Orsted hikes renewables target to 50 GW; US unveils California offshore wind zones

Our pick of the latest wind power news you need to know.

Related Articles

Orsted aims to install 50 GW renewables by 2030

Denmark's Orsted is increasing its investment in renewable energy to 350 billion Danish crowns ($57 billion) by 2027 in a bid to install 50 GW by 2030, up from a previous target of 30 GW set out in 2018.

"Our aspiration is to become the world's leading green energy major by 2030," CEO Mads Nipper, who joined Orsted in January, told investors at a Capital Markets Day on June 2.

The world's largest offshore wind developer, Orsted had 7.6 GW of installed offshore wind capacity at the end of 2020 and expects to reach 15 GW by 2025.

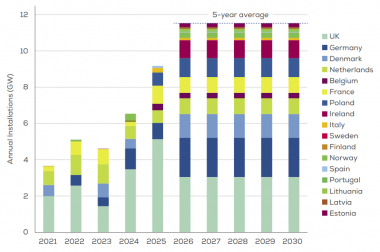

Forecast offshore wind build in Europe

(Click image to enlarge)

Source: WindEurope, February 2021

Orsted had previously targeted investments of 200 billion crowns by 2025. Around 80% of the investment will be in offshore wind, including green hydrogen projects, and 20% in onshore wind, solar, storage and biomass, the company said.

Offshore wind costs have plummeted and competition is increasing as utilities increase spending and oil and gas groups and institutional investors enter the market.

UK developer seeks to fast-track 3 GW of floating wind

Infrastructure developer Cerulean Winds has submitted plans to the Scottish government to build 3 GW of floating wind capacity to supply the majority of UK oil and gas platforms.

Cerulean has submitted a formal request to Marine Scotland for seabed leases west of Shetland and in the Central North Sea, requesting a streamlined regulatory process, the company said June 1.

The 10 billion pound ($14 billion) project consists of 200 floating wind turbines that would feed 3 GW of power to existing and future oil and gas platforms, as well as 1.5 GW of power to onshore green hydrogen plants.

The project would be funded under an infrastructure project finance model and would require no state subsidies or contract for difference (CFD) requirements, Cerulean said.

The cost of the power delivered to offshore platforms would be below gas turbine costs, decarbonising energy supply at "no upfront cost" for the platform operators, it said.

If approved, Cerulean aims to reach financial close in Q1 2022 and supply first power from 2024.

US selects Morro Bay, Humboldt for first California offshore projects

The US government has selected sea areas near Morro Bay and Humboldt Bay in central and northern California for the first West Coast offshore wind projects, the White House announced May 25.

The sites could host up to 4.6 GW of offshore wind capacity and will form part of the Biden government's pledge to install 30 GW of offshore wind by 2030. Last month, the Biden administration approved the Vineyard Wind project in Massachusetts, the US' first large-scale offshore wind farm, and aims to complete environmental reviews of 16 projects by 2025.

The Department of the Interior (DOI) has identified an area in Morro Bay of 399 square miles that could host 3 GW of capacity and is "advancing" the Humboldt Bay areas as a "potential" development zone, the government said. The DOI worked in coordination with the Department of Defense (DOD), which has significant activities in the area.

For several years, West Coast developers have been working with local stakeholders to reduce risks and accelerate deployment. The projects are based on floating wind technologies as the waters are too deep for lower-cost fixed-bottom designs.

Castle Wind, a joint venture between Trident Winds and German power group EnBW, hopes to build a 1 GW project in Morro Bay.

In Humboldt Bay, Portuguese utility EDPR has teamed up with Aker Solutions, Principle Power and the Redwood Coast Energy Authority (RCEA), to develop a 120-150 MW facility.

Economic studies have also shown significant potential for offshore wind further north in Oregon.

California, Texas at risk of power shortages this summer: NERC

California, Texas, New England and the MISO grid area in central and northern US are at risk of power shortages this summer due to above-normal temperatures predicted across much of the region, the federal grid regulator North American Electric Reliability Corporation (NERC) said May 14.

"Of greatest concern in the high-risk category is California, where up to 11 GW of additional transfers are expected to be needed in late afternoon to offset reduced solar output. This is in contrast to 1 GW of transfer needed on a normal peak day," NERC said. California also faces lower hydroelectric supplies than last year due to an ongoing drought. Reservoir levels are currently at 70% of normal, according to regional grid operator CAISO.

Hot temperatures prompt a surge in power demand as households and businesses turn up air-conditioning devices. Last August, a heatwave led to rotating power interruptions across California and CAISO urged consumers to conserve electricity during afternoon and evening periods. California's vast solar fleet is unable to meet power demand after sundown and additional issues included unplanned stoppages of gas-fired plants, swinging wind resources and a lack of imports from neighbouring states suffering similar temperatures.

California's energy agencies pledged to accelerate new capacity installations including battery storage and adapt resource planning targets to worsening climate change effects, to avoid a repetition of the blackouts.

Some 2 GW of additional capacity will be available during peak demand periods this year and the power authorities are looking at ways to add a further 1.5 GW by the summer, CAISO said in its latest summer outlook. California's power system is better placed than last year but key risks include a reduction of power imports into California due to wider shortages across the western US and further disruption to supplies from serious wildfires, it said.

California forecast peak power capacity by fuel type - summer 2021

Source: CAISO's 2021 summer loads and resources assessment, May 2021

Growing renewable energy penetration is increasing the value of energy storage as operators look to mitigate intermittency risk. Solar and battery costs are continuing to fall and many developers are coupling solar projects with batteries to access higher power prices during peak demand periods. Wind-battery proposals have also surged, representing half of all wind projects in the CAISO interconnection queue at the start of 2020.

"The 2021 forecasted peak demands are about the same as last year under normal weather conditions," CAISO said in its latest outlook. "However, extreme heat events are becoming more likely."

China wind, solar installs set to drop after record year

China's National Energy Administration (NEA) has ordered power transmission operators to connect at least 90 GW of wind and solar wind capacity this year, 25% less than last year's record level, Reuters reported May 20.

China installed 120 GW of renewables in 2020, including 72 GW of wind and 48 GW of solar, more than double the level in the previous year. From now on, the NEA will set renewable energy targets based on transmission rather than construction, to avoid excess capacity, it said.

"China will no longer issue annual targets for renewable capacity, but will give forecasted renewable power consumption and guide local governments to arrange construction of new projects, as well as promote cross-region renewable power trade," the NEA said.

China had 530 GW of installed wind and solar capacity at the end of 2020 and Beijing aims to supply 11% of power demand from wind and solar resources in 2021, up from 9.7% in 2020. By 2025, the Asian powerhouse aims to supply 20% of its primary energy demand from non-fossil fuel resources, rising to 25% by 2030.

China aims to reach peak carbon emissions by 2030 and coal consumption will continue to rise until 2025, when it will start to be reduced, President Xi Jinping said in April.

Global emissions are forecast to bounce back by 5% this year to reach close to 2019 levels, the International Energy Agency (IEA) said. Demand for fossil fuels will rise and more than 80% of the global growth in coal demand will come from Asia, led by China, it said.

Reuters Events