Solar owners see repowering value in maturing US, Europe markets

Ageing assets, technology innovations and financial incentives are building the case for PV repowering as owners seek a competitive market edge, solar investors said.

Related Articles

As PV operators continue to drive towards lower operations and maintenance (O&M) costs, owners of older assets are approaching important decisions on repowering or retrofitting of assets.

In mature solar markets in Europe and the U.S., many projects are approaching the middle of their projected lifespans, when initial investment costs have typically been recovered. U.S. repowering projects also benefit from bonus depreciation, under which the plant owner can receive a 50% tax deduction on new component investment.

Benefits of repowering include higher plant efficiency, improved asset reliability, standardization of components in an operator’s portfolio and extension of warranty periods.

Full repowering involves a comprehensive upgrade of plant infrastructure, such as modules and inverters, or alternatively "retrofitting", which involves the replacement of certain components with newer models.

Retrofitting of components might take place between year five and year 12 of operations, while repowering might take place after around 25 years assuming a 50-year projected lifespan, Ernesto Chieffo, Technical Director at Octopus Investments, told New Energy Update.

“You can assume that the majority of the plants built in Spain, Germany and Italy are already matured for retrofitting/repowering,” Chieffo said.

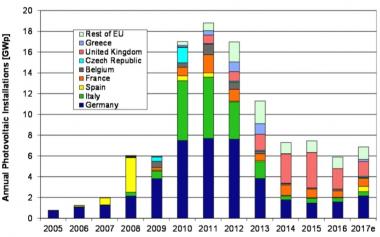

Europe annual PV installations by country

(Click image to enlarge)

Source: European Commission's PV Status Report 2017.

Multiple drivers

Octopus manages 2 billion pounds ($2.8 billion) of renewable energy assets and is the U.K.'s largest solar investor. The company is active in the repowering space and has completed retrofitting projects with other projects ongoing.

According to Chieffo, typical repowering scenarios include:

1) The current modules have a problem and need to be replaced. Repeated outages increase O&M costs.

2) New technology offers higher revenues– often through greater efficiency or reliability – that were not available when the project was originally developed. These benefits can outweigh the costs of repowering.

3) The owner wants to extend the lifetime of the lifetime of an asset and so increase the return on investment (ROI).

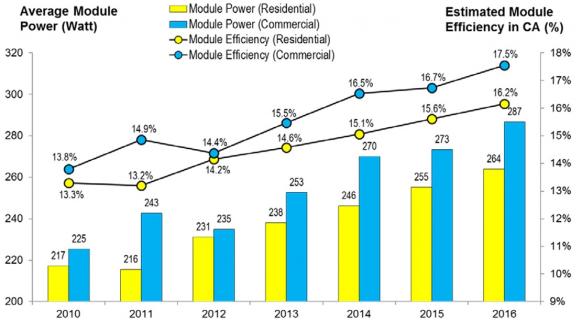

Trend in module efficiency in California

(Click image to enlarge)

Source: National Renewable Energy Laboratory's 'U.S. Solar Photovoltaic System Cost Benchmark Q1 2017' report (September 2017).

Clearly, the degradation rate of components will influence the timing of repowering and changes to taxation regimes can also have an impact.

Other factors influencing repowering decisions include the owner’s exit strategy, the size of the portfolio, the failure rate of the components and the availability of spares, Chieffo said.

Component degradation and higher efficiency requirements are key drivers of repowering projects, but O&M costs can also play a major role, Arnoud Klaren, Technical Director at Foresight Group investment fund, told New Energy Update.

For example, an operator may choose to switch between inverter types in order to reduce maintenance costs, Klaren said.

“There are already interesting products on the market that can help with repowering like string optimizers; you might start to see that centralized inverters are going to be exchanged for string inverters to reduce maintenance cost, etc,” he said.

Regulatory support

Pending power market reforms could also affect repowering strategies going forward, Chieffo noted.

For example, it could be economical to retrofit inverters to respond to new voltage and frequency regulation requirements, provided grid operators offer a sufficient tariff, he said.

Reforms to European power markets currently underway are set to provide a wider role for renewables. In the U.S., a number of regional grid operators are testing new market designs which allow solar operators to participate in balancing, voltage and frequency response markets.

The power electronics interfaces of PV plants make them well-equipped to provide fast communications services to aid grid balancing and advances in PV plant control are expected to open up new revenue streams.

Case specific

As global competition continues to pressure supplier margins and drive forward new products, repowering decisions must take into account the financial health of suppliers and longevity of component design. Price pressures have driven some manufacturers out of the market and components can become obsolete, even on projects just a few years old years old.

In one hypothetical example, a company operates 40 modules of capacity 1 MW, but the manufacturer has announced it will soon stop production of the modules.

According to Chieffo, one possible solution is replacing the modules while they are still in production, while using the replaced components as spares. This has the added benefit of extending the warranty period for the new modules, he noted.

Energy market competition is set to intensify in the coming years and Klaren said that the level and timing of repowering must be considered on a case-by-case basis.

“Repowering is an expensive business so you better do it right. You have to put down a significant payment up front and reap the benefits over time. If those benefits are less than expected you might have a problem”, he said.

By Neil Ford