Chinese solar panels pass U.S. customs; EU plans to mandate long-term power contracts

The solar news you need to know.

Related Articles

U.S. panel imports rise as customs gridlock eases

U.S. imports of solar panels are picking up after months of gridlock triggered by a new law that bans goods made with forced labor, two Chinese solar companies told Reuters on March 6.

The Biden administration's Uyghur Forced Labor Protection Act (UFLPA) prevents the import of goods produced using forced labor in China’s Xinjiang Province, including much of the polysilicon used in solar panels.

The UFLPA was enforced in June 2022 and checks have blocked panel imports at the U.S. border, delaying projects and driving up project costs. U.S. Customs and Border Protection (CBP) had detained 1,000 panel shipments by early November and last month pricing platform LevelTen Energy estimated this figure had risen to 1,400.

A White House official said clearer federal guidance was unlocking shipments, Reuters reported on March 6. Importers must prove the entire value chain is free from production in Xinjiang and a lack of precise guidance from U.S. Customs and Border Protection (CBP) had meant panels were taking months to clear customs, industry experts said.

Chinese supplier Trina Solar said more than 900 MW of its solar panels have cleared U.S. customs in the last four months, Reuters reported on March 6. Less than 1% of its products had been detained for examination, Trina said, saying its tracing systems had significantly reduced delays.

Rival company Jinko Solar Holding Co Ltd (JKS.N) has also had shipments released from detention, a source close to the company said.

Most of the 1,000 shipments seized the CBP by November were made by Trina, Jinko and Longi Green Energy, according to industry sources. Those companies typically account for up to a third of U.S. panel supplies. Longi did not respond to Reuters' requests for comment.

The vast majority of U.S. panel imports come from the four Southeast Asian countries of Cambodia, Malaysia, Thailand and Vietnam, but most contain materials and components produced in China. The Xinjiang region produced almost half of all global polysilicon output in 2021, according to U.S. Department of Labor estimates.

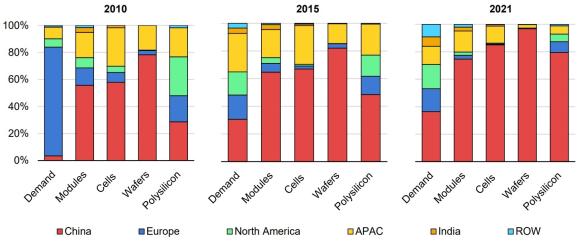

Solar manufacturing capacity by country, region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

U.S. solar developers have also faced import tariff uncertainty and soaring global demand that has hiked prices and delayed projects.

Utility-scale solar installations fell by 23% last year as delays pushed projects into 2023 while average solar PPA prices in Q4 rose 33% on a year ago.

The delivery challenges come as activity is set to soar on the back of tax credits set out in President Biden's 2022 Inflation Reduction Act. Solar installations must triple to 60 GW/year by the middle of the decade to meet the President's goals, the Department of Energy (DOE) said in a report in 2021.

EU plans wider use of state-backed renewable energy contracts

The European Union wants to expand the use of state-guaranteed contracts for difference (CFDs) for renewable energy projects in a draft set of proposals that aim to shield consumers from volatile wholesale prices.

The European Commission pledged to reform electricity market rules after record high gas prices following Russia's invasion of Ukraine sent power prices skyward. EU leaders have already implemented a temporary limit on revenues from renewable energy generation and an EU-wide cap on gas prices, to limit the impact.

A draft of the EU executive's market proposals, seen by Reuters on March 7 and due to be published on March 16, steered clear of fundamental market redesign and suggested limited changes that increase the use of fixed-price contracts.

CFDs are long-term fixed price contracts where the generator pays the state if wholesale markets rise above the agreed price. UK offshore wind growth has been underpinned by CFD contracts and France and Spain rolled out similar schemes in recent years.

EU members should use CFDs or similar contracts for renewable energy projects and also make it easier for all businesses to sign long-term power purchase agreements (PPAs) with generators, the draft said.

The commission also suggested allowing national governments to intervene and temporarily fix energy prices if European prices spike to the extreme levels seen last year.

In September, EU energy ministers agreed to limit revenues from solar, wind and nuclear power generation to 180 euros/MWh ($191.4/MWh) from December until the end of June and several national governments are imposing lower price caps.

In December, EU energy ministers agreed an EU-wide cap on gas prices.

Effective since February 15, the gas price cap will be implemented if prices exceed 180 euros/MWh for three days on the front-month contract at the benchmark Dutch Title Transfer Facility (TTF) gas hub. The TTF price must also be 35 euros/MWh higher than a reference price based on existing liquefied natural gas (LNG) price assessments for three days.

EU carbon prices surpass 100 euros for first time

The price of carbon permits in the European Union's Emissions Trading Scheme (ETS) hit 100 euros per tonne ($106.57/mt) for the first time on February 21, sending more positive price signals for renewable energy deployment.

The European Union Allowances (EUAs) are used by manufacturers, power companies and airlines to pay for each tonne of carbon dioxide they emit.

EUA prices were lingering around 25 euros until they started climbing in 2021. Reforms to the EU carbon market last year created bullish sentiment that has been heightened in recent weeks as companies approach the annual April deadline to cover last year's emissions. In addition, power sector demand for EUAs increased in 2022 as some generators fired up coal-fired plants to make up for dwindling gas supplies from Russia following its invasion of Ukraine.

Reuters Events