Nuclear takes a leaf out of Oil&Gas book on decommissioning

When it comes to decommissioning, studies show nuclear power and the fossil-fuel industry, from oil rigs to coal-fired power stations, have a lot to learn from each other on how to drive project performance.

Related Articles

To date, of the 442 nuclear power reactors in operation worldwide, 189 power reactors have been shut down and just 17 have been fully decommissioned , while some 130 fuel cycle facilities and 440 research reactors have also been decommissioned.

And as decommissioning work gains pace, it is important that operators are pushed to prepare in advance for the inevitable job of dismantling and cleaning up after a reactor ends its operational life.

Research shows that the decommissioning of both nuclear and fossil-fuel sites, in many cases, has broadly similar characteristics.

They both face high uncertainties due to factors that include limited available information on their design, construction, and operations, are affected by interdependencies between facilities and the work is at least partially funded by a state entity and must comply with evolving regulations.

Project management literature has attempted to use project reviews to learn from the deconstruction of large power plants, but researchers have found that project reviews are not always conducted in a consistent manner.

Studies have shown that processes that are learned from shared expertise are rarely carried out and lessons learned are only shared across projects in a limited way, especially between teams working in different industrial sectors.

“While research focusing on the transfer of knowledge within a single industrial sector have been performed, research on cross-sectorial knowledge-transfer is still very limited,” according to the paper “Tapping Non-Nuclear Knowledge”, published on Radwaste Solutions, from the American Nuclear Society (ANS).

The research is especially important since costs for many decommissioning projects almost always experience significant increases from their established budgets.

“While it is widely known that costs will increase, there is limited understanding why this is repeatedly occurring during the decommissioning process,” researchers said in the 2018 paper “Decommissioning Projects in Europe: What Can the Offshore Oil & Gas and Nuclear Industries Learn from Each Other?”

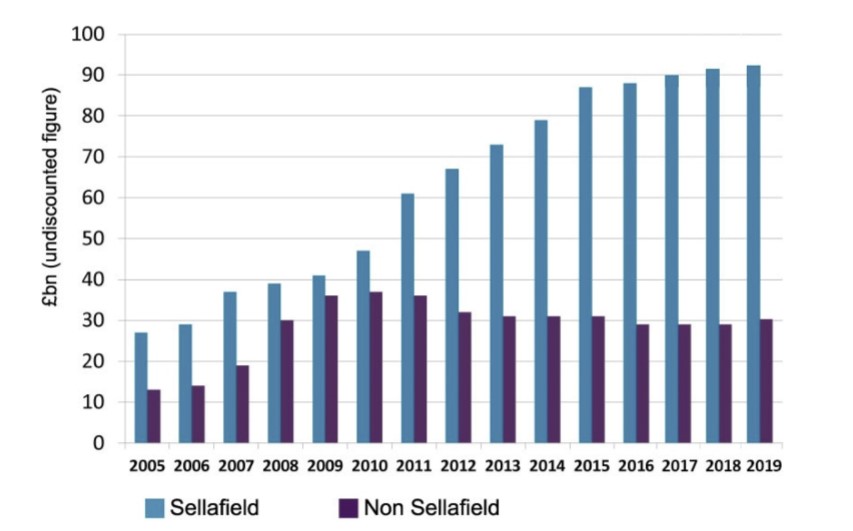

In the UK, the estimates for the decommissioning of civil nuclear assets currently range from £99 billion ($132 billion) to £232 billion compared to £20 billion to £40 billion just 15 years ago, according to the Nuclear Decommissioning Authority (NDA). Since most nuclear decommissioning in Europe is funded by state coffers, it is taxpayers who often shoulder this cost hike.

Decommissioning cost of UK legacy

(Source: UK Government)

(Source: UK Government)

Forward planning, silo working and interdependence

Mega energy projects, such as nuclear power plants, should be designed with decommissioning in mind and this did not happen when the early nuclear power plants were built with no “design for decommissioning” says Diletta Colette Invernizzi, one of the co-authors of the ANS analysis and the 2018 paper.

“New plants (nuclear and not) should take this into consideration (and some are doing so already) and plan waste routes or, even better, plan how to re-use and recycle material when possible, ideally under the circular economy principles.”

Circular economy principles require products to be designed to be reused, refurbished and repaired, preserving the function or service they provide and preventing their technical value from becoming waste in order that demand for raw materials is drastically reduced, according to the 2020 paper “Developing policies for the end-of-life of energy infrastructure: Coming to terms with the challenges of decommissioning,” which Invernizzi also co-wrote.

Planning in advance is key but decommissioning is a project of such complexity that once it comes time to take apart the reactor in question, it is vital the whole team is working in a coordinated fashion.

The pandemic has forced many to work from home and that isolation might increase the risk of “silo working,” a practice that was already seen by some as a problem, Invernizzi says.

“It is now emerging more strongly the need and importance to lower organizational barriers that hinder communications within the company, as well as continuing to promote communication with external stakeholders (including regulators, clients, contractors, etc.),” Invernizzi says.

“In parallel, there is an increased recognition of the importance of early planning and efficient change control, even (if not more) when contracts are managed remotely.”

A roadmap for the improvement of cross-sectorial transfer of lessons learned

(Source: Jacobs)

Interdependencies between facilities can also hinder decommissioning and end up costing money that could be saved with a little forward planning, the studies point out.

In the oil and gas industry, facilities often have interconnecting pipelines that need to be taken care off so the dismantling of one facility does not affect another that is still up and running. This is also often the case in nuclear where reactors share electrical infrastructure, pipelines or both.

Evolving regulations also play a part of potential cost rises during dismantling.

“Nuclear and oil & gas decommissioning projects must comply with both international and national laws and standards, which can change over time and require further compliance to rules and regulations as they develop and evolve,” according to the “Decommissioning Projects in Europe,” study.

If regulations change during the lifetime of a long-term project, scope changes can lead to costs rising, the study points out.

Useful but limited

Invernizzi’s and others’ studies have found that cross-sectorial learning is useful but has its limitations.

The need to plan for radioactive materials is the most pressing difference between nuclear and oil and gas facilities, but also nuclear decommissioning can take years compared just months for fossil fuel plants and some traditional plants can be partially dismantled and recycled while nuclear faces more stringent deconstruction rules.

The trick, say researchers, is finding the areas that can be applied between two different industries and those that are unique to each project.

Project management aspects, commercial and contractual management, and innovation management learnings are areas where learnings can be transferred between nuclear and non-nuclear activities, while specific technical challenges are more particular to a single industry, the studies found.

“There is clearly a growing interest in continuous learning and this quick internal research is just one small step to share existing (but unfortunately often still tacit) knowledge,” says Invernizzi.

By Paul Day