Saskatchewan nuclear secretariat to study economic impact of SMRs

The sparsely-populated Canadian province of Saskatchewan is creating an around five-person secretariat to examine the potential of small modular reactors (SMRs) and the economic impact of introducing nuclear power to the region.

Related Articles

The secretariat will be formed over the next few months from internal and external candidates and will concentrate on nuclear power’s position in the province in terms of necessary workforce training, regulation, communications and the country’s climate change plan, says Environment Minister Dustin Duncan.

“The plan for the 2020s is to pair natural gas with wind and solar energy and augment additional hydro capacity from Manitoba, but from 2030 the picture gets a lot fuzzier and, in the event that SMRs are part of that plan for the province, we have to start now to get in to a position to ultimately make that decision,” Duncan told journalists at the end of June.

Canada has pledged to reduce greenhouse gas emissions by 30% below 2005 levels by 2030 and have net zero carbon emissions by 2050 and is already leaning heavily on nuclear power, the second most used generating source providing 15 percent of the country’s power mix.

Much of Canada’s nuclear is concentrated in Ontario and has yet to reach Saskatchewan which generates 84% of its power from natural gas, coal and coke.

“The face of the industry is changing pretty rapidly and plans that seemed to be solid not that long ago are back on the drawing board,” Duncan said, adding that a large deuterium uranium (CANDU) reactor is not on the cards and that SMRs are the main focus.

Promising Market

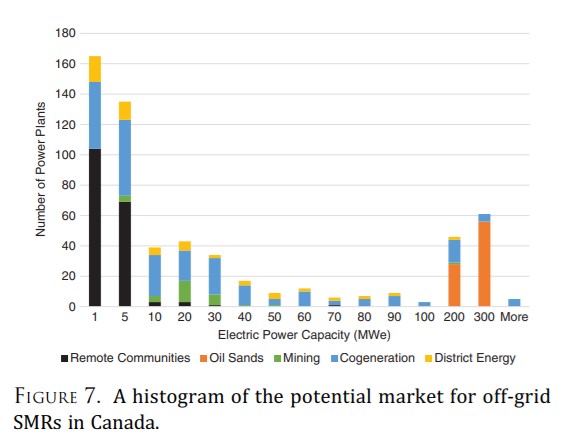

The Canadian Ministry of Natural Resources’ (NRCan) 2018 SMR Roadmap Projects studied on-grid and off-grid applications for SMRs and found that oilsands producers and remote mines would benefit from medium-term options for bulk heat and power such as that produced by the small reactors.

“Canada has one of the world’s most promising domestic markets for SMRs. Conservative estimates place the potential value for SMRs in Canada at $5.3B between 2025 and 2040,” the report said.

At first look, the technology would be a perfect fit for Saskatchewan. Mining provides over a quarter of the gross domestic product of the province which is also home to some 70 First Nation populations, many in remote communities, and has a total population of just under 1.2 million people spread across an area a little larger than France.

Since the report’s release, Canada Nuclear Laboratories (CNL) has announced its intention to have a demonstratable SMR at its national labs by 2026 while Ontario aims to have one running by 2028 at its Darlington site.

There are currently four project proponents at various stages of development as part of CNL’s invitation process with Global First Power’s proposed SMR design (a 5 MWe high-temperature gas reactor) at stage three of a four stage process.

Saskatchewan mining companies are especially interested in SMRs. Off-grid power demand in many of the hard-to-reach mines is provided by expensive, subsidized, diesel-fired plants with fuel transport issues in some locations inflating prices to several hundred dollars per MWh.

The report estimates they could cut the cost of electricity by 20-60% by making the switch to 10-80 MWe generators from diesel generators.

(Source: CNL Nuclear Review)

Guaranteed Supply

Some 20% of the world’s production of uranium is mined and milled in northern Saskatchewan while much of the refining and conversation to make nuclear fuel takes place in Ontario, giving any project in the province a guaranteed local supply chain.

SaskPower, the provinces’ main utility, has been working closely with Bruce Power and Ontario Power Generation (OPG) while assessing the business case and strategy for SMRs in the province.

“The signing of an MOU earlier this year between Ontario, New Brunswick and Saskatchewan is an important first step for small modular reactor development. It demonstrates a critical willingness from these three governments to bring forward a technology that is cost effective and also addresses environmental and climate change concerns in a very meaningful way,” says Director of Corporate Communications at Bruce Power John Peevers.

Bruce Power’s 15-year Major Component Replacement (MCR) project for its 6.5 GW power plant in Ontario to replace the remaining six of the plant’s eight reactors to extend its life by 30-35 years to 2064 has recapitalized the country’s supply chain giving it a competitive advantage, Peevers says.

Meanwhile, following the MOU, OPG says it has been working closely with SaskPower, Bruce Power and New Brunswick Power on feasibility studies for the deployment of SMRs in their respective markets both on- and off-grid.

OPG has been working closely with SaskPower and the province’s Ministry of the Environment on technology due diligence to find an SMR design that would work as part of a pan-Canadian “fleet approach” to on-grid SMRs, the company says in an emailed response to questions.

“We’re proud to be working with them, and excited to see their government taking the step of establishing their own SMR secretariat to coordinate the planning, licensing, and related work that needs to be done to ensure a successful deployment of SMRs in Saskatchewan,” the company says.

By Paul Day