US hybrid wind rush highlights tax credit impact

Developers of wind-solar-storage projects are prioritising wind construction to maximise tax credits and capitalize on falling solar and storage costs.

Related Articles

In early December, NextEra Energy Resources (NextEra) and Portland General Electric (PGE) started commercial operations at the 300 MW Wheatridge wind farm in eastern Oregon, the first phase of their joint 380 MW wind-solar-storage project. A week later, NextEra brought online the 250 MW wind section of its 700 MW Skeleton Creek wind-solar-storage plant in Oklahoma.

Demand for hybrid renewable energy projects is growing as developers look to increase revenue and optimise land resources and transmission capacity. As wind and solar capacity grows, combined systems and storage capability can offer a competitive advantage.

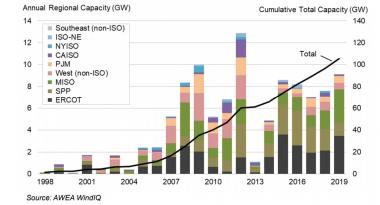

US annual wind installations by region

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory, August 2020

At the end of 2019 there were only two hybrid wind-solar-storage projects online, but falling costs and tax credit deadlines have stoked demand. NextEra is developing another wind-solar-storage project at Arlington in California while Scout Clean Energy recently announced that its Horse Heaven project in Washington State will include all three technologies.

The phasing out of federal tax credits is driving construction schedules as developers push to meet deadlines. The Wheatridge wind farm was built in around 11 months and the partners will install a 50 MW solar plant and 30 MW battery unit by the end of this year.

“Wind was prioritized [at Wheatridge] to ensure it captured the full amount of tax credits," Brett Sims, vice president for strategy, regulation & energy supply at PGE, told Reuters Events.

COVID-19 restrictions have delayed some projects and extensions to tax credit deadlines passed by Congress last month should ease pressure on some developers and construction groups.

The Wheatridge project will also receive full investment tax credits for the solar and storage sections. By staggering construction, the partners can capitalise on falling costs, Sims said.

The levelised cost of utility-scale solar fell by 9% last year while wind costs fell 2%, Lazard consultancy said in a report. Battery costs are falling as manufacturing grows and could drop below $100/kWh by 2023, IHS Markit said in a research note.

The later addition of storage can “make a lot of sense given the declining cost of batteries," Ryan Wiser, Senior Scientist at the Lawrence Berkeley National Laboratory, said.

Wind support

PGE will own 100 MW of the wind project and NextEra will own the balance of the project and sell its output to PGE under 30-year power purchase agreements. The project will expand PGE's wind power portfolio to over 1 GW, but the company has some way to go to reach its target of net zero greenhouse gas emissions by 2040.

PGE's power supply mix (2019)

Source: Portland General Electric

The Wheatridge project is located on the Columbia Plateau where the timing of wind and solar resources often differs. This allows the operator to optimise the transmission capacity, Sims said.

GE Renewable Energy will supply 120 wind turbines of capacity 2.3 MW and 2.5 MW.

"The turbine mix is to ensure the maximum level of PTC eligibility for the project, as the 2.3 MW turbines qualified for the IRS safe harbor provisions," Sims said. The safe harbour provisions allow developers to secure maximum tax credits with lower initial capital outlay.

The battery will provide four hours of storage and typically supply evening peak demand when solar resources wane.

To receive maximum ITCs, the battery must charge from the PV plant for the first five years. The battery will initially be tied to the solar section of the plant but the final configuration is “still being determined," Sims said.

The project is permitted to use storage technologies tied to alternating current (AC) or direct current (DC), allowing for future applications with solar or wind, he said.

Wind sections allow operators to save battery discharge from the PV-storage system, helping to optimise the battery use, Wiser said.

Longer or more frequent battery dispatch accelerates degradation and can also cut into maintenance windows for shared components such as inverters. Batteries must be replaced or upgraded several times within the lifetime of the solar plant and inverters represent a key maintenance cost.

Hybrid future

NextEra will operate and maintain the entire Wheatridge plant with a team of around 10 staff. The hybrid design will bring operational synergies and will require a wide range of technology expertise. Operations and maintenance (O&M) roles are becoming more complex as developers opt for new technologies like storage and bifacial solar and implement new analytics systems.

At suitable sites, wind-solar-storage plants can offer greater value for power customers than standalone projects, Sims said. PGE is currently studying other storage projects for a range of grid support applications.

Transmission capacity will be an issue for some developers. Wheatridge benefits from a new transmission line that feeds into the regional Bonneville Power Administration high-voltage grid.

A number of sites in Western US would be suitable for hybrid projects as they benefit from “strong, steady winds and sustained solar exposure, as well as a robust transmission system,” Sims said.

Projects will be particularly attractive on sites where wind and solar output is negatively correlated, Wiser noted.

Wider growth in wind and solar will also see hybrid deployment enter new markets. Indeed, Skeleton Creek is the first hybrid wind-solar-storage plant in the Southwest Power pool region, which spans Oklahoma and 13 other states in central US.

Reporting by Neil Ford

Editing by Robin Sayles