Alternative enrichment tech may struggle to take hold

The slow uptake of new nuclear power plants in the United States and Europe and existing stockpiles of enriched uranium mean laser enrichment may struggle to gain a hold against the already well-established global centrifuge market.

Related Articles

The global nuclear power industry is approaching a crossroads and while many countries in Asia and the Middle East are choosing the path to more reactors, Europe and the United States are not so committed.

At the end of 2021, 53 reactors were being built worldwide but only two of those were under construction in the United States and just six in West and Central Europe.

Of the ten reactors permanently shut down in 2021, one was in the United States, three in the United Kingdom, and three in Germany.

Next generation nuclear power technology, which is slated as being inherently safe and potentially easy to mass produce at a reduced cost, and enormous social pressure to reduce carbon emissions, promise to turn that tide, but many Generation IV reactors are still as much as a decade away from commercial availability.

Meanwhile, the fuel that runs existing plants is plentiful, for now.

A drop in demand for enriched uranium following the Fukushima Daiichi accident in 2011, coupled with projects aimed at increasing production that were put in place before the disaster, resulted in a market saturated with supply, according to the OECD-Nuclear Energy Agency’s (NEA) report Uranium 2020: Resources, Production and Demand.

Short term leveling off of uranium production and potential limitations on government inventories are also critical considerations, the OECD-NEA report said, adding that any expected increase in demand would be long term and concentrated outside of the United States and Europe.

“Asia and the Middle East are the most critical markets for new reactors, and new uranium production will be needed in the coming decades,” the report said.

“However, new uranium supply capacity would need the right price signals for producers to make investments.”

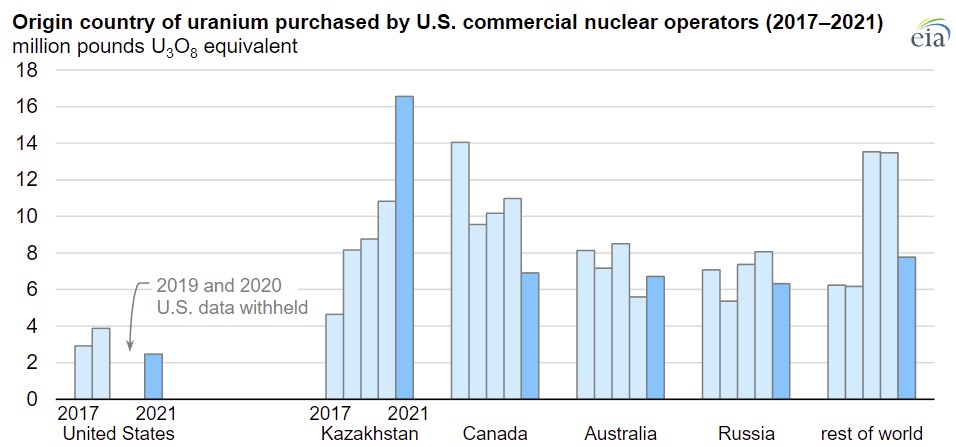

Source: U.S. Energy Information Agency's Uranium Marketing Annual Report

A changing world

With a limited pressing need for immediate additional enriched uranium in the West, and the short-term decision making often favored by politicians in modern democracies, the immediate future of enrichment technology such as laser is likely to hang squarely on the developing geopolitical situation surrounding Russia’s invasion of Ukraine.

Russia’s Rosatom produces around 46% of the world’s enriched uranium via centrifuge, compared to 8% produced in the United States, according to the World Nuclear Association Nuclear.

“Laser enrichment could be competitive if Russia is banned from enriching uranium for the West,” says Geoffrey Rothwell former principal economist at OECD’s Nuclear Energy Agency and author of the book ‘Economics of Nuclear Power’.

“It’s possible but it’s expensive and who’s really going to invest?”

Long-term government commitment to nuclear technology would help reinforce the case that novel enrichment techniques must be supported for greater energy independence, and in the United States, there are some that are championing this cause, especially for uranium enriched to near 20% and needed for most new reactors known as high-assay, low-enriched uranium (HALEU).

The only uranium enrichment capability in the United States is at Urenco’s New Mexico plant which in 2020 produced some 4.7 million Separative Work Units (SWU, used to measure the amount of work done to enrich uranium).

That compares to some 28.7 million SWU produced in Russia in 2020, nearly half the total global output.

In April, Republican Senator John Barrasso, ranking member of the Senate Committee on Energy and Natural Resources, introduced a bill calling for the establishment of a program to accelerate the availability of domestically produced HALEU in the United States and block enriched uranium acquisition from Russia.

However, an evenly split Senate and deepening animosity between the Democrats and Republicans means the bill may have to wait until a change in Washington’s legislative makeup, despite a mostly bi-partisan backing of nuclear power.

The European Commission’s Euratom Supply Agency (ESA) noted in a 2019 paper ‘Securing the European Supply of 19.75% enriched Uranium Fuel’ that “if no action is taken, there is a risk that the supply of this critically important material cannot be guaranteed after 2030-2040.”

Any calls within Europe to domestically produce HALEU, meanwhile, are drowned out by the heated politically motivated discussion over whether nuclear power should be part of the energy transition to net zero at all.

Far from competitive

Laser-enrichment technology promises to overturn the current, accepted way of how nuclear fuel is made and by who, but the slow increase of new nuclear reactors means there is glut of enriched fuel offered by Russia leaving the economies of laser far from competitive.

There is also doubts as to whether a new way to enrich uranium beyond the tried-and-tested centrifuge method, is necessary.

“Laser enrichment does not diversify uranium supply. It diversifies enrichment services,” says Professor of Nuclear Engineering at MIT, R. Scott Kemp.

“My expectation is the long-run marginal cost of centrifuge enrichment will remain lower than the long-run marginal cost of laser enrichment – which will make it difficult for laser enrichment to enter the market sustainably.”

If demand for enrichment services grows on the back of a new generation of reactors, centrifuge companies will not be able to fund an expansion that covers the growing demand, he says.

Centrifuge activity, once up and running, is difficult and expensive to shut down.

“In that case, laser enrichment would slowly enter the market and overtake centrifuges on a roughly 20-year timescale,” Kemp says, noting that 20 years is the accounting depreciation time for centrifuges.

Current capital costs for existing nuclear reactors are too high, the new generation of nuclear also appears to come with a high price tag, and nuclear cannot compete with wind, solar, and emerging storage capabilities, he says.

“Given all these considerations, I would predict that demand for enrichment services would decrease over the next several decades. Bottom line, this is basic economics, and the economics don’t really support the emergence of a new enrichment technology,” Kemp says.

By Paul Day