US installs 5.9 GW wind in fourth quarter; Annual corporate wind deals hit 4.2 GW

Our pick of the latest wind power news you need to know.

Related Articles

US installs 5.9 GW wind in fourth quarter as development activity grows

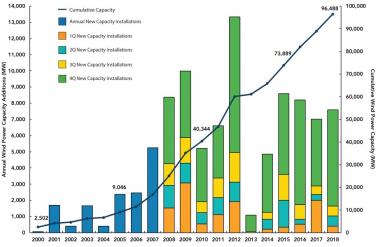

The U.S. wind sector installed 5.9 GW of new capacity in Q4 2018 to bring the total for the year to 7.6 GW, an 8% increase on 2017, the American Wind Energy Association (AWEA) said in a report published January 30.

Wind operators completed 909 MW of partial repowering projects in the fourth quarter for an annual repowering total of 1.3 GW, AWEA figures showed.

US annual wind installations

(Click image to enlarge)

Source: American Wind Energy Association (AWEA)

The U.S. is forecast to install 10.9 GW wind capacity in 2019-- the highest level since 2012-- as developers race to meet production tax credit (PTC) deadlines, the Energy Information Administration (EIA) said in its latest Short-Term Energy Outlook published in January. The wind installation forecast represents a 3 GW increase on the 2019 projection set out in EIA's 2018 Annual Energy Outlook.

More than half of the new wind capacity additions will be located in Texas, Iowa, or Illinois and most of the capacity will come online towards the end of the year, EIA said.

Some 16.5 GW of wind projects were under construction at the end of 2018, with a further 18.6 GW in advanced development, AWEA said in its report. The combined total of 35.1 GW was up 22% year-on-year. Some 20% of this activity was in Texas while other prominent states included Wyoming, Iowa, South Dakota and New Mexico, AWEA said.

GE Renewable Energy reclaimed the top spot for turbine manufacturers in 2018, installing 40% of U.S. wind turbines by capacity. Vestas installed 38% of capacity while Nordics USA held 11% of the market and Siemens Gamesa held 8%.

Most of the turbines installed were of capacity between 2 MW and 3 MW while 24% were over 3 MW, AWEA said.

In October, GE unveiled a new 5.3 MW turbine which incorporates 77-meter blades and hub heights of up to 160 m.

US corporate wind purchases soar as buyer pool deepens

U.S. wind developers signed 4.2 GW of corporate wind power purchase agreements (PPAs) in 2018, a 66% increase on the previous record set in 2015, the American Wind Energy Association (AWEA) said in a report published January 30.

U.S. corporate renewable PPAs tripled in 2018 to 8.5 GW to represent over 60% of global deals, BloombergNEF (BNEF) said in a separate report published January 28.

Global corporate renewable energy purchases rose 120% in 2018 (more than double) to 13.4 GW, BNEF said.

Global corporate renewable PPA volumes

Source: BloombergNEF (BNEF)

Facebook was the largest global buyer of renewable energy, purchasing 2.6 GW of capacity, mostly in the U.S.

A number of smaller corporate renewable energy buyers entered the U.S. market in 2018, BNEF said. Some 34 new companies signed their first clean energy PPAs, making up 31% of U.S. activity, it said.

These smaller companies are aggregating their electricity demand to buy into large-scale solar and wind projects, often alongside an "anchor" buyer with a stronger balance sheet to help lower risks.

In one example, Microsoft signed in 2018 a 315 MW solar PPA for SPower’s 500 MW Pleinmont project in the U.S. state of Virginia.

Microsoft's strong credit rating would support project financing and allow the developer to sell power to other counterparties at a “lower rate," Brian Janous, Microsoft's General Manager of Energy, told New Energy Update.

Europe-based companies signed 1.5 GW of new wind PPA deals, industry group WindEurope said in a separate report.

The Nordic PPA markets were the most active in Europe, boosted by large deals by Norsk Hydro and Alcoa in Sweden and Norway.

Germany, Spain and Poland also signed their first wind PPAs while Denmark and Finland signed their second deals.

US to allocate $28 million to floating wind design teams

The U.S. Department of Energy (DOE) is to allocate up to $28 million to new floating offshore wind design projects, the DOE announced February 1.

The 'ATLANTIS' floating wind research program aims to create "radically new" floating offshore turbines designs which maximize rotor area to total weight ratio and increase turbine generation efficiency, the DOE said.

The U.S. West Coast is seen as a key early market for floating wind projects. In October, California unveiled its first offshore wind lease zones, calling for developers to submit information on nominations for commercial offshore wind leases in three designated deepwater areas.

Floating wind developers are cutting design weight and maximizing onshore build capability in order to minimize costs. In the short term, developers will require regulatory and infrastructure support to bridge the gap from small-scale projects to competitive large-scale arrays.

The ATLANTIS program will encourage the use of control co-design (CCD) methodologies that integrate all relevant engineering disciplines at the start of the design process, the DOE said.

The program "encourages collaboration, calling on scientists, engineers, and practitioners from different disciplines, technology sectors, and organizations to form diverse and experienced project teams," it said.

“The ATLANTIS projects will help advance American offshore wind production and the accompanying job, manufacturing, and investment growth for the nation," Rick Perry, U.S. Secretary of Energy, said in a statement.

New Energy Update