Portugal sets record-low global solar price; California probes power mix after heatwave woes

Our pick of the latest solar news you need to know.

Related Articles

Portugal solar auction sets record price, secures storage

Spanish company Enerland bid a new record low price of 11.1 euros/MWh ($13.2/MWh) in Portugal's latest solar auction, for a 10 MW project, according to media reports.

Enerland's bid pips the record $13.5/MWh tariff set by the giant 2 GW Al Dhafra project in Abu Dhabi in April and was 24% lower than the lowest price recorded in Portugal's previous auction in June 2019.

Solar technology costs are continuing to fall and the sites allocated in Portugal's tender are located in the south where solar irradiance is high.

South Korean solar manufacturer Hanwha Q Cells won the most capacity in the auction, securing 315 MW of the 700 MW on offer. The other auction winners were Spanish utility Iberdrola, Enel's Spanish subsidiary Endesa, developer Audax and Germany's TAG Energy.

Hanwha, Endesa and Iberdrola included storage in their bids, media reported, and will be paid a fixed premium for dispatch flexibility.

The intense price competition comes alongside soaring activity in Spain, Portugal's closest neighbour. Spain is forecast to install around 4 GW of new solar capacity per year for the next five years as developers race to meet auction deadlines and falling costs spur unsubsidised projects.

California to review generation stack after heatwave cuts supply

California's power agencies will review power procurement plans and demand forecasting processes after a mid-August heatwave led to rotating power interruptions across the state.

California grid operator CAISO urged consumers to conserve electricity during afternoon and evening periods. Issues included unplanned stoppages of gas-fired plants, swinging wind resources and a lack of imports from neighbouring states suffering similar temperatures.

California's vast solar fleet is unable to meet power demand after sundown, requiring significant gas-fired generation. California has around 28 GW of installed solar capacity, including 13.4 GW utility-scale, 7.0 GW of wind capacity and 4.2 GW of energy storage capacity, mainly pumped hydro. Peak power load surpassed 46 GW during the heatwave.

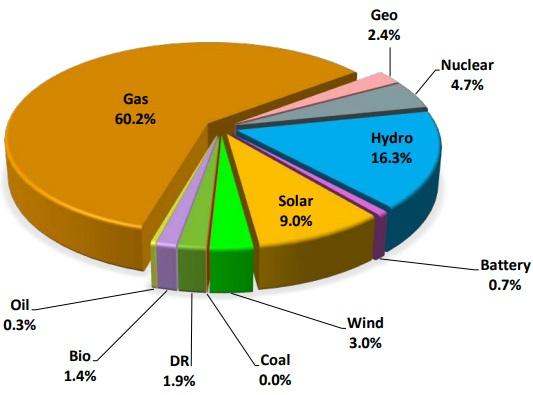

California summer 2020 max on-peak power generation by type

Source: CAISO's Summer Loads and Resources Assessment, May 2020

"Our organizations want to be clear about one factor that did not cause the rotating outage: California's commitment to clean energy," the California Public Utilities Commission (CPUC), CAISO and California Energy Commission (CEC), said in a joint letter to Governor Gavin Newsom on August 19.

"Clean energy and reliable energy are not contradictory goals," they said.

High system demand, unanticipated loss of supply, and low net import availability due to hot temperatures throughout the Western US created "untenable system conditions," the agencies said.

Going forward, state forecasting and planning reserves must better account for the fact that climate change will mean more heat storms and more volatile imports, the groups said.

"Our changing electricity system may need larger reserves," they said.

Last year, the CPUC ordered 3.3 GW of new capacity to come online by 2023 after identifying peak demand is occurring later in the day.

Capital Dynamics, Tenaska to develop 2 GW of storage in California

Capital Dynamics and Tenaska have agreed to jointly develop nine battery storage facilities in California to provide 2 GW of power to the Bay Area, Los Angeles and San Diego.

The projects aim to alleviate power shortages caused by growing renewable energy capacity, heatwaves and other local supply limitations, the companies announced August 19.

Tenaska has developed 10.5 GW of gas and renewable power projects, including two solar projects in Southern California in which Capital Dynamics is an investor.

In July, Capital Dynamics and Tenaska agreed to co-develop 4.8 GW of solar projects in the Midcontinent Independent System Operator (MISO) and Southeast Reliability Council (SERC) markets.

The deal includes 24 solar projects and follows a partnership between the groups in November 2018 for 2 GW of capacity in the MISO market, situated in the states of Michigan, Missouri, Illinois, Wisconsin, Indiana and Minnesota.

The July deal "represents a large share of solar projects currently in the MISO and SERC interconnection pipelines and further diversifies Capital Dynamics’ growing utility-scale solar power portfolio across seven new states," the company said.

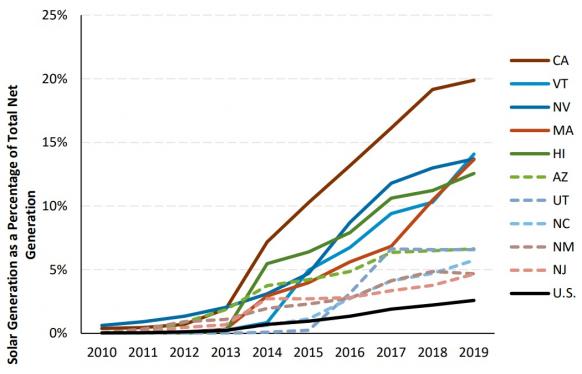

US solar penetration by state

(Click image to enlarge)

Source: US National Renewable Energy Laboratory (NREL), Energy Information Administration (EIA)

Capital dynamics already owns several US battery storage projects. In August 2019, Capital Dynamics acquired the 180 MW solar/90 MW storage Townsite project in Nevada from Skylar Resources. The Townsite project is the first US solar plus storage project to secure fixed volume power purchase agreements (PPAs). Tenaska Power Services will provide energy management services, including sale and purchase of surplus or deficit merchant power and battery scheduling.

In October 2019, Spanish group Acciona acquired 3 GW of US PV projects and 1 GW of energy storage capacity being developed by Tenaska.

Acciona will work with Tenaska to complete the projects and plans to bring online eight of the plants, representing 1.5 GW of peak power capacity, by 2023, the company said.

Reuters Events