UK solar developers deploy storage to capture peak returns

Falling technology costs and rising renewable energy capacity are improving the business case for solar plus storage in the UK and revenue streams should multiply in the coming years, industry experts told Reuters Events.

Related Articles

Two recent partnerships highlight the growing demand for UK solar plus storage projects.

Macquarie’s Green Investment Group (GIG) has formed a joint venture with renewable energy developer Enso Energy to develop 1 GW of unsubsidized solar plus storage capacity in the UK.

French electricity giant EDF also announced a partnership with UK renewable energy developer Octo Energy to build 200 MW of solar plus storage capacity in England and Wales.

France's largest power supplier, EDF is one of the "Big Six" energy suppliers in the UK. EDF's partnership with Octo is part of the group’s plan to build 10 GW of storage capacity in Europe by 2035 and double its renewable energy capacity to 50 GW by 2030.

Falling technology costs are increasing the competitiveness of solar plus storage projects and many are now being developed without subsidies.

Rising renewable energy capacity and changing consumption patterns are creating opportunities for price arbitrage, by shifting dispatch to times of higher prices, experts told Reuters Events.

Power prices fell as COVID-19 lockdowns sliced demand, but wholesale prices were already under pressure.

“Managing these revenue risks increases the appeal of storage,” Nathan Welch, Managing Director at Octo Energy, said.

UK day-ahead power prices, by week (GBP/MWh)

(Click image to enlarge)

Source: Nordpool power exchange

Negative prices will become increasingly common as higher volumes of zero marginal cost renewables are connected to the grid, Lauren Moody, Senior Energy Analysis Manager at National Grid ESO, said.

“Energy storage like solar plus [storage] can exploit these price patterns," Moody said.

Solar future

Despite only moderate solar resources in the UK, ongoing technology improvements have made solar plants competitive.

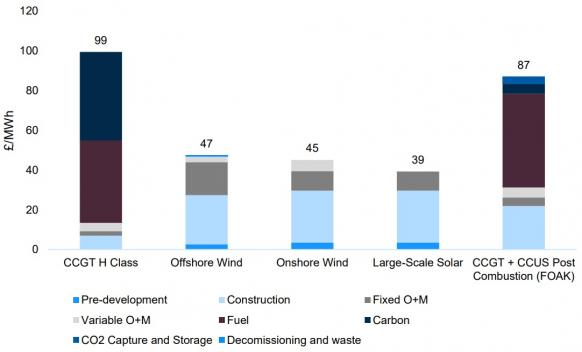

By 2025, large-scale solar will be the lowest-cost energy source, new analysis by the UK government showed this month. Large-scale solar plants are forecast to cost 44 pounds/MWh ($59.0/MWh) on a levelised basis, compared with 46 pounds/MWh for onshore wind, 57 pounds/MWh for offshore wind and 85 pounds/MWh for gas-fired plants, the Department for Business, Energy & Industrial Strategy (BEIS) said.

By 2030, the cost of solar is forecast to drop to 39 pounds/MWh, some 6 pounds/MWh lower than onshore wind and 8 pounds/MWh lower than offshore wind, BEIS said.

Forecast UK power generation costs in 2030

(Click image to enlarge)

Source: UK government, August 2020

In March, the government reopened subsidies for solar and onshore wind projects after a four-year moratorium which has favoured less mature technologies like offshore wind. From next year, PV and onshore wind projects will once again be able to bid for UK contracts for difference (CfDs) as the government looks to accelerate decarbonisation plans.

Wider corporate demand for renewables is also growing. GIG and Enso plan to sign corporate power purchase agreements (PPAs) for their projects, they said.

Double gains

UK developers are also taking advantage of advancements in bifacial solar panel technology.

Demand for bifacial modules is soaring as developers seek greater plant efficiency. By 2028, bifacial cells could represent 40% of the global solar market, according to the International Technology Roadmap for Photovoltaic (ITRPV).

GIG and Enso Energy will deploy bifacial panels at their projects. Bifacial panels can increase output by several percentage points compared with monofacial panels, at marginal extra cost.

Bifacial panels suit regions with lower solar irradiance and limited land availability, such as the UK, Ed Northam, Head of GIG, UK and Europe, told Reuters Events.

The UK’s high population density means that land availability and permitting is a challenge. Procurement of large flat areas next to grid connection points is difficult and many landowners initially expect high lease rates, a legacy of earlier solar subsidies.

EDF and Octo will seek out opportunities on dual-use sites, such as farmland, the partners said in June.

The market for combined agri-PV concepts is growing as competition over land intensifies.

“Our strategy is to identify lower grade agricultural land, which tends to suit livestock farming. Sheep farming, for example, is ideal given the land can continue to be farmed in the same manner,” Welch said.

Many UK farmers are yet to install solar projects, offering strong growth potential.

"When we survey our members we find over 30% are using solar," Jonathan Scurlock, Chief Adviser, Renewable Energy and Climate Change, the UK’s National Farmers' Union (NFU), told Reuters Events last month.

Grid payments

Greater access to the power balancing market and grid services are also improving the economics of solar plus storage, Moody said.

National Grid ESO recently widened access to the balancing mechanism to bring in more distributed solar and wind. The network operator is also working with partners to create a reactive power market for distributed energy that will increase capacity in south-east England by 4 GW. In November 2019, Lightsource BP became the first UK solar operator to provide reactive power services at night. The trial, performed at Lightsource's 4 MW St Francis solar plant in East Sussex, was "an exciting first step," Biljana Stojkovska, project lead at National Grid ESO, said in a statement.

The UK market for ancillary services is still developing and long-term returns are difficult to predict, Northam noted.

Contracts currently typically last between one and four years, he said. Future improvements to the market framework should lead to greater visibility of long-term revenues.

Battery boosters

A rapid expansion of UK offshore wind capacity in the coming years will increase the demand for storage.

UK offshore wind capacity is currently around 10 GW and the government plans to hit 40 GW by 2030, taking advantage of vast sea areas to hit carbon emissions targets. ScottishPower, the first utility to produce 100% of power from renewable sources, plans several battery storage projects to complement its growing offshore wind portfolio.

There is currently over 13 GW of battery storage projects in the pipeline, figures from the UK Solar Trade Association (STA) show, and the government plans to relax planning regulations for large-scale projects.

Demand-side factors will also impact the need for storage and solar plus storage plants in the coming years.

Increasing use of demand management and smart grids will affect load trends, as will the planned rollout of electric cars. The government aims for at least 50% of new cars to be ultra-low emissions by 2030 and plans to ban the sale of new petrol and diesel cars from 2035. These targets could change, however.

"The key in analysing how this will play out is essentially to understand the timing of this fundamental transition,” Welch said.

Last November, EDF bought Pivot Power, a UK-based developer of storage and infrastructure for electric vehicle charging. Pivot plans to install 2 GW of battery capacity directly to the high-voltage transmission system and the first projects are expected online in south-east England this year.

Reporting by Neil Ford

Editing by Robin Sayles