Wind industry facing supply crunch; EU clean tech law lacks tools for growth

The wind power news you need to know.

Related Articles

Wind builders facing supply bottlenecks by mid-decade

Wind developers in the United States and Europe are facing supply chain bottlenecks around the middle of the decade due to an acceleration in deployment and a lack of investment in global supply chains, the Global Wind Energy Council (GWEC) warned in its latest annual report.

Government policies such as the U.S. Inflation Reduction Act will hike average annual wind installations to 136 GW per year through 2027, up from 78 GW in 2022, GWEC said.

Without action by policymakers, the U.S. and Europe are "likely to see supply bottlenecks for turbines and components from as soon as 2025, as the wind market sees the positive impact of the U.S. Inflation Reduction Act, increased ambition in Europe, continued rapid build out in China and large developing countries speeding up their deployment," GWEC said.

Spare capacity in wind energy manufacturing will disappear unless urgent investments are made in the supply chain, industrial capacity, as well as training and skills, GWEC warned.

In the offshore wind sector, European turbine assembly capacity will need to double to meet demand in the region and will no longer be able to support growth in the U.S. and elsewhere, it said. The U.S. is relying heavily on European components and vessels to deploy its first offshore wind projects.

Government measures in the U.S. and Europe to expand domestic manufacturing and reduce imports could worsen the availability of components, the council said.

"Attempts to create rigid local content requirements or implement protectionist trade measures create the risks of sharply higher costs or even serious delays to the necessary expansion of wind and renewables," it said.

New EU laws lack tools needed to hit wind targets

A new Net Zero Industry Act proposed by the European Commission on March 16 sets ambitious targets for wind manufacturing but lacks the funding measures and rule changes needed to achieve these goals, industry group WindEurope said.

The act sets a target of 40% of renewable energy components from EU factories by 2030 and domestic content rules in renewable energy tenders that favour EU products. The act forms part of the EC's Green Deal Industrial Plan to accelerate renewables and bolster energy security.

The industrial plan currently "falls short of what’s needed to support and expand Europe’s wind supply chain and deliver on our energy security and climate targets," WindEurope said. The RePowerEU plan, agreed by leaders last year, raised the EU's renewable energy target for 2030 from 40% of gross energy demand to 45% and pledged to rapidly end the region's reliance on Russian oil and gas.

"We urgently need to expand existing factories and build new ones," WindEurope said. "This requires substantial investments in the entire wind energy value chain – factories, grids, ports, vessels and skilled workers."

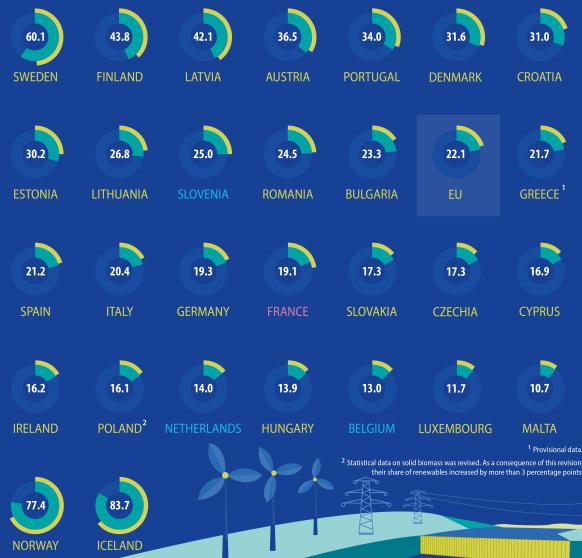

Share of gross energy from renewables in EU in 2020

(Click image to enlarge)

Source: Eurostat (European Commission)

Financial support at EU and national level will be key to achieving the EU's goals, the industry group said. In the short term, the EC must adapt the EU Innovation Fund to focus more on building out supply chains rather than supporting technology innovations, it said. More longer term, the EC proposes a new Sovereignty Fund and is expected to provide more details this summer.

In addition, the EC must simplify the local content rules proposed for renewable energy tenders, clarifying the concept of supply chain resilience by recognising the value of European supply chains, WindEurope said.

The net zero act must be approved by the European Parliament and the European Council before it can enter into force.

Japan's JERA enters EU offshore wind market

Japanese utility JERA has agreed to buy Belgian offshore wind developer Parkwind from Virya Energy for 1.6 billion euros ($1.7 billion), expanding its activity into the European Union, the group said on March 22.

Through the deal, JERA will acquire Parkwind's four offshore wind farms in Belgium, a new wind farm being built in Germany, and other projects in development elsewhere, including Ireland.

JERA, a joint venture between Tokyo Electric and Chubu Electric, already holds offshore wind assets in the UK and Taiwan.

"We want to gain Parkwind's know-how and knowledge of offshore wind power projects in Europe that can be utilized in JERA's existing wind farms and new projects mainly in Asia," Ken Matsuda, the head of JERA's overseas offshore wind power business group, told a news conference.

JERA aims to double its renewable energy capacity to 5 GW by March 2026 through new development and acquisitions, he said.

Offshore wind installations are set to soar in Europe as countries seek to bolster energy security while rapidly reducing carbon emissions.

The EU aims to quadruple offshore wind capacity to 60 GW by 2030 but some EU members have set higher targets. Meanwhile, the UK has set a target of 50 GW over the same period.

U.S. renewable energy output surpasses coal, nuclear combined

U.S. renewable energy generation surpassed coal and nuclear combined for the first time in 2022 on new wind and solar installations, the Energy Information Administration (EIA) said on March 27.

Renewable energy accounted for 21% of total generation, including wind, solar, hydropower, biomass and geothermal. Wind and solar combined represented 14% of total output, up from 12% in 2021, and is expected to hit 17% this year, EIA said.

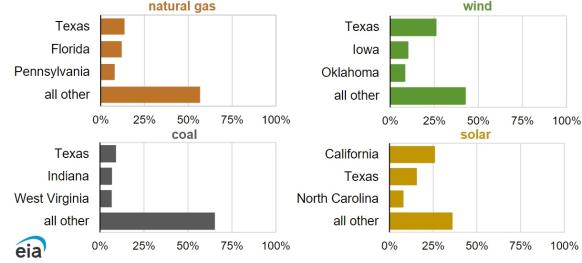

Natural gas remained by far the largest source of generation, rising to 39% of total output, compared with 37% in 2021. The share of coal-fired generation fell by three percentage points to 20% in 2022, due to plant retirements and lower usage at existing plants. The share of nuclear generation slipped by one percentage point to 19% following the closure of the 800 MW Palisades nuclear power plant in Michigan in May 2022.

Texas accounted for 26% of total U.S. wind generation last year, followed by Iowa (10%) and Oklahoma (9%).

Share of US power generation - top three states

(Click image to enlarge)

U.S. utility-scale wind capacity was 141 GW at the end of 2022 while solar capacity was 71 GW, EIA said.

Reuters Events