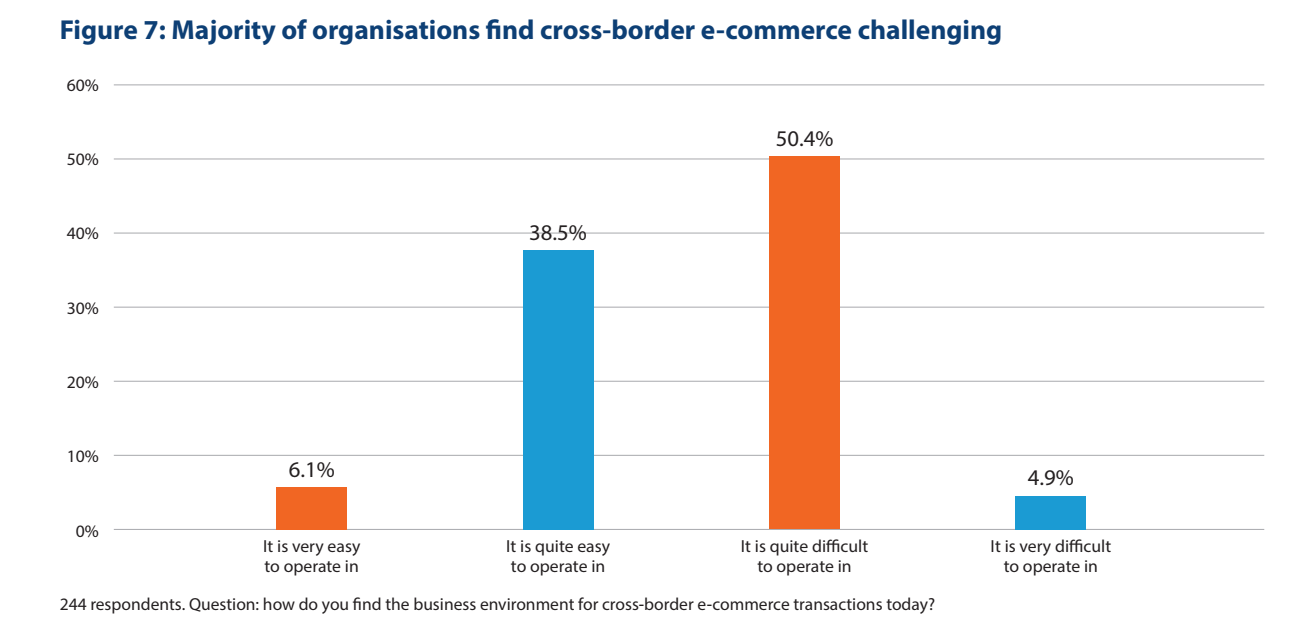

Fifty-five per cent of organisations polled in industry survey say that the business environment for cross-border e-commerce is challenging, with compliance, delays and costs topping the headaches

While cross-border e-commerce is a thriving market, 55% of organisations selling and shipping internationally report that they find the business environment challenging, with compliance, delays and associated costs the biggest issues.

The new state of global cross-border e-commerce report 2023-24 report, which is free to download here, found that just 6% find moving e-commerce goods across borders very easy.

The research highlighted three main hurdles that organisations shipping internationally regularly encounter, namely:

- The challenge of complying with customs.

- The potential delays created by processing documentation and shipping cross-border.

- The costs arising from the above that make it more expensive than a domestic supply chain.

This can be seen in the top five challenges reported for cross-border e-commerce, which are:

- Shipments being delayed in customs - 43%.

- Customs regulatory compliance / HS codes - 41%.

- Added supply chain costs from cross-border e-commerce - 41%.

- Added costs of tariffs and duties - 37%.

- Delivery costs - 33%.

Cutting costs key to success

With three of the top five issues directly related to the costs of doing business across borders, it is clear that margins are thin for international e-commerce and companies will be keeping a close eye on their balance sheets over 2023 and 2024.

This was emphasised by the issues respondents to the report’s industry survey expect to become more prominent in 2023, with the possibility of recession (54%), inflationary pressures (52%) and the cost of shipping (40%) listed as the top three concerns that could hinder growth this year.

The report notes that while the cost of international ocean freight fell continuously and rapidly throughout 2022 and is subdued to open 2023, the opposite has largely been true across the remainder of the supply chain, with parcel shipping continuing to trend upwards and often exceeding the rate of inflation in many countries.

According to estimates from shipping intelligence platform Reveel, the average UPS customer will pay 10.2% more in 2023 than they did in 2022 and the average FedEx customer will pay 9.1% as a result of General Rate Increases (GRI) and adjustments to surcharges, rules and fees. Similarly, DHL announced a 7.9% general average shipment price for US customers to open the year.

Reuters Events survey of European supply chains from the start of 2023 also found that 91% of LSPs planned to pass on costs to their customers over the coming 12 months and 25% intend for those cost pass-throughs to be ‘significant’, underlining this trend.

Parcel shipping costs will therefore most likely continue to trend upwards throughout 2023, putting pressure on cross-border e-commerce supply chains to cut overheads.

The report recommends that organisations look towards automation and partnerships to produce accurate documentation and calculate the correct fees due in order to tackle these issues.

Download the completely free research by clicking here!