By

By

The Third of our Three Megatrends concluding our #InsuranceMap Series

Back to Contents

Read it as a PDF

Over the past weeks and months, we have taken you the length and breadth of our inaugural Insurance Nexus Global Trend Map, covering the broad industry sea-changes, the technological and functional developments and the regional trends in play across today’s rapidly evolving insurance ecosystem. At the start of this week, we introduced our concluding Three Megatrends, a synthesis of the stand-out developments from across this content series:

- MEGATREND 1: Worldwide low interest rates coupled with soft market conditions

- MEGATREND 2: The complexification of risk in today’s increasingly globalised societies

- MEGATREND 3: Distribution disruption and the insurance industry's customer-centric ‘turn’

- AFTERWORD: Insurtech - Reinventing the Spokes, Not the Wheel

In our previous post, we tackled Megatrend 2: the complexification of risk in today's increasingly globalised societies... Today, we look at our Megatrend 3, which has appeared repeatedly, in numerous different guises, throughout our explorations, whether we're talking about telematics solutions in Europe or mobile microinsurance in Africa: Distribution Disruption and the insurance industry's customer-centric turn.

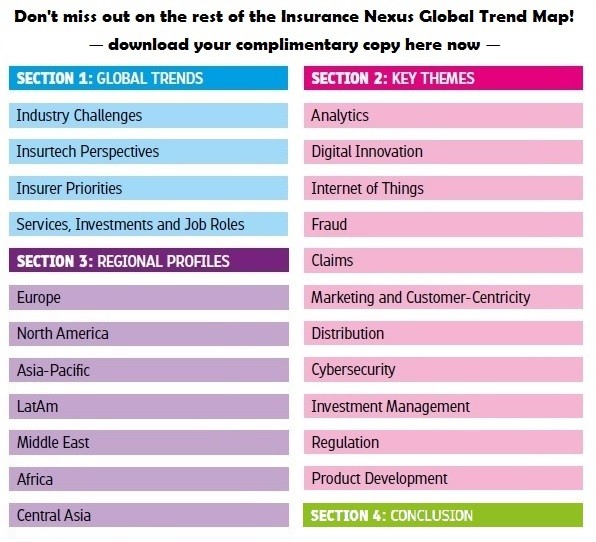

Access all three Insurance Megatrends, and much more, by downloading your free copy of the Insurance Nexus Global Trend Map here!

MEGATREND 3: DISTRIBUTION DISRUPTION AND THE CUSTOMER-CENTRIC 'TURN'

If we had to choose the one word looming largest on insurers’ minds, based both on the statistics and the direct testimonials we have presented in this content series, that word would be: ‘customer-centricity’.

There is a prevailing view – not just confined to the vibrant and vocal Insurtech community – that something is wrong with the customer relationship implicit in traditional insurance, at least in the personal lines.

This is a relationship that has long had something of a standoff about it, with one subsidiary industry dedicated to bumping customer claims up and another to hauling them back down again (loss assessment and loss adjustment). Meanwhile, fraud and counter-fraud soak up huge amounts of the industry’s capital. In broad strokes, the new relationship being demanded and pursued is one in which client and insurer are ‘risk partners’, whereby it is in each party’s interest to share as much information with the other as possible so that they can work together proactively to reduce exposures.

This change in attitude has not occurred in a vacuum. While the traditional insurance market has always suffered from periodic high competition on price (as part of the Insurance Cycle), competition on customer service was for a long time completely slack (simply put, in the pre-digital era there were limits on where you could take customer service, at least for general insurance).

The key factor here is the same that has been instrumental in so many industries: the arrival of the Internet. This opened a new channel for communicating with customers both existing and potential – be that as a branding play, for informational purposes or as a full-service buying channel. It took a while before ships were built capable of navigating this new North-West Passage to the customer, but as of today the sea-lane is officially open for business.

The Internet: it took a while before ships were built capable of navigating this new North-West Passage to the customer but, as of today, the sea-lane is officially open for business.

Distribution disruption opened the door to a whole raft of new e-ventures (gone was the monopoly of legacy players on distribution) and also reared a new generation of ultra-demanding consumers, weaned first on Amazon and latterly on real-time services like Uber. With an extra, brand-new lane added to the race, all new players have had to do is run faster than the old ones, and this has rarely proven difficult given the possibilities inherent in digital technologies.

At various points in this content series we have illustrated the customer ‘turn’ in the industry as new entrants appearing and circumventing incumbents – but it is as much a story of incumbents trying to circumvent each other using the additional differentiation potential digital gives them. The march of the Insurtechs (bottom-to-top digital insurers) is not the first, it is the latest iteration of this trend – and by far the one that has spooked legacy insurers the most.

See also: Insurance Nexus Global Trend Map #2 Insurtech Perspectives

The traditional industry is now beginning to realise that digital does not stop with a customer-friendly website but must in fact embrace every building block of the organisation – must, in the sense that otherwise someone else will get there first and eat everyone’s lunch. Everyone – incumbents and Insurtechs alike – is in exactly the same race to find the winning combination, and each brings unique strengths to bear.

The winner will get themselves in front of more customer eyeballs and offer better customer service at lower prices. This has both a technological and, more critically, a business-model aspect to it.

Winning the Insurance Technology Race

We spoke briefly about the cost-cutting aspect of new technologies in relation to our first Megatrend on low interest rates and soft market conditions and loosely pooled them into two camps:

- AI and robotics enabling straight-through processing and pricing

- IoT facilitating intervention and proactive claims control

By deploying technologies in the first category, insurers can achieve more watertight underwriting and plentiful operating efficiencies; by deploying the second category, they can move towards a better book from a claims perspective.

However, to roll these technologies out as point solutions would be to play the cycle (low interest rates and soft market conditions), not the fundamental paradigm shift: the industry turn towards greater customer-centricity. Simply playing with efficiencies and consolidation in anticipation of the return of higher interest rates, while not a recipe for bankruptcy, is not a recipe for insurance growth and embarks carriers on long, painless path to self-liquidation.

Simply playing with efficiencies and consolidation in anticipation of the return of higher interest rates, while not a recipe for bankruptcy, is not a recipe for insurance growth and embarks carriers on long, painless path to self-liquidation.

The key for insurers is to use all these technology tools in unison to serve a fundamentally new business model – it is in this way that these technologies can be truly transformative (beyond just delivering incremental change in line with carriers’ cyclical cost-cutting efforts). As for this new business model: in the broadest possible terms, it is about closing the loop between the claims and the underwriting parts of the business, the front end and the back.

For all the facts and stats, download the full Insurance Nexus Global Trend Map here!

Towards a New Business Model for Insurance

Manifestations of the emerging front-to-back insurance model are Usage-Based Insurance (UBI) and its variants, whereby insurers and customers cooperate – in a virtuous circle of data-sharing – to work risks down. Real-world IoT data that captures exactly what is going on with specific customers and risks is transparently fed back into analytics and machine-learning models at the back end to create optimal policy-price options. And, seeing and believing the benefits of the new-age insurance proposition (lower prices and fewer bad things happening), customers will further extend their willingness to participate.

It is through seeing and believing the benefits of the new-age insurance proposition – lower prices and fewer bad things happening – that customers will further extend their willingness to participate.

This new relationship relies on insurers establishing a new bond of trust with their customers – and a lot of this will come from being more transparent with pricing, less obscure with terms and conditions and clearer about the benefits of the overall proposition.

In addition to personalising – and optimising – the treatment of existing policies held by customers, the "UBI approach" also facilitates on-demand coverage. Rather than just updating long-term premiums based on cumulative customer data, insurers have the potential to create time-sensitive policies on the fly based on real-time information, something which obviously requires straight-through processing, among other things, to be practicable.

Here again, we see a technology often viewed through the lens of cost-cutting – robotics – coming into its own as a customer-centricity and new-business enabler. Straight-through processing, not just for underwriting but for claims as well, cannot just aim for efficiencies; it needs to be about giving customers what they want, when and where they want it.

We should remember at this point that, while the component technologies are making ground on their (often separate) marches through the industry, and while UBI is certainly a heavily discussed approach, only around a third of our survey respondents reported having a UBI strategy (see our earlier post on Product Development). Also, the vision of an omniscient, fully optimised, ‘ideal’ marketplace for insurance needs to be tempered with a dose of real-life pragmatism, particularly when we reflect on the host of regulatory and ethical questions that development down this path raises (witness the concern, by no means unique to insurance, with the ‘predatory algorithm’).

Finally, there may, paradoxically, be adoption issues… Many consumers may object on principle – in the same breath as they demand better pricing! – to the new, unaccustomed relationship they are being invited to form a part of, as well as to the notion of insurers gathering and holding data on them.

The UBI approach, this brave new customer covenant, is developing many different forms, at variable rates, across different lines. The overall trend is towards a model where fewer bad things happen and people pay less for insuring a given asset, by taking an active role in their own risk management. As the customer-service and engagement element is intimately bound up with the cost-reducing mechanism, it is hard to know which is more important to the customer, and by what degree ... Intuitively, we feel that old-style insurance cannot be rescued by pure customer service, regardless of how many bells and whistles it has on it – but better-priced, new-style insurance may well be lost without it.

For the most part, what we end up with ultimately is a strange sort of race-to-the-bottom – with people paying less for great service and rating it as great primarily for that reason. Assuming the pool of addressable risks remains the same, we would, on this model, expect carrier revenue, costs and profit to shrink in proportion. So, is the insurance industry eating itself?

The main problem with the above statement is that the pool of addressable risks will not remain the same but will grow substantially, as we hinted at above in the case of on-demand real-time UBI. All the technologies we have mentioned – and the low-cost insurance model they are ushering in – can act as an enormous new-business enabler.

Access all three of our Megatrends by downloading your complimentary copy of the full Insurance Nexus Global Trend Map here!

Insurance Industry Outlook: the Clouds and Silver Lining of Commoditisation

In relation to the first of our three Megatrends on low interest rates and soft market conditions, we imagined all the things the average person might wish to insure against as they went through life – if representative insurance were truly available at a representative price (see Chartered Mephistopheles). This was largely to emphasise that it has been the practice, rather than the theory, of insurance that has held the industry back. Insurance, as a concept, has plenty of mileage in it yet.

Scale is the silver-lining of commoditisation – if risks are cracks in the Earth, you can fundamentally fill in more space with tiny uniform grains of sand than with a few massive and irregular boulders.

Scale is the silver-lining of commoditisation; if risks are cracks in the Earth, you can fundamentally fill in more space with tiny uniform grains of sand than with a few massive and irregular boulders. This move within insurance, away from a small number of large transactions towards a large number of small transactions, would be the same evolution we have already witnessed, for instance, in the logistics industry – moving from pallet-based store replenishment to single-item e-commerce.

This is not to say that there are no ‘premium’ insurance services made possible by these technologies. The insurance proposition is partly about price and risk reduction; another key part is the question of the agreed mitigation (where it is again beneficial for carrier and customer to work together). The more that insurers can guarantee (for example, guaranteeing that someone’s car will not just be repaired but will be repaired at a given garage using given parts within a given timeframe), the more they can hope to charge.

We have talked about how customers need to trust their insurers, but equally important in the case of premium mitigation services is insurers’ trust in their customers and in what is going on in the outside world. The idea with IoT (rendered watertight through Blockchain) is that insurers can know this with confidence in real time. This means ultimately that they can set up Smart Contracts to be enacted, also in real time, for clients’ benefit, so that, if Event X comes to pass, Mitigation Y will immediately be on its way.

Smart Contracts: if Event X come to pass, Mitigation Y will immediately be on its way.

There is huge potential for specialist IoT/Blockchain solutions in commercial scenarios where millions of dollars’ worth of business interruption can ride upon the non-contentious settlement of claims and speedy containment of losses. One example we gave of this, in our Internet of Things post, was of insuring sensitive cargoes in transit so that new cargoes are immediately ordered, should certain limits on the existing cargo be exceeded (like damagingly high temperature, for instance).

We did not gather any direct statistics on Blockchain and Smart Contracts as part of the Insurance Nexus Global Trend Map (download your complimentary copy here), but the technology will certainly have greater pride of place in the next edition. The example above is commercial but these technologies (IoT, Blockchain and Smart Contracts) have obvious benefits for personal lines as well (such as Auto) and can streamline the overall claims process (by pre-populating relevant data securely and acting on it as agreed) – leading not just to lower operational costs but superior customer experience at that point in the cycle where customers value it the most.

See also: Insurance Nexus Global Trend Map #10 Claims

None of this is a fait accompli – the practical objections to every stage of the journey we have so cursorily outlined here are endless. The idea that we can know everything we need about a person or a risk in real time through today’s IoT systems is still far-fetched, and doesn’t help insurers juggling limited budgets and multiple priorities in 2018. Similar qualifications apply to the other technologies that form part of the ‘stack’ (like Blockchain), and many commercial applications will require maturity across multiple technology areas before we see adoption.

This naturally imposes limits on the optimism that might otherwise flow from our foregoing description of the tech-enabled, customer-centric turn in the industry. However, it also limits the more pessimistic interpretation, namely the fear of universal commoditisation. Everything that stands in the way of this ‘end state’ represents ground to fight on for carriers and a means to differentiate their capabilities on the market.

For example, the fact that the latency of IoT systems is not magically zero – and their security not magically infallible – means that whichever insurer can shave off the most time, or throw up an additional security barrier, can potentially reap the benefit of that in market competitiveness. The same applies to other capabilities; as customer data isn’t boundlessly available, even with IoT (far from it!), insurers can outmanoeuvre their competition by eking out a few extra points of customer data (and this is about being open and clear on the value proposition, not about espionage). And, in the context of endemic legacy systems and silos, being able to link different pools of data together that bit quicker could be the hair’s breadth that sets you apart from your competitor.

In the context of endemic legacy systems and silos, being able to link different pools of data together that bit quicker could be the hair’s breadth that sets you apart from your competitor.

Silos and legacy are a major problem for incumbents, and this is a point that has been raised time and time again by the correspondents we have consulted across this content series in all seven of our global regions: Europe, North America, Asia-Pacific, LatAm, Africa, the Middle East and Central Asia. This is due both to the ad-hoc way in which different functions have coalesced and to M&A activity over the years. Even assuming that silos can be bridged, many older systems – and many insurers are running on systems that are decades old – simply cannot support the level of analytics and machine-learning that insurers are wanting to run today.

This lack of legacy is a stand-out advantage enjoyed by Insurtechs over incumbents. That said, Insurtechs wishing to take advantage of this might not be best-placed trying to build an alternative mega-system from the bottom up. All systems represent large one-off costs, and it may be that the Age of Systems is passing into the Age of Ecosystems. With customer and market requirements diversifying – and fluctuating – at such a rate, there is no one configuration that can guarantee success. So, the more open, and the more capable of integrations, insurance players can keep their tech, the better – and the more able they will be to meet new requirements as they arise.

With customer and market requirements diversifying – and fluctuating – at such a rate, there is no one configuration that can guarantee success: the Age of Systems is passing into the Age of Ecosystems.

This trend towards more federated systems, towards more of an ‘API culture’, has surfaced at various points across this series (see our Regional Profiles on Asia-Pacific and LatAm, for instance). An adjunct of this is carriers’ use of incubators and accelerators to drive innovation beyond their four walls. It is in this context that we find carriers investing in – and in some cases founding their own – Insurtechs, to act as their younger, hipper and more nimble representatives before the customer.

See also: Beyond the Incubator – Solving the Insurtech "People Challenge"

We pointed out how insurers can differentiate themselves based on their technology capabilities, with big data, speed and security being three key components. Insurers can also differentiate themselves on how they put their innovation effort together, which has an enormous multiplier effect on the business. By the same token, Insurtechs can also benefit enormously by pursuing strategic business relationships, particularly with existing carriers – and this is something we touch on in next week's Afterword, the 34th and final post in this #InsuranceMap Content Series. And of course, if you'd like to read ahead straight away, simply download the full Insurance Map here whenever you like (it's free!).

For any inquiries relating to the Insurance Nexus Global Trend Map, this on-going content series or next year's edition, please contact:

Alexander Cherry, Head of Research & Content at Insurance Nexus (alexander.cherry@insurancenexus.com)

Forward to #34 Afterword on Insurtech: Reinventing the Spokes, not the Wheel >>>

<<< Back to #32 Complexification of Risk