UK floating wind leases show intent but target could be doubled

New offshore lease auctions are propelling the UK towards large floating wind arrays but better government planning could accelerate build and cut costs faster, industry experts said.

Related Articles

Last month, the UK announced it will tender leases in the Celtic Sea off the UK’s western coast for floating wind projects, each of capacity around 300 MW. The leases will be three times larger than in previous UK lease offers and will propel the UK towards its target of 1 GW of floating wind by 2030, the UK Crown Estate said.

The tender comes after UK floating wind experts called on the government to double its target to 2 GW and make floating wind subsidy-free by the end of the decade. In a new report, the Offshore Renewable Energy (ORE) Catapult and industry partners identified floating wind opportunities off England, Wales and Scotland and called for new leasing rounds in the Celtic Sea and North East England.

The UK is the world leader in offshore wind capacity but floating wind has been limited to a handful of demonstration and pre-commercial projects.

Early commercial-scale deployment is critical to cutting floating wind costs and 2 GW can be installed by 2030 if the government works with industry to unlock private sector investment in supply chain and port infrastructure, Ralph Torr, Programme Manager at the ORE Catapult Floating Offshore Wind Centre of Excellence (FOW CoE), told Reuters Events.

The UK is increasing domestic content requirements for offshore wind to 60% of project value and rolling out freeport schemes to attract manufacturers. Offshore wind partners have called for more regular auctions for contract for difference [CFD] subsidies, along with coordinated leasing and consenting, to establish clear project pipelines.

“Whether we limit our [floating wind] ambitions to 1 GW or raise them and commit to 2 GW, it’s vital the government takes a coordinated approach to leasing and CFD allocations to facilitate this," Torr said.

Securing offtake

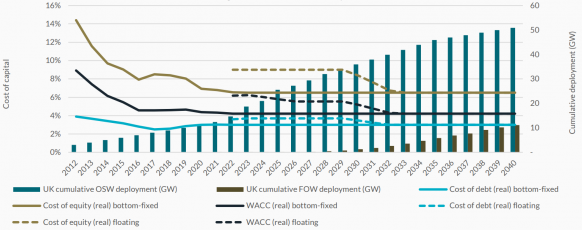

The report by ORE Catapult and partners modelled cost reductions in floating wind under different deployment rates, learning rates and cost of capital.

"In the short term and medium term, the primary driver of UK floating offshore wind cost reduction is scale of UK deployment, augmented by innovation," the report said. "In the longer term, the primary driver is innovation, augmented by UK and international deployment rates."

A further 4 GW of UK floating wind projects should be allocated for deployment in the early 2030s, it said.

Forecast cost of capital for floating wind versus fixed-bottom

(Click image to enlarge)

Source: UK ORE Catapult report 'Floating offshore wind: cost reduction pathways to subsidy free,' January 2021.

Later this year, the government is expected to hold its Round 4 CFD auction, where for the first time floating wind developers will not compete against lower-cost fixed-bottom projects. Allocated every two years, CFDs represent a crucial offtake commitment for developers, providing operators with a minimum revenue at an agreed strike price for 15 years.

Experts predict very few floating wind projects will be ready in time for the Round 4 auction as it takes years to secure the required planning permission, grid connection agreements and supply chain plans.

According to Torr, one or two smaller-scale projects in England and Wales are targeting Round 4.

Last year, Blue Gem Wind was awarded a lease for its 96 MW Erebus floating wind project off the coast of Wales under a special test and demonstration scheme. Blue Gem, which is 80% owned by oil and gas group Total and 20% owned by Simply Blue Energy, plans to submit Erebus in the Round 5 auction expected in 2023.

Larger projects of capacity 300 MW would not be ready to bid until Round 6 in 2025, at the earliest, Rick Campbell, Head of Offshore Markets at consultancy Natural Power, told Reuters Events.

Crown Estate Scotland is currently holding the first auction for Scottish leases in a decade. Covering an area of 8,600 sq km, the Scotwind auction includes deep water areas only suitable for floating wind technologies.

Sven Utermohlen, Chief Operating Officer, Offshore Wind at RWE Renewables urged Crown Estate Scotland to fix the ScotWind award date as soon as possible.

RWE is rapidly expanding its offshore wind portfolio and won two leases for fixed-bottom projects in the latest tender in England and Wales.

Suppliers wanted

The UK is developing two new offshore wind ports on England’s North Sea coast but significant gaps remain in UK floating wind supply.

Designated as freeports, the new ports in the Humber and Teeside regions offer tax benefits and accommodate growing offshore turbine dimensions and will host up to seven manufacturers. GE Renewable Energy has agreed to build a turbine blade factory at the Teeside port by 2023 while the Humber port could soon host the UK's first monopile factory.

The UK needs more ports suitable for floating wind, particularly in Scotland and Wales, more large-scale manufacturing and assembly facilities and Tier 1 suppliers that can bid and secure major project contracts, Torr said.

“Not having these impacts the level of UK content in these areas directly but presents a barrier to the UK supply chain in terms of lower tiers winning sub-contracts," he said.

A coordinated local supply chain is key to reducing costs, allowing integrated design and manufacturing processes, Torr said.

For example, the design and manufacturing of floating wind substructures can be "optimised for engineering performance, manufacture, assembly, installation, operation and maintenance”, he said. Cost-effective cable, mooring and anchoring systems are also required and the UK government recently announced 20 million pounds ($27.9 million) of innovation funding in these areas.

RWE and ORE Catapult are studying the potential for Scottish businesses to produce commercial-scale concrete foundations for floating wind projects.

"We believe concrete floating foundations offer a unique opportunity for the Scottish supply chain,” Utermohlen said.

"The Scottish engineering supply chain in particular has significant expertise working in offshore marine environments."

Reporting by Neil Ford

Editing by Robin Sayles