Operators told to plan shutdowns three years ahead, focus on labor

Nuclear operators must start decommissioning work at least three years before shutdown and prioritize labor placement decisions to minimize the transition period and associated staffing costs, Richard Reid, Manager of Electric Power Research Institute’s Used Fuel and High Level Waste Program, said at the 2016 Nuclear Decommissioning & Used Fuel Strategy Summit.

Related Articles

Low wholesale prices have slashed nuclear operators’ profits and increased the need to optimize decommissioning costs. There are currently 18 nuclear power plants being decommissioned in the U.S. and this will soon increase following a recent spate of plant closure announcements. Many more plants are at risk of closure under current market conditions.

A recent study by the Electric Power Research Institute (EPRI) has shown that sufficient planning pre-shutdown can significantly shorten the transition period into decommissioning activities and minimize costs.

Operators should create decommissioning planning teams during the operational phase to submit regulatory documents and plan human resources strategy and key dismantling activities, Reid told the Summit on October 4.

"Transition is a period of great change and how you manage that change is going to have a large impact on not only the transition period but also the decommissioning project as a whole," he said.

EPRI studied decommissioning strategies applied in U.S., Germany, France, Spain and Switzerland and found that longer preparation times correlated with shorter transition periods and lower costs.

The transition period for the U.S. 582 MW Connecticut Yankee plant was 2.8 years after a swift shut down in 1996 and no prior decommissioning preparation, EPRI data shows. In contrast, the transition period for Entergy's 620 MW Vermont Yankee plant, shut down in 2014, was just 1.3 years following around 1.3 years of decommissioning planning.

Nuclear utilities should share decommissioning experience to benchmark transition timelines and understand regulatory requirements to prioritize labor transfer decisions and minimize wasted resources, Reid said.

"You're really no longer a nuclear safety facility, you're really a construction type facility," he said.

Labor needs

EPRI has estimated that staffing costs account for around 43.5% of total decommissioning costs and this portion does not include the labor workforce performing the dismantling.

Staffing costs during the transition phase have been estimated at around $25 million per year equating to $70,000 per day, but some utilities have reported costs of up to $300,000 per day, Reid said.

"The more you shorten that [transition period], the more money you are going to save for your decommissioning program," he said.

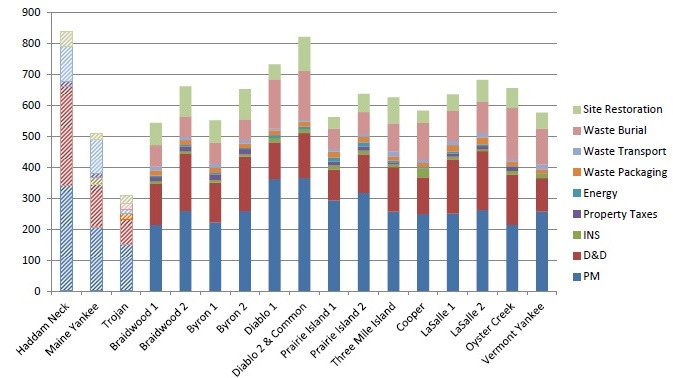

US decommissioning costs (million $2013)

Note: PM represents Project Management

Note: PM represents Project Management

Source: OECD Nuclear Energy Agency's ‘Costs of Decommissioning Power Plants’ report (2016). The cost estimation data are based on the work breakdown structure (WBS) for data provided by two different companies, Thomas LaGuardia (TLG) and Energy Solutions (ES).

A detailed Human Resources Plan can provide clarity to employees and reduce anxiety during the transition phase, Reid said.

"People are concerned about their future but at the same time you need certain qualified staff remaining to do the work," he said.

In addition, utilities must build a comprehensive Historical Site Assessment during operations to avoid delays in post-shutdown regulation, Reid said.

"If you know you are going to be shutting down in 3 to 5 years start gathering this information now because as people leave you lose that tribal knowledge in your Historical Site Assessment," he said.

A number of post-shutdown safety regulation submissions can be prepared during the operational phase, Reid noted.

"Start to prepare the regulatory submittals and submit those... there is really no reason not to get started on this relatively early," he said.

Some regulatory submissions are not strictly required but can reduce costs. These include licence amendment requests for emergency plan reductions, security plan exemptions, decommissioning trust fund (DTF) exemptions and insurance exemptions.

International challenge

Many of Europe's nuclear plants are also set for closure and Reid noted that pre-shutdown decommissioning regulation can be far more onerous than in the U.S.

European operators must perform significant work during the operations phase to demonstrate the technical and financial capabilities required for a decommissioning licence.

The license application can take more than two years to develop and the review and approval of the licence can take between three and five years, Reid said.

"If you have an unplanned shutdown outside the U.S. it could take more than five years just to get your decommissioning license so you can actually start," he said.

With decommissioning costs clearly dependent on the length of the process, operators must communicate with each other and with other industry experts to optimize the transitioning period, Reid said.

"You really can't overstate the importance of benchmarking...one on one dialogue between utilities is highly valuable," he said.

Entergy's 16 month transition period for the U.S. Vermont Yankee plant "sets the bar" for transitioning phases of plant shutdowns, Reid said.

"Utilities should be trying to beat that as best they can,” he said.

Nuclear Energy Insider