Hydrogen production guidelines prompt fierce debate

The guidelines stipulating what counts as clean hydrogen are the focus of fierce debate in the United States in a high stakes battle for billions of dollars of tax credits.

Related Articles

Vast amounts of new electricity will be needed to build a U.S. hydrogen industry and while some are calling for a strict adherence to the “Three Pillars” standard – additionality, deliverability, and hourly matching – others say that such restrictions would mean the U.S. clean hydrogen industry would be ‘dead on arrival.”

The debate has focused largely on additionality, which stipulates that a subsidy, such as that offered by the Inflation Reduction Act (IRA), can only be granted to a hydrogen producer using electricity from a new generating source.

A new source generator means the producer’s electrolyzer will not be drawing from an already stretched grid, the argument says.

Some of those already working on raising the capacity of available electrolyzers and building a new, green hydrogen economy, say this would be a disaster for the nascent industry as green hydrogen production would have to take a back seat to renewable power development.

Hydrogen production from long-term projects, such as nuclear and hydro power, would be almost non-existent, while states with low renewable resources would be locked out of the hydrogen renaissance, detractors say.

Stifled market

In May, the Fuel Cell & Hydrogen Energy Association (FCHEA) penned a letter to the Treasury cosigned by dozens of companies calling for lifecycle analysis calculations to include market-based mechanisms such as renewable energy credits (REC), power purchase agreements (PPA), or energy attribute certificates (EACs) without any additionality restrictions.

“The concept of additionality suggests that hydrogen producers can recognize clean electricity and feedstocks used in their processes only if it is derived from new projects,” the letter said.

“To do so would significantly stifle the clean hydrogen market by adding unreasonable costs and delays for clean hydrogen producers, running counter to the IRA and undermining its economic, jobs, and environmental benefits.”

The timelines for clean hydrogen scale up and siting are different than the timelines for new solar, wind, or biogas installations, and vastly different from nuclear and hydropower facilities, and to link the two negates the independent path clean hydrogen needs to complement these resources, the letter says.

“Additionality means there'll be less opportunities to build green hydrogen plants and it won't allow us to expand this ecosystem, which is really part of the IRA,” says President and CEO of Plug Power Andy Marsh.

Plug Power builds end-to-end green hydrogen ecosystems that address every step of operations and Marsh says the company could turn its focus on Europe, where additionality restrictions have been modified, to give producers more flexibility.

“If the goal was to get to a carbon free grid by 2050, you need to have the infrastructure in place to generate the hydrogen. So, it's really important to jobs, it's really important to how fast you build. And quite honestly, it's really critical to whether Plug will be building more plants in Europe,” says Marsh.

“The economics start looking very questionable in many places in the United States and we won't get the green hydrogen infrastructure, which will make it much more difficult to meet the government cost targets.”

Each new electrolyzer would need an equivalent new green generator of electricity, which would delay new electrolyzer roll out by a couple of years at least, and potentially delay nuclear- or hydro-powered hydrogen plants for decades, say critics of the additionality requirement.

Smart Design

Defenders of the additionality plan, meanwhile, warn that lax guidance on the source of the industry’s power would vastly increase emissions while leaving the industry vulnerable to failure once the tax credits expire after ten years.

In February, a broad coalition of academics, environmental organizations, and companies drafted a letter to the Treasury and Department of Energy (DOE) calling for the implementation of the 'Three Pillars', arguing that “weak guidelines for grid-connected systems risk driving up emissions, in direct conflict with the IRA’s requirements.”

Such as failure could force the Treasury to spend more than $100 billion in subsidies for hydrogen projects that result in increased net emissions, the letter said.

“Even if the electrolyzer is claiming the use of clean energy, it's in reality causing fossil fuel power plants to ramp up if this clean energy isn’t new. And so, when you take those emissions into account, then the hydrogen production ends up being as much as two to five times as emissions intensive as how we make hydrogen today through steam methane reformation,” says Dan Esposito, a Senior Policy Analyst at energy and climate policy think tank Energy Innovation.

Additionality can be broken down into three categories; building a new clean energy project; increasing an existing clean energy project’s capacity via un uprate; and using clean electricity that would otherwise be curtailed, Esposito said in his study, ‘Smart Design of 45V Hydrogen Production Tax Credit will Reduce Emissions and Grow the Industry.’

While there are differences in how the United States and the European Union power markets function, the manner in which the Europeans are approaching additionality serve as a useful starting point for designing the U.S.’s IRA’s 45V Hydrogen Production Tax Credit guidance, Esposito says.

The EU rules claim clean energy projects to be new if they came into operation less than 36 months before an electrolyzer begins its clean hydrogen production and, if it is grid connected, it must also have a power purchase agreement with the electrolyzer.

Such a window would give developers flexibility to build multiple projects, while the PPA provides evidence that the electrolyzer was necessary for clean energy project financing, the study says.

Counting the cost

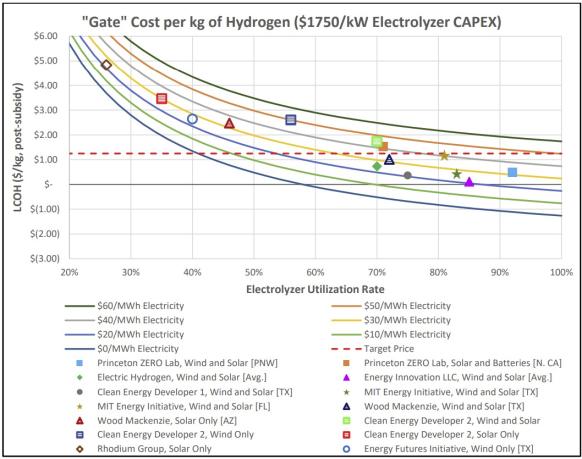

Studies showing that high compliance costs for robust standards, as argued by those rejecting the need for additionality, rely on unrealistically pessimistic assumptions for either electrolyzer costs or clean electricity availability, according to a Princeton University policy memo; ‘The Cost of Clean Hydrogen with Robust Emissions Standards: A Comparison Across Studies.'

"Gate" Cost per kg of Hydrogen ($1,750/kW Electrolyzer CAPEX)

(Click to enlarge)

Source: Princeton University policy memo; ‘The Cost of Clean Hydrogen with Robust Emissions Standards: A Comparison Across Studies.'

“Correcting for these specific unrealistic assumptions, all available evidence demonstrates that clean hydrogen production meeting robust emissions standards will be cost-competitive in the United States from day one, enabling the nascent industry to scale up and contribute to long-term emissions reductions,” the study says.

Using an interactive levelized cost of hydrogen (LCOH) calculator tool, the study compared the findings of ten recent studies assessing the cost of clean hydrogen production compliant with the 'Three Pillars' standard.

“Oversizing wind and solar power relative to the electrolyzer consistently leads to a competitive LCOH for the full realistic range of electrolyzer capital costs,” the study found.

By Paul Day