EU to set out one-year permitting rule for renewables; Biden directs staff to speed up approvals

The wind power news you need to know.

Related Articles

EU to set out one-year deadline for renewable energy permitting

The European Union executive will propose EU countries designate areas in which renewable energy permits must be awarded within one year of application, Reuters reported May 9, citing a draft document by the European Commission.

The EC is expected to unveil Wednesday measures that accelerate renewable energy projects in a bundle of policies aimed at ending the EU's reliance on Russian gas and oil.

The proposed rules will require EU members to identify "go-to areas" areas on land and sea where renewable energy would have a low environmental impact, the EC document said. An environmental assessment would be performed for these areas as a whole, removing the need for individual projects to go through the full process.

The overall permitting process within these areas "shall not exceed one year," the document said, adding that this could be extended by three months in "extraordinary circumstances."

Wind and solar permitting can take several years due to complex administrative processes and a lack of resources at permitting authorities. Several EU members are adapting national permitting procedures in a bid to speed up deployment.

Spain plans to fast-track permitting of solar projects with capacities up to 150 MW and new wind farms up to 75 MW while Portugal plans to waive environmental impact assessments for solar projects up to 50 MW. Germany will fast-track new energy laws this summer that remove permitting hurdles for renewable energy projects.

White House directs government to prioritise permitting

The Biden administration has called on government agencies to expand permitting teams and collaborate on environmental reviews to accelerate the deployment of renewable energy and other critical infrastructure.

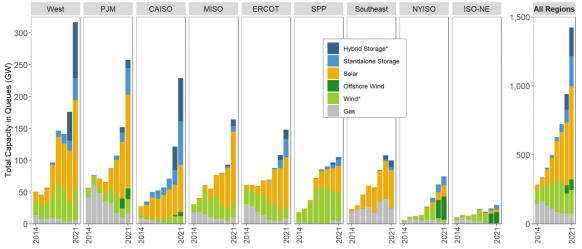

Lengthy approval processes and a lack of administrative staff are delaying wind and solar projects and jeopardising President Biden's target of a decarbonised power sector by 2035. PJM, the largest U.S. grid operator, has halted approvals of new solar and wind installations to reduce a backlog of applications.

U.S. power generation in interconnection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2022

The Permitting Action Plan will use new financing and government agencies created in President Biden's $1 trillion Bipartisan Infrastructure bill to reduce application queues and provide clearer timelines for developers and local communities, the White House said May 11.

Last month, the Federal Energy Regulatory Commission (FERC) opened a consultation on new rules that will require grid operators to plan ahead and unlock capacity for renewable energy projects. In January, the Department of Energy (DOE) launched $20 billion of federal financing tools and planning authority changes for grid upgrades.

Under the action plan, specific teams will be created to steer onshore and offshore wind projects and new grid infrastructure and greater transparency and accountability will be provided to all stakeholders, the White House said.

These teams will "facilitate inter-agency coordination on siting, permitting, supply chain, and related issues, and promote efficient and timely reviews," it said.

Government agencies will be required to accelerate hiring of permitting staff and work with other agencies to develop more efficient environmental review processes and perform collaborative field studies. Agencies will also simplify data collection and develop training resources to help all stakeholders to the environmental review.

"This plan should help accelerate clean energy infrastructure permitting by setting clear timeline goals for federal permitting and environmental review decisions, and improving coordination among agencies...and finding ways to alleviate strained agency resources," the American Clean Power (ACP) association said.

"ACP looks forward to working with the [Biden] administration as it implements the Permitting Action Plan and considers further necessary refinements to federal permitting processes," it said.

California officials warn of summer electricity shortfall

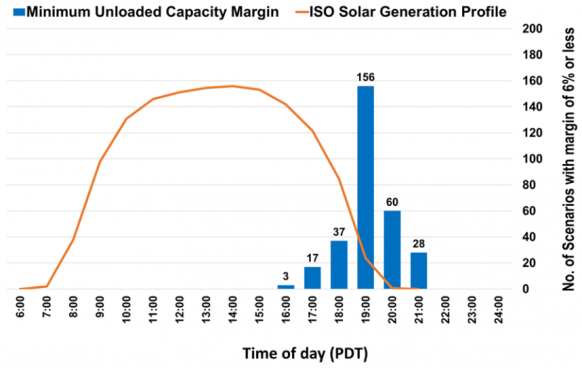

California could suffer a shortfall of 1.7 GW of power during extreme heatwave conditions this summer due to delays to renewable energy projects and the impact of droughts on hydroelectric supplies, state energy officials said May 6.

Officials forecast the shortfall could rise to 5 GW under extreme summer heat waves that ramp up energy demand while curbing supply, Reuters reported, citing an online briefing from three state agencies and the office of Governor Gavin Newsom. Demand typically peaks in the evening when solar resources wane, increasing the importance of dispatchable generation assets such as fossil fuel plants, hydroelectric stations and energy storage.

California summer 2022 power shortfall risk by time of day

(Click image to enlarge)

Source: California ISO, May 2022

State officials ordered utilities to procure more renewable energy after a heatwave in August 2020 prompted rotating power outages, but many solar and storage projects have been delayed due to supply chain challenges following the pandemic and market uncertainty following an investigation of solar import tariffs by the Department of Commerce. The Western U.S. also suffered a historic drought in 2021, cutting California's hydroelectric power generation to 48% below the annual average.

In June 2021, the California Public Utilities Commission (CPUC) ordered utilities to procure 11.5 GW of new renewable energy or demand management measures in 2023-2026. Several GWs of new capacity were already set to come online following earlier procurement orders and in February the CPUC approved a long-term plan to build 19 GW of solar and 15 GW of storage by 2032, along with 3.5 GW of onshore wind, 1.7 GW of offshore wind and 1.5 GW of new imported wind capacity.

The current capacity shortfall could see Californian operators extend the lifespan of fossil fuel and nuclear plants, setting the state back in its quest to supply 100% of power from renewable sources by 2045.

"We need to make sure that we have sufficient new resources in place and operational before we let some of these retirements go," Mark Rothleder, chief operating officer at the California ISO grid operator, told the online briefing.

"Otherwise we are putting ourselves potentially at risk of having insufficient capacity."

Duke Energy wins first offshore wind lease in Carolinas

U.S. utility Duke Energy secured its first offshore wind development lease in the Biden administration's latest tender off the coast of North and South Carolina.

Duke bid $155 million to secure a 55,154-acre site while France's Total paid $160 million for a 54,937-acre site, the Bureau of Ocean Energy Management (BOEM) said May 11.

Together, the projects could generate 1.3 GW of power. The government has set a target of 30 GW offshore wind by 2030 and aims to complete the environmental reviews of 16 projects - representing 19 GW of capacity - by 2025.

Total was among six offshore wind developers that secured leases in the New York Bight earlier this year.

The bid prices in the Carolinas were far lower than those in New York Bight, where developers paid a total of $4.4 billion for 488,000 acres, reflecting either higher potential revenues or more favourable development conditions in the northeastern markets.

The Carolinas lease auction was the first to award a 20% credit to bids that committed investments in the domestic supply chain.

Iberdrola subsidiary Avangrid is developing the first offshore wind farm in North Carolina through a lease awarded in 2017. The Kitty Hawk project could potentially generate 2.5 GW of power and entered the BOEM's environmental review process last year.

Norway to install 30 GW offshore wind by 2040

Norway will aim to build 30 GW of offshore wind capacity by 2040, much of which would be exported or used to electrify offshore oil platforms, the Norwegian government announced May 11.

Norway will launch its first offshore wind lease auction this year for 1.5 GW of capacity but industry participants fear slow progress is hampering development and supply chain plans.

The government must amend the country's Offshore Energy Act to open up new offshore wind areas and now plans to carry out the next licensing round in 2025.

"The Ministry of Petroleum and Energy will consider how to streamline the licensing process by assessing applications and approving the detailed plans at the same time," it said.

The 30 GW targeted by the government would almost double Norway's power output. A "significant portion" would be exported to other countries and some could be used to power Norway's large fleet of offshore oil platforms, the government said. Norway sources most of its electricity from hydropower, limiting the need for domestic renewable energy capacity.

Norway has decades of experience in offshore oil and gas operations but the country has fallen behind other nations in the growing offshore wind market. Norwegian oil and gas group Equinor was an early mover in floating wind projects but several other European countries are progressing faster with commercial floating wind tenders that will allow developers to gain economies of scale and build out supply chains.

“Offshore wind can truly become a new industrial pillar for Norway, once the authorities follow up on the political ambition by announcing new areas for both floating and bottom-fixed offshore wind,” Leif Winther, Chief Market Developer at Denmark's Orsted, the world's largest offshore wind developer, told Reuters Events in March.

Reuters Events