Nuclear hydrogen economics could favor small modular designs

High temperatures and operational flexibility could position small modular reactors (SMRs) at the heart of the growing hydrogen market, experts told Nuclear Energy Insider.

Related Articles

As SMR developers bring a wide range of reactor technologies closer to market, many developers see industrial applications such as hydrogen production as a key growth opportunity.

Steam methane reforming is currently the dominant method to produce hydrogen. Natural gas is submitted to thermal processes, typically in large plants built onto existing natural gas infrastructure.

In the U.S., where shale production has driven down gas prices, 95% of hydrogen is produced by steam methane reforming. However, steam methane reforming produces CO2 and High Temperature Steam Electrolysis (HTSE) is seen as a viable low carbon alternative towards the decarbonization of the network.

The high temperature capabilities of nuclear plants lend themselves to HTSE, which uses electrolysis to split water into hydrogen and oxygen.

Existing large-scale reactors could be used for HTSE, but SMR developers believe their smaller, modular designs and passive safety features make them better-suited to industrial applications.

The smaller capacities and emergency planning zone (EPZ) requirements of SMRs mean they could directly supply individual sites. In addition, the individual modules of SMR plants could provide a range of different applications, including hydrogen production, electricity and heat, developers say.

A study by SMR developer NuScale and the DOE's Idaho National Laboratories in 2014 concluded that a six module, 300 MW NuScale light water reactor IPWR plant could supply the hydrogen demand of a mid-sized ammonia production plant, while a twelve-module plant could support a mid-sized refinery. Individual modules could also be assigned to different applications. To date, NuScale is the only SMR developer to have filed a full design certification application (DCA) to the US Nuclear Regulatory Commission (NRC) and the developer is currently on track to deliver its first 600 MW commercial reactor to Utah Associated Municipal Power Systems (UAMPS) by around 2026.

In the coming decades, next-generation high temperature nuclear reactor designs could provide the best-value hydrogen production. In the short term, nuclear-based hydrogen production would need to accompany electricity production to be economical, experts told Nuclear Energy Insider.

Growing market

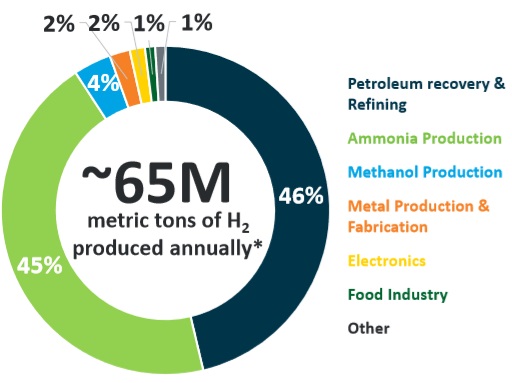

Current hydrogen demand is dominated by two markets: petroleum refineries and ammonia production. It is also used for applications in metals production & fabrication, methanol production, food processing and electronics sectors.

US hydrogen demand by sector

Source: U.S. Department of Energy. Uses 2015 figures from CryoGas International.

A report published by the Freedonia market research group in 2014 predicted world consumption of captive and merchant hydrogen would increase by an average of 3.5% per year to 2018, to more than 300 billion cubic meters, driven by rising use in refinery hydroprocessing, particularly in developing countries in Asia. The use of hydrogen fuel cells is also on the rise as costs fall and fuelling networks expand.

Nuclear power operators could derive the greatest value from hydrogen production as part of a baseload generation strategy, Matt Rooney, energy and environment research fellow at the UK’s Policy Exchange, told Nuclear Energy Insider. Rooney published the report “Small Modular Reactors: the next big thing” in January.

Hydrogen can be produced at times of low electricity demand, or when renewable energy load is high, allowing the nuclear operator to maximise load factors and wholesale market revenue, Rooney said.

The hydrogen could be stored for long periods in facilities such as the salt caverns currently used for natural gas storage, he said.

“The only way to become competitive is to design systems that can make use of off-peak electricity as part of an overall hybrid energy system strategy,” James O’Brien, Research Engineer and Group Leader, Hydrogen Analysis and Experiments at Idaho National Laboratory (INL), said.

The latest estimates for the cost of nuclear HTSE are at around $4/kg, compared with around $1.5/kg for steam reforming, O'Brien said. HTSE clearly has some way to go to hit the DOE’s 2020 cost target for distributed hydrogen production, set at $2.30/kg.

Hydrogen production applications must take into account wider energy market challenges, such as the volatility of electricity prices brought about by intermittent renewable energy capacity, O'Brien said.

“Development of flexible systems that can take advantage of these fluctuations is essential. Hydrogen production is well suited to this need,” he said.

Gas prices

Sustained low U.S. gas prices mean that hydrogen markets outside North America could offer the greatest opportunity for nuclear power generators.

NuScale and INL's study in 2014 concluded that HTSE hydrogen could directly compete with natural gas reforming if the price of natural gas is above $15/MMBtu.

Global gas prices ($/mmBtu)

Source: BP Statistical Review of World Energy (June 2017). Annual prices are given for benchmark natural gas hubs together with contracted pipeline and LNG imports. The prices for LNG and European border are calculated as cif prices, where cif = cost + insurance + freight (average freight prices) in U.S. dollars per million British thermal units (Btu).

HTSE also becomes more competitive if hydrogen production takes place away from existing gas supply infrastructure at smaller scale production plants, the study said.

In the U.S., distributed hydrogen production facilities can only be competitive if they have access to electricity at prices equivalent to off-peak power rates, O'Brien noted.

Going forward, new regulation could transform the competitiveness of HTSE against steam reforming, for example through a subsidy for low-carbon hydrogen production or a higher tax on carbon emissions from steam reforming processes.

Hydrogen future

The demand for hydrogen fuel cells will continue to rise in the coming years, particularly for long-distance haulage where batteries may not be suitable. Other potential applications include fuel cells which store power and return it to the grid at times of high prices.

"We see the market for hydrogen increasing with fuel cell vehicles but also hydrogen is starting to be investigated more to be used as energy storage or as a buffer on the grid which the US Department of Energy hydrogen project office is looking more into," Lenka Kollar, NuScale’s Director of Business Strategy, told Nuclear Energy Insider.

NuScale is continuing to perform research into applications such as hydrogen production under its Diverse Energy Platform project.

Hydrogen demand could also increase significantly if hydrogen is used to decarbonize residential heating supply by replacing methane as energy source, Rooney said.

For example, Rooney estimated around 700 TWh of electricity would be required to replace the U.K’s methane-based residential heating supply. This equates to double the U.K.'s current national power output.

Next Generation reactors

Going forward, next generation high-temperature SMR designs could produce hydrogen at greater efficiency.

High-temperature gas cooled reactors, helium cooled reactors, and molten salt reactors, offer high temperature process heat which enhances the efficiency of hydrogen production, O'Brien noted.

Indeed, advanced reactor developer Terrestrial Energy says its Integrated Molten Salt Reactor can produce heat at around 600 degrees celsius and could supply energy intensive processes such as hydrogen production, desalination and petrochemical refining.

Advanced reactor developers must complete multi-year design licensing reviews before deployment and many experts do not expect fourth-generation plants to be widely deployed until the 2030s.

Terrestrial Energy is one of several advanced reactor developers leading the charge and hopes to build its first plant in North America in the 2020s.

Last November, Terrestrial became the first advanced reactor developer to complete phase 1 of the Canadian Nuclear Safety Commission's (CNSC) pre-licensing vendor design review. The company has also begun pre-application activities with the U.S. Nuclear Regulatory Commission (NRC).

In March, Terrestrial affiliate Terrestrial Energy USA (TEUSA) and plant operator Energy Northwest signed a memorandum of understanding (MoU) on the possible siting, construction and operation of an integral molten salt reactor (IMSR) on a site at the Idaho National Laboratory (INL).

By Neil Ford