US launches Atlantic offshore build programs; Global wind costs fall 18% on year

Our pick of the latest wind power news you need to know.

Related Articles

US launches offshore lease sale in Massachusetts, seeks new Atlantic sites

The U.S. federal Bureau of Ocean Energy Management (BOEM) last week launched a lease sale proposal for two offshore wind sites offshore Massachusetts. In addition, BOEM has called for information on nominations to develop wind farms in New York State waters and has launched an assessment of Atlantic coast waters for potential future offshore wind lease areas.

The announcements signal growing federal support for the U.S. offshore wind sector. The BOEM has already awarded 13 commercial wind energy leases off the Atlantic coast.

The two new leases in Massachusetts cover sites of 248,015 acres and 140,554 acres. A 60-day public comment period would begin April 11, the Department of Interior said in a statement.

“The proposed sales that we are announcing today are the result of extensive work with our partners in the Commonwealth and with a broad community of engaged stakeholders, including fishing communities,” Vincent DeVito, Interior Counselor for Energy Policy, said in a statement.

“Together, we identified areas that can support a large-scale commercial wind project, while minimizing the impacts to fishing habitats, marine species, and other uses of the OCS [Outer Continental Shelf],” DeVito said.

BOEM also called for information on nominations to develop wind farms on areas in the New York bite proposed in New York State's Offshore Wind Master Plan.

State Governor Andrew Cuomo said the new sites would help New York State achieve its target of 2.4 GW of offshore wind energy by 2030.

"To advance our clean energy goals, we are undertaking one of the largest offshore wind development plans in the country, which will power 1.2 million New York homes and create 5,000 good-paying jobs," Cuomo said.

Separately, the BOEM has launched an assessment of the waters off the Atlantic coast for potential future offshore wind lease areas, the bureau announced.

The BOEM suggested sites situated further than 10 nautical miles from shore and in water depths below 60 metres may be most suitable, along with sites adjacent to states with offshore wind incentives.

The BOEM has called for market participants to comment on these proposed factors and submit any other factors which should be considered.

Falcon, Fred Olsen joined forces to supply US offshore market

Seacor subsidiary Falcon Global and Norway's Fred Olsen Wind Carrier have agreed to jointly supply vessels and marine installation crews to the U.S. offshore wind market, the companies announced March 29.

The cooperation deal will combine Fred Olsen Windcarrier’s fleet of Wind Turbine Installation vessels with Falcon Global feeder vessels. The Falcon Global fleet consists of one of the largest existing U.S.-flag and Jones-Act compliant lift boats.

The collaboration will shorten installation periods and reduce costs, the companies said in a joint statement.

"In addition, the vessel spread will enable access to the existing ports and infrastructure," the firms said.

In 2016, Falcon Global vessels and Fred Olsen Windcarrier successfully installed the five turbine Block Island project, the first offshore wind farm in the U.S.

Fossil fuels threatened by 18% drop in renewables costs: BNEF

Global benchmark wind costs have fallen by 18% over the last year, to $55/MWh in the first half of 2018, Bloomberg New Energy Finance (BNEF) said in a new report published March 28. Benchmark solar costs also fell by 18% to $70/MWh.

Large-scale wind and solar projects have already achieved much lower prices in areas with high resources. According to BNEF, wind, solar and energy storage plants are now threatening to displace fossil fuel powered generation in three key market applications of bulk generation, dispatchable generation, and grid flexibility.

In dispatchable power, wind plus storage and solar plus storage plants are set to challenge the competitiveness of coal and gas-fired generation, BNEF said. Lithium-ion battery prices have fallen from $1,000/kWh in 2010 to $209/kWh in 2017, according to BNEF's battery price index.

In the provision of grid flexibility, stand-alone batteries are starting to compete on price with open cycle gas plants and pumped hydro technologies, BNEF said.

Some existing coal and gas power stations with sunk capital costs will continue to provide bulk generation and balancing for many years, Elena Giannakopoulou, head of energy economics at BNEF, said in a statement.

"But the economic case for building new coal and gas capacity is crumbling, as batteries start to encroach on the flexibility and peaking revenues enjoyed by fossil fuel plants," Giannakopoulou said.

Apple achieves 100% power from renewable energy plants

Apple has now signed renewable energy contracts to cover 100% of its global energy needs, the technology company announced April 9.

In addition, a further nine manufacturing partners have committed to purchasing 100% of energy needs from renewable sources, bringing the total number of supplier commitments to 23, Apple said.

The announcement came just days after Google announced it had bought enough renewable energy to supply 100% of its global power demand. On March 21, Microsoft announced it had signed the U.S.' largest ever solar offtake contract.

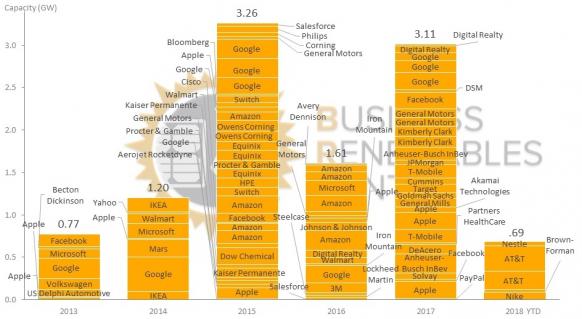

US corporate renewable energy deals

(Click image to enlarge)

Source: Rocky Mountain Institute (RMI), April 2018.

Technology companies face rising power demand from data warehouses in the coming years and power purchase agreements (PPAs) provide long-term price visibility. Since 2014, Apple has sourced 100% of its datacenter power demand from renewable energy plants.

Apple has also been active in renewable energy development. The group currently owns stakes in 25 operational renewable energy projects for a total capacity of 626 MW. The company is currently building 15 additional renewable energy projects.

EDF to build 10 GW of energy storage in 8 billion-euro plan

EDF is to build 10 GW of global energy storage capacity by 2035 through 8 billion euros of new investments, the French state-controlled company announced March 27.

In the next 12 months, EDF will launch "at least three" battery projects which will improve the performance of the power networks, the company said.

EDF will look to develop storage projects in all sectors and aims to become the leading supplier of residential storage in France and Europe, it said. In Africa, EDF aims to develop a portfolio of 1.2 million storage customers by 2035 through local partnerships.

In December, EDF announced it would develop 30 GW of solar power capacity in France by 2035, through its renewable energy subsidiary EDF Energies Nouvelles (EDF EN). This equates to over four times France's installed solar capacity, currently at around 7 GW. A former monopoly, EDF remains France's dominant power generator and supplier, providing most of its power through nuclear power plants and large-scale hydroelectric facilities.

EDF plans to invest 70 million euros in research and development (R&D) for power network storage in 2018-2020, the company said March 27. Over the same period, EDF will invest in 15 million euros in energy storage and grid flexibility start-ups.

"EDF’s Electricity Storage Plan is based on the expertise coming from all entities within our Group and 25 years of investment in R&D. The new limit the Group is setting is a 100% carbon-free power system by 2050," Jean-Bernard Levy, EDF’s CEO and Chairman, said.

By end of 2017, EDF EN had developed almost 12 GW of renewable energy projects globally with a further 1.9 GW under construction.

South Africa agrees $4.6 billion of solar, wind projects

The South African government has signed the much-delayed power purchase agreements (PPAs) for 27 renewable energy projects allocated under bidding windows 3.5 and 4 of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), the Department of Energy announced April 5. The agreement marks the first major investment deal under President Cyril Ramaphosa.

“The procurement of the 27 new projects is the biggest IPP [independent power producer] procurement by the Department of Energy to date, representing a total of 56 billion rand [$4.6 billion] of investment and about 2,300 MW of generation capacity to be added to the grid over the next five years,” Energy Minister Jeff Radebe said.

South Africa's Northern Cape region will receive the majority of investment by building 15 new wind, PV and CSP projects.

Faced with dwindling national grid capacity and limited state finances, state utility Eskom had delayed the signing of the PPAs since 2016.

Since its launch in 2011, South Africa’s REIPPPP has thus far procured 102 projects, representing investments of some 194.1 billion rand including 53.4 billion rand from foreign investors, according to data published by the South African Renewable Energy Council (SAREC) in 2017.

South Africa's latest National Development Plan set a target of 20 GW of renewable energy by 2030.

New Energy Update