Biden waives tariffs on panels from Southeast Asia; SMA to double inverter output in Europe

The solar news you need to know.

Related Articles

Biden waives tariffs on panels from Southeast Asia to regain growth

U.S. President Joe Biden has waived import tariffs on solar panels from the four largest supplier countries in Southeast Asia for two years in an attempt to ease price uncertainty that has delayed projects and curbed investments.

In March, the U.S. commerce department launched an investigation into panels imported from Malaysia, Thailand, Vietnam and Cambodia after U.S. manufacturer Auxin claimed Chinese manufacturers shifted production to these countries to avoid paying U.S. anti-dumping duties on imports from China. The four Southeast Asian countries supply most of the modules installed in the U.S. and the trade probe could theoretically result in retroactive tariffs of 50 to 250%.

Biden used a Declaration of Emergency to waive the tariffs, saying panel imports have fallen sharply and solar developers now face an "acute shortage" of modules and components.

"Grid operators around the country are relying on planned solar projects to come online to ensure there is sufficient power to meet demand," the White House said in a statement.

Biden also authorised the use of the Defence Production Act to accelerate domestic manufacturing and triple domestic solar manufacturing capacity to around 22.5 GW by 2024.

The tariff exemption for panels from Asia would act as a "24-month bridge" while domestic manufacturing is scaled up, the White House said.

The measures come after a number of U.S. lawmakers sent letters to Biden calling for a rapid end to the tariff investigation. Letters from 20 governors, 22 senators and 85 members of the House of Representatives warned the tariff probe was having a devastating impact on solar investment and employment.

Without action, the tariff investigation would cut U.S. solar installations by 24 GW over the next two years, the U.S. Solar Energy Industry Association (SEIA) said. Energy Secretary Jennifer Granholm warned a prolonged tariff investigation could prevent the U.S. from achieving the Biden administration's goal of a zero-carbon power sector by 2035.

U.S. solar installations must quadruple to around 60 GW/year by the middle of the decade and 70 GW/year in 2031-2035 to meet the President's power sector goal, the Department of Energy (DOE) said in a report in September.

U.S. warns of summer power deficit in central states

The power grid in Central U.S. may need to impose rotating blackouts this summer due to a number of plant retirements and planned outages, federal energy officials said in a note June 3.

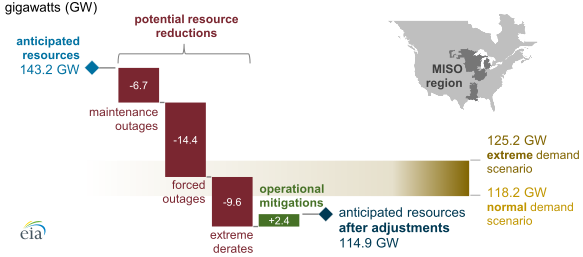

The Midcontinent Independent System Operator (MISO) is forecast to have 114.9 GW of available generation capacity, compared with a peak demand of 118.2 GW under a normal scenario and 125.2 GW under extreme hot temperatures, data from federal grid regulator North American Electric Reliability Corporation shows. The generation forecast includes scheduled plant outages, recent trends in hydroelectric supplies, and assumes the average level of unplanned outages over the last five years.

Forecast summer power margin in MISO grid

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA).

Last month, California Governor Gavin Newsom set out plans for a 5 GW multi-fuel power generation reserve after officials warned California could suffer a power shortfall of 1.7 GW during extreme heatwave conditions this summer. The shortfall could rise to 5 GW under extreme summer heat waves that ramp up energy demand while curbing supply, officials said.

SMA to double inverter manufacturing capacity in Germany to 40 GW

Europe's largest inverter supplier SMA Solar will double manufacturing capacity at its German headquarters to 40 GW by 2024 as Europe looks to strengthen supply chains and improve energy security, the company announced June 2.

The move comes after the European Union executive pledged to double solar capacity to 320 GW by 2025 and install 600 GW by 2030 under a new plan to accelerate renewables and end the region's reliance on Russian gas and oil. The 'RePowerEU' plan includes the creation of an EU Solar PV Industry Alliance that will help to expand Europe's solar manufacturing base, drawing from EU funding mechanisms including InvestEU, the Innovation Fund and Recovery and Resilience facilities.

Soaring global materials prices and supply chain constraints have pushed up solar project prices and dented growth.

The EU hosts just 8 GW of module manufacturing capacity and could achieve 20 GW by 2025, reducing its reliance on China and other countries, the European Commission said. The European Solar Manufacturing Council (ESMC) wants 60 GW of manufacturing capacity built by 2026 and developers have called for much larger factories to gain economies of scale and compete with Asian imports.

SMA will start to build its new 47,000 m2 factory near Kassel in central Germany later this year, the company said.

“Building this new factory will help us safeguard supply chains and gain greater independence from ever-changing trade conditions," the company said.

"Greater customer proximity will be an important driver especially in the large-scale PV power plant segment," it said.

EU leaders agree faster permitting rules to accelerate renewables

European Union leaders have agreed to accelerate solar and wind permitting alongside a ban on most Russian crude oil imports by the end of 2022.

At a May 31 summit, EU leaders agreed to ban all Russian oil delivered by sea while Poland and Germany also pledged to end pipeline imports, effectively halting 90% of Russia's oil imports into the 27 EU countries by the end of the year.

Leaders also called for the speeding up of permitting procedures for renewables projects as set out in the European Commission's RePowerEU plan to end the region's reliance on Russian gas. Russia supplies around 40% of Europe's gas and the EU has already pledged to cut Russian supplies by two thirds by the end of the year and end supplies by 2027.

The RePowerEU plan raises the EU's renewable energy target for 2030 from 40% to 45%, hikes energy efficiency goals and sets out measures to diversify fossil fuel supplies.

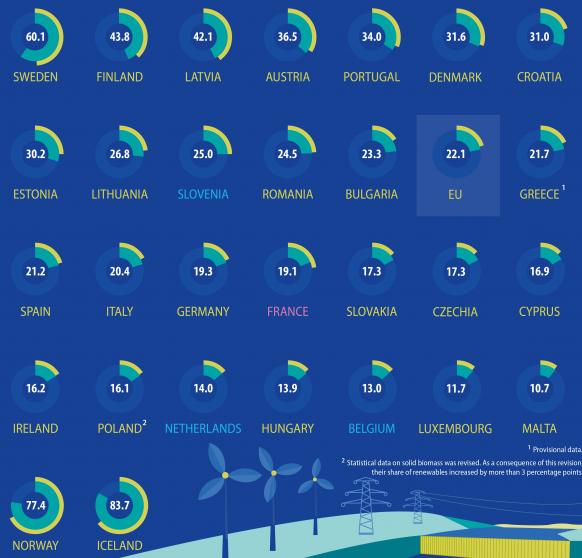

Share of energy from renewables in EU in 2020

(Click image to enlarge)

Source: Eurostat (European Commission)

EU members will be required to designate areas in which permits for large solar and wind projects must be awarded within one year of application. Countries would identify "go-to areas" areas on land and sea where renewable energy would have a low environmental impact. An environmental assessment would be performed for these areas as a whole, removing the need for individual projects to go through the full process.

Solar and wind permitting can take several years due to complex administrative processes and a lack of resources at permitting authorities. Several EU members are adapting national permitting procedures in a bid to speed up deployment.

Total acquires 50% stake in U.S. developer Clearway

France's TotalEnergies has agreed to acquire a 50% stake in Clearway Energy from Global Infrastructure Partners (GIP) in the oil and gas group's largest U.S. renewable energy acquisition to date.

Total and GIP will jointly own Clearway, which has 7.7 GW of operational solar and wind assets and a 25 GW pipeline of renewable energy and storage projects, of which 15 GW are in an "advanced stage" of development, the company said.

As part of the deal, GIP will receive $1.6 billion in cash and an interest of 50% minus one share in the Total subsidiary that controls U.S. solar group SunPower.

Total has been rapidly expanding its U.S. renewable energy business over the past year, acquiring around 7 GW of solar and storage assets from developers Core Solar and SunChase and winning 4 GW of offshore wind leases in the New York Bight and North Carolina.

The Clearway acquisition will allow Total to "scale up in the U.S. market, one of the most dynamic in the world, benefiting from operating assets and a 25 GW high quality pipeline, in wind, solar and storage, with a wide geographic coverage with a presence in 34 states," Patrick Pouyanne, Chairman and CEO of TotalEnergies, said.

Reuters Events