Westinghouse's SMR aims to take advantage of lessons learned from AP1000

Westinghouse’s AP300 small modular reactor (SMR) will be a more versatile reactor than its larger cousin the AP1000 while taking advantage of the regulatory and technological lessons learned from decades of development and operations.

Related Articles

The pressurized water reactor (PWR) joins the list of more than 70 SMR designs currently being developed around the world.

The focus on the small new reactors over the large, Gen III models in Europe and the United States is in parts financial, societal, and technological.

SMRs may fill a space that the larger reactors cannot and are a response to a rapidly changing electricity ecosystem that is increasingly reliant on variable renewable energy, according to the study ‘Laying the Foundation for New and Advanced Nuclear Reactors in the United States,’ by National Academies of Sciences, Engineering, and Medicine.

The new technologies offer a variety of sizes and scales for various electricity output requirements, non-electrical applications, such as process heat, transportable reactors, and factory manufacture of reactor modules, or complete factory manufacture of entire reactors, it says.

Advanced nuclear technology, such as that being used by many SMR designs, still face significant challenges, the report notes. They are still, mostly, to be demonstrated, they must verify their utility in new business cases, and they must prove that they can produce better cost metrics than their predecessors.

Many must also pass through the long and expensive regulatory approval process, something Westinghouse hopes to largely avoid with the AP300 which enjoys the benefits of both SMRs and Gen III reactors.

Tried-and-tested design

The AP300 is unique amongst many of the SMR designs in development as, rather than wholly new technology, it’s a smaller version of the company’s tried-and-tested AP1000 reactor, a gigawatt-capacity pressurized water reactor (PWR) that is already up and running in China and the United States, and has examples in construction or planned in Turkey, Ukraine, and Poland.

The plant is a single-loop version of the AP1000, will generate 300 MW electricity, or 900 MW thermal, and will use advanced instrumentation and controls as well as the larger plant’s passive safety system.

The AP1000 plant’s Generation III+ technology grants the AP300 regulatory approval in the United States, Britain, and China while also complying with European Utility Requirement standards for nuclear power plants.

Westinghouse is targeting design certification for the AP300 by 2027 and site-specific licensing and construction on the first unit toward the end of the 2020s.

“The nth-of-a-kind is going to look like the first-of-a-kind. On the manufacturing side, we get repeatability, dependability, reproducibility. Also, maintenance outages and refueling outages, all of that is similar plant to plant,” says Rita Baranwal, Senior Vice President for Energy Systems at Westinghouse and picked to lead the AP300 SMR development team.

The plant’s smaller nuclear island and radiological footprint – one plant will take up around a quarter the area of a soccer field – keeps the costs down, and lower costs make the reactor a more palatable option for communities that have no experience of nuclear power or countries that have grids that can’t handle the 1,200 MW churned out by the larger reactor.

Once the plants enter mass manufacturing, each AP300 is expected have an overnight capital cost of less than $1 billion with an overnight cost of $3,400/kw, Baranwal says.

“Because of our experience with AP1000, we have a clear understanding of the cost drivers for SMR technologies, and we've mitigated them in our design. The AP300 avoids creating a large plant footprint, and it avoids a focus on unproven designs and licensing uncertainty,” she says.

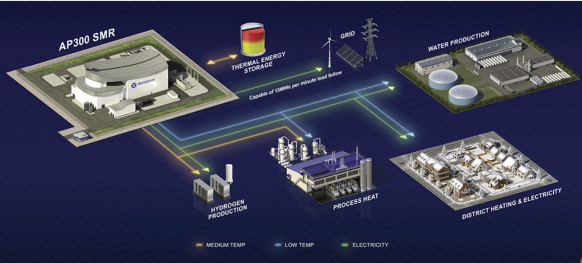

AP300 Application Versatility

(Click to enlarge)

Source: Westinghouse

All reactors great and small

Many experts argue that, while SMRs bring flexibility, more accessible financing, and potentially, fast deployment in the medium term, plans also need to be drawn up for more large reactors as soon as possible.

There are about 60 large (over 400 MW) power reactors currently being constructed in 15 countries, mostly in China, India, and Russia. Of those, only two have been built in the United States in recent decades – Vogtle 3 and 4 – two in Britain – Hinkley Point C1 and C2 – and one in France – Flamanville 3, according to the World Nuclear Association.

In Canada, meanwhile, as it prepares a roadmap for SMRs, the country is reinforcing its large CANDU (Canada Deuterium Uranium) reactors.

“CANDU reactors are the backbone of Canada’s nuclear energy sector – yesterday, today, and into the future,” says Executive Vice-President, Strategy and Business Development, at Atomic Energy of Canada Limited (AECL) Grant Gardiner.

While the CANDUs provide large base load power, SMRs will help fill gaps that the larger plants cannot.

“It should be noted that there are different markets in Canada, including smaller grids and off-grid applications that enables them to fill niches for which large reactors are not well suited and position SMRs very well for Canada,” says Gardiner.

AECL sees nuclear capacity needs in the country rising to 60GW or more by 2050 from the around 13GW today.

Refurbishment, underway in Darlington and Bruce Nuclear Generating Stations and potentially coming to Pickering, will maintain current capacity, but new build SMRs and large reactors will still be needed, Gardiner says.

“To put it into perspective, 50 GW corresponds to about 160 SMRs each producing 300 MW, or about 70 large reactors each producing 750 MW. So, large and small, we need them all,” he says.

By Paul Day