Orsted raises offshore wind target in $30bn spending plan; Vestas wins first contract to replace Senvion turbines

Our pick of the latest wind power news you need to know.

Related Articles

Orsted raises 2025 offshore wind target to 15 GW

Denmark's Orsted has raised its 2025 offshore wind capacity target by 3 GW to 15 GW, the company announced November 28.

By 2030, Orsted aims to install more than 30 GW of capacity, including onshore wind, solar and energy storage projects.

"We expect the global market for renewable energy to more than triple towards 2030," Henrik Poulsen, Orsted CEO and President said in a statement.

"We want to maintain our position as global market leader in offshore wind and continue our build-out in Europe, North America and Asia," he said.

Orsted's portfolio currently consists of 11.9 GW of capacity, mainly offshore wind farms, which are either in operation, under construction or have completed a final investment decision (FID).

Orsted plans gross investments of 200 billion Danish krone ($30.4 billion) in 2019-2025, of which 75%-85% will be on offshore projects, the company said. Return on capital invested is predicted at 10% over the period, it said.

Orsted predicts an internal rate of return (IRR) of 7.5%-8% for offshore wind projects won in competitive tenders since 2015, namely the Borssele 1&2, Hornsea 2, Gode Wind 3&4 and German Cluster 1 projects in Europe, Greater Changhua 1&2a and 2b&4 projects in Taiwan and Revolution Wind in the U.S.

In October, Orsted acquired 100% of U.S. offshore wind developer Deepwater Wind at a price of $510 million. Orsted will merge Deepwater's 3.3 GW U.S. offshore wind portfolio with its own 5.5 GW of potential projects, creating the largest U.S. offshore wind pipeline of any developer.

Orsted will also look to grow its onshore wind, solar and storage businesses, Poulsen said.

In August, Orsted agreed to buy 100% of U.S. onshore wind farm developer Lincoln Clean Energy (LCE) to gain a foothold in the onshore wind market. LCE’s portfolio comprises of 513 MW of recently commissioned wind capacity, 300 MW under construction, and a 1.5 GW development pipeline.

Orsted has also established an office in Austin, Texas to develop battery storage and solar projects.

"It’s our ambition to create a leading North American company within renewable energy," Paulsen said.

"In addition, we’ll continue to explore the growth and value creation potential in our Bioenergy business and strengthen the route to market for our product portfolio in Customer Solutions," he said.

Vestas wins US contract to replace Senvion turbines

Danish turbine supplier Vestas is to replace 47 Senvion turbines at PacifiCorp's Goodnoe Hills wind farm with Vestas models in its first brand replacement repowering contract, the company announced November 28.

Vestas will swap out 2 MW Senvion turbines commissioned in 2008 with optimised 2.2 MW Vestas models, increasing the capacity of the Goodnoe Hills wind farm from 94 MW to 103 MW. Goodnoe Hills is situated in Washington state.

Turbine delivery will begin in the first quarter of 2019 and the contract includes a long-term service agreement, Vestas said.

In June, PacifiCorp ordered 260 MW of Vestas turbines to repower its Marengo I and II projects, also in Washington.

U.S. production tax credits (PTCs) have accelerated wind repowering activity as operators look to use technology advancements to optimize ageing fleets. Falling costs and growing wholesale market exposure have pressured margins for suppliers and operators.

Some 2.1 GW of U.S. online wind capacity was repowered in 2017 and over 15 GW of capacity is "ripe" for repowering in 2018, ICF consultancy said in a report published in May. Repowering could add 300 MW of additional U.S. wind capacity in 2017-2022, according to Bloomberg New Energy Finance (BNEF).

GE Renewable Energy held a 63% share of the U.S. wind turbine market in the first three quarters of 2018, while Denmark's Vestas claimed 26% and China's Goldwind held 10%, according to the American Wind Energy Association.

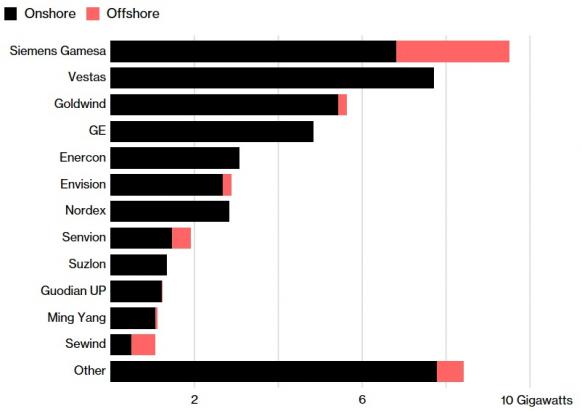

Globally, Vestas was the leading global onshore wind turbine supplier in 2017, according to the latest annual turbine market report from Bloomberg New Energy Finance (BNEF).

Top global turbine manufacturers in 2017

(Click image to enlarge)

Source: Bloomberg New Energy Finance (BNEF)

Siemens Gamesa to extend lifespan of 238 MW wind capacity in Spain

Siemens Gamesa is to extend the lifespan of 238 MW of wind capacity in Spain, from 20 years to 30 years, the turbine supplier announced November 29.

The life extension program will consist of monitoring and structural upgrades at 264 wind turbines, all owned by an unnamed Spanish company, Siemens Gamesa said.

The turbines are situated at six wind farms in the provinces of Zaragoza and Teruel and have an average age of 15 years.

Siemens Gamesa has operated the units since they were installed and will continue to operate them and provide full scope maintenance services, it said.

Siemens Gamesa currently maintains 62 wind farms in Spain for a total capacity of 5.9 GW.

Last month, Spain's minority Socialist government set out a plan to build 3 GW of wind and solar capacity per year over the next decade and produce 35% of energy from renewable sources by 2030.

The Socialist government's proposals must be agreed by other parties as Socialists hold only a quarter of seats in Parliament.

Almost half of coal plants unprofitable as renewables growth bites

Some 42% of global installed coal-fired capacity is unprofitable due to high fuel costs and low wholesale power prices, Carbon Tracker said in a report published November 30. Carbon Tracker is a UK-based think tank that advocates protection against climate change.

By 2040, 72% of global coal-fired capacity could be operating at a loss as wind and solar costs continue to fall and existing carbon pricing and pollution regulations drive up coal plant costs, Carbon Tracker said.

By 2030, the cost of wind and solar plants will be lower than 96% of the world's coal-fired capacity, it said.

Share of coal-fired generation at higher cost than renewables

Source: Carbon Tracker, November 2018.

Carbon Tracker assessed the operating costs of coal plants based on fuel and maintenance costs, investments required to meet existing environmental standards and carbon pricing where relevant.

In China, the research group used satellite images and advanced machining learning to estimate the activity of each plant.

This technique was "found to be more than 90% accurate when trialled against known data in the U.S. and EU," it said.

New Energy Update